Japan Commercial Vehicles Market Overview

- The Japan Commercial Vehicles Market is valued at USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by the rising demand for logistics and transportation services, robust infrastructure development, and expanding e-commerce, which require efficient delivery vehicles and advanced supply chain solutions. Technological advancements, including the adoption of electric, hybrid, and autonomous commercial vehicles, as well as improved fuel efficiency and safety features, are accelerating market expansion.

- Key players in this market benefit from strategic logistics hubs such as Tokyo, Osaka, and Nagoya, which dominate due to their advanced infrastructure, high population density, and concentration of industrial and commercial activities. These cities facilitate the movement of goods and services nationwide, supporting both domestic and export-oriented logistics. The presence of major manufacturers and service providers in these urban centers further amplifies commercial vehicle demand.

- In 2023, the Japanese government strengthened emissions regulations for commercial vehicles through the "Automobile NOx and PM Law (Amendment), 2023" issued by the Ministry of the Environment. This regulation mandates that all new commercial vehicles must comply with stricter nitrogen oxide (NOx) and particulate matter (PM) emissions standards, requiring manufacturers to invest in cleaner technologies such as electric, hybrid, and hydrogen fuel cell vehicles. The law applies to both domestic and imported vehicles, with compliance monitored through periodic inspections and certification processes.

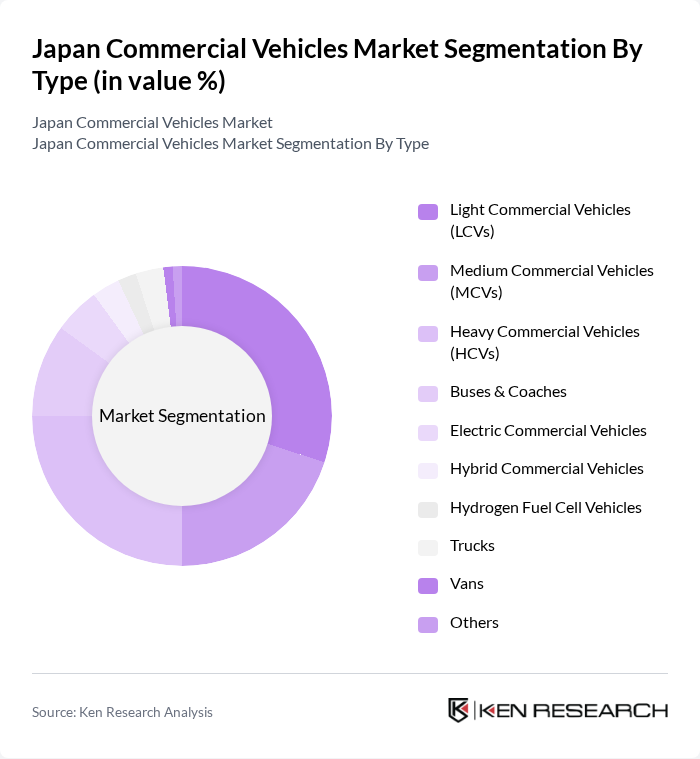

Japan Commercial Vehicles Market Segmentation

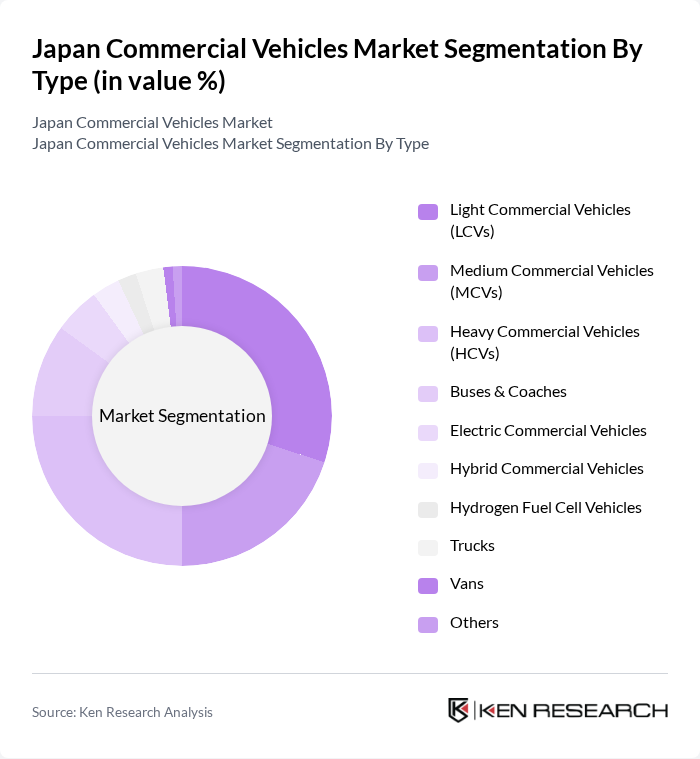

By Type:The market is segmented into various types of commercial vehicles, including Light Commercial Vehicles (LCVs), Medium Commercial Vehicles (MCVs), Heavy Commercial Vehicles (HCVs), Buses & Coaches, Electric Commercial Vehicles, Hybrid Commercial Vehicles, Hydrogen Fuel Cell Vehicles, Trucks, Vans, and Others. Each sub-segment addresses distinct operational needs: LCVs and HCVs are particularly popular for their versatility in urban logistics and long-haul transportation, while electric and hybrid vehicles are gaining traction due to regulatory incentives and sustainability goals.

