Region:Asia

Author(s):Shubham

Product Code:KRAC0640

Pages:83

Published On:August 2025

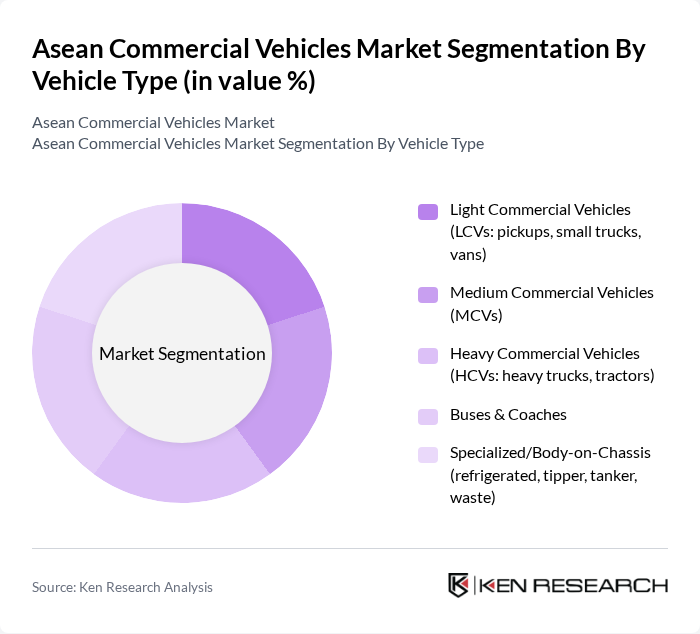

By Vehicle Type:The vehicle type segmentation includes various categories such as Light Commercial Vehicles (LCVs), Medium Commercial Vehicles (MCVs), Heavy Commercial Vehicles (HCVs), Buses & Coaches, and Specialized/Body-on-Chassis vehicles. Among these, Light Commercial Vehicles are currently leading the market due to their versatility and increasing demand in logistics and e-commerce sectors. The growing trend of last-mile delivery services has significantly boosted the sales of LCVs, making them a preferred choice for businesses. Additionally, the rise in urbanization and infrastructure projects has further solidified the position of LCVs in the market.

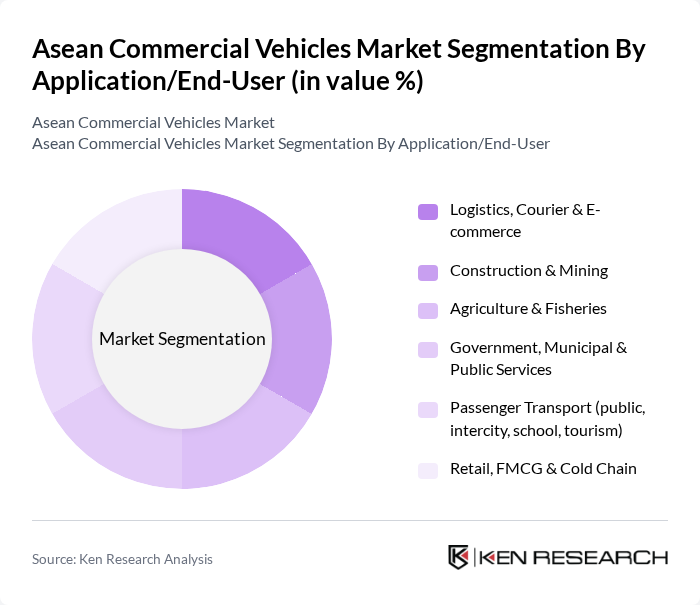

By Application/End-User:This segmentation encompasses various applications including Logistics, Courier & E-commerce, Construction & Mining, Agriculture & Fisheries, Government, Municipal & Public Services, Passenger Transport, and Retail, FMCG & Cold Chain. The Logistics, Courier & E-commerce segment is currently dominating the market, driven by the exponential growth of online shopping and the need for efficient delivery systems. The increasing reliance on e-commerce platforms has led to a surge in demand for commercial vehicles tailored for logistics, making this segment a key player in the overall market dynamics.

The Asean Commercial Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Isuzu Motors Limited, Hino Motors, Ltd., Toyota Motor Corporation, Mitsubishi Fuso Truck and Bus Corporation, UD Trucks Corporation, Foton Motor, Tata Motors Limited, Ashok Leyland Limited, Volvo Group, Scania AB, MAN Truck & Bus SE, Daimler Truck AG, BYD Company Limited, Dongfeng Motor Corporation, FAW Group Corporation, Hyundai Motor Company (Commercial Vehicles), Kia Corporation (Commercial Vehicles), THACO (Truong Hai Auto Corporation), VinFast Commercial & Services (bus operations), PT Astra International Tbk (Isuzu/Hino distributor, Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The ASEAN commercial vehicles market is poised for transformative growth driven by urbanization, e-commerce, and infrastructure investments. As governments prioritize sustainable transportation, the adoption of electric vehicles is expected to rise significantly. Additionally, advancements in technology, such as IoT integration in fleet management, will enhance operational efficiency. The focus on last-mile delivery solutions will further shape the market, creating a dynamic environment for innovation and investment in commercial vehicles.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Light Commercial Vehicles (LCVs: pickups, small trucks, vans) Medium Commercial Vehicles (MCVs) Heavy Commercial Vehicles (HCVs: heavy trucks, tractors) Buses & Coaches Specialized/Body-on-Chassis (refrigerated, tipper, tanker, waste) |

| By Application/End-User | Logistics, Courier & E-commerce Construction & Mining Agriculture & Fisheries Government, Municipal & Public Services Passenger Transport (public, intercity, school, tourism) Retail, FMCG & Cold Chain |

| By Gross Vehicle Weight (GVW) | Up to 3.5 tons (LCV) –7.5 tons –16 tons Above 16 tons |

| By Propulsion/Fuel Type | Diesel Gasoline CNG/LNG Hybrid (HEV/PHEV) Battery Electric (BEV) |

| By Sales Channel | OEM/Direct Sales Authorized Dealerships Fleet/Leasing & Rental Secondary/Used & Auctions |

| By Country (ASEAN) | Indonesia Thailand Vietnam Malaysia Philippines Singapore Myanmar Cambodia Laos Brunei |

| By Price Band | Entry/Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light Commercial Vehicles | 150 | Fleet Managers, Small Business Owners |

| Medium Commercial Vehicles | 110 | Logistics Coordinators, Operations Managers |

| Heavy Commercial Vehicles | 80 | Transport Company Executives, Procurement Managers |

| Electric Commercial Vehicles | 70 | Environmental Compliance Officers, Fleet Sustainability Managers |

| Vehicle Maintenance and Services | 90 | Service Center Managers, Automotive Technicians |

The ASEAN Commercial Vehicles Market is valued at approximately USD 45 billion, driven by increasing demand for transportation and logistics services, urbanization, and government initiatives promoting infrastructure development.