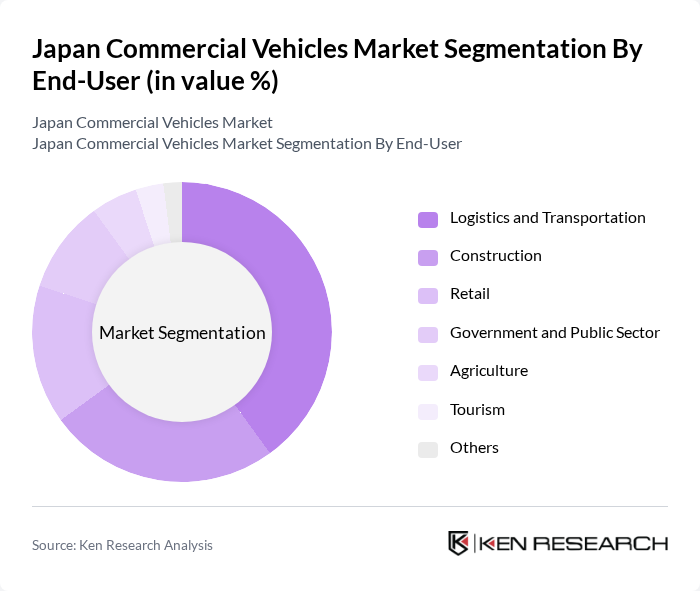

By End-User:The end-user segmentation includes Logistics and Transportation, Construction, Retail, Government and Public Sector, Agriculture, Tourism, and Others. Logistics and transportation remain the largest consumer segment, propelled by the surge in e-commerce and the need for efficient supply chain management. Construction and agriculture sectors also contribute substantially, leveraging commercial vehicles for material transport and operational efficiency.

Japan Commercial Vehicles Market Competitive Landscape

The Japan Commercial Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Isuzu Motors Limited, Hino Motors, Ltd., Nissan Motor Co., Ltd., Mitsubishi Fuso Truck and Bus Corporation, UD Trucks Corporation, Suzuki Motor Corporation, Daihatsu Motor Co., Ltd., Scania AB, Volvo Group, MAN SE, PACCAR Inc., Navistar International Corporation, Ford Motor Company, General Motors Company contribute to innovation, geographic expansion, and service delivery in this space.

Japan Commercial Vehicles Market Industry Analysis

Growth Drivers

- Increasing Demand for E-commerce Logistics:The surge in e-commerce has significantly boosted the demand for commercial vehicles in Japan. In future, the e-commerce sector generated approximately ¥20.7 trillion ($150 billion), with projections indicating a growth rate of 10% annually. This growth necessitates a robust logistics framework, leading to an increased requirement for delivery trucks and vans. Consequently, manufacturers are focusing on producing vehicles tailored for last-mile delivery, enhancing operational efficiency and meeting consumer expectations.

- Government Initiatives for Infrastructure Development:The Japanese government has allocated ¥5.2 trillion ($36 billion) for infrastructure projects in future, aimed at enhancing transportation networks. This investment includes the construction of new highways and the modernization of existing roads, which directly benefits the commercial vehicle sector. Improved infrastructure facilitates smoother logistics operations, reducing transit times and operational costs for businesses, thereby driving demand for commercial vehicles across various industries.

- Technological Advancements in Vehicle Manufacturing:The commercial vehicle industry in Japan is witnessing rapid technological advancements, particularly in electric and hybrid vehicle production. In future, it is estimated that electric commercial vehicles will account for approximately 7% of total sales, driven by innovations in battery technology and manufacturing processes. This shift not only aligns with global sustainability goals but also meets the increasing consumer demand for eco-friendly transportation solutions, further propelling market growth.

Market Challenges

- Stringent Environmental Regulations:Japan's commitment to reducing carbon emissions has led to stringent environmental regulations impacting the commercial vehicle market. The government aims to achieve a 46% reduction in greenhouse gas emissions in future, necessitating compliance from manufacturers. This regulatory landscape poses challenges for traditional vehicle producers, as they must invest significantly in research and development to meet these standards, potentially increasing production costs and affecting profitability.

- Fluctuating Fuel Prices:The volatility of fuel prices remains a significant challenge for the commercial vehicle market in Japan. In future, the average price of diesel fuel is approximately ¥160 ($1.10) per liter, with fluctuations attributed to global oil market dynamics. Such instability impacts operational costs for logistics companies, leading to budget constraints and affecting their ability to invest in fleet expansion or upgrades, thereby hindering overall market growth.

Japan Commercial Vehicles Market Future Outlook

The future of the Japan commercial vehicles market appears promising, driven by ongoing technological innovations and a shift towards sustainable practices. As electric and hybrid vehicles gain traction, manufacturers are expected to invest heavily in R&D to enhance efficiency and reduce emissions. Additionally, the expansion of e-commerce logistics will continue to create demand for versatile delivery solutions. With government support for infrastructure development, the market is poised for significant transformation, aligning with global trends towards smarter and greener transportation systems.

Market Opportunities

- Growth in Electric Commercial Vehicles:The increasing focus on sustainability presents a substantial opportunity for electric commercial vehicles. With government incentives projected to reach ¥800 billion ($6 billion) in future, manufacturers can capitalize on this trend by developing innovative electric models, catering to environmentally conscious consumers and businesses seeking to reduce their carbon footprint.

- Expansion of Last-Mile Delivery Services:The rise of e-commerce has led to a burgeoning demand for last-mile delivery services. In future, the last-mile delivery market is expected to grow to ¥2.5 trillion ($18 billion), creating opportunities for commercial vehicle manufacturers to design specialized vehicles that enhance delivery efficiency and meet the unique needs of urban logistics.