Region:Asia

Author(s):Dev

Product Code:KRAB0656

Pages:92

Published On:August 2025

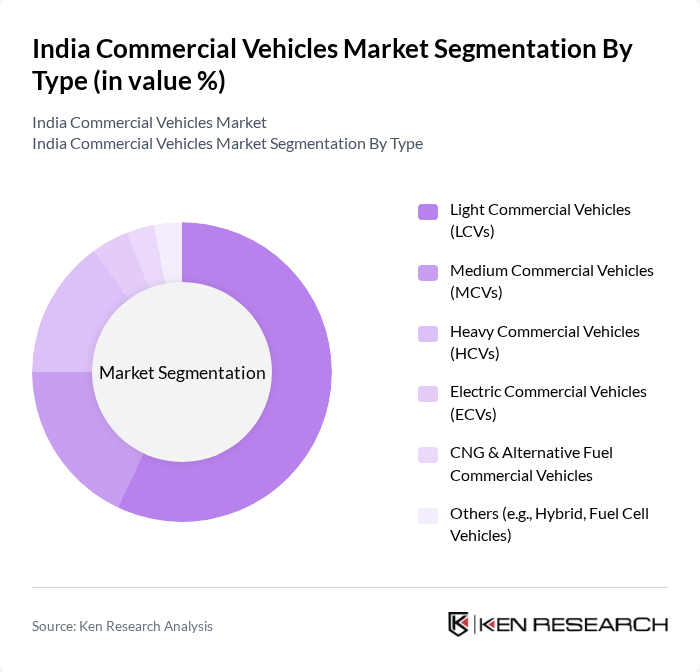

By Type:The market is segmented into various types of commercial vehicles, including Light Commercial Vehicles (LCVs), Medium Commercial Vehicles (MCVs), Heavy Commercial Vehicles (HCVs), Electric Commercial Vehicles (ECVs), CNG & Alternative Fuel Commercial Vehicles, and Others (e.g., Hybrid, Fuel Cell Vehicles). Among these, LCVs are currently leading the market, driven by their versatility, adaptability in urban logistics, and strong demand from last-mile delivery and e-commerce sectors. The segment is further supported by the adoption of electric and CNG variants and innovative financing options .

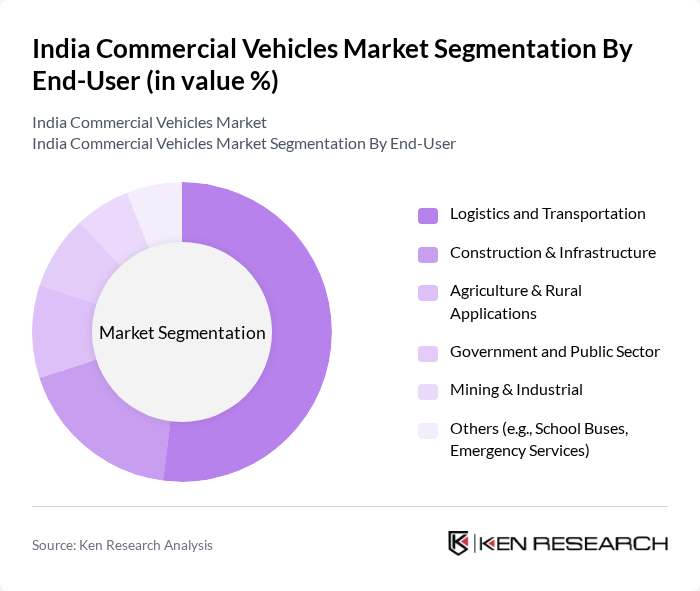

By End-User:The end-user segmentation includes Logistics and Transportation, Construction & Infrastructure, Agriculture & Rural Applications, Government and Public Sector, Mining & Industrial, and Others (e.g., School Buses, Emergency Services). The Logistics and Transportation sector is the dominant end-user, driven by the rapid growth of e-commerce, expansion of organized retail, and the increasing need for efficient supply chain and last-mile delivery solutions. Construction and infrastructure projects, as well as government fleet modernization, also contribute significantly to demand .

The India Commercial Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Motors Limited, Ashok Leyland Limited, Mahindra & Mahindra Limited, Eicher Motors Limited, Daimler India Commercial Vehicles Pvt. Ltd. (BharatBenz), Isuzu Motors India Private Limited, Volvo Eicher Commercial Vehicles Limited, Force Motors Limited, SML Isuzu Limited, Piaggio Vehicles Private Limited, VE Commercial Vehicles Limited, JCB India Limited, Scania Commercial Vehicles India Pvt. Ltd., Maruti Suzuki India Limited (Super Carry LCV Segment), and AMW Motors Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India commercial vehicles market appears promising, driven by technological advancements and a shift towards sustainable transport solutions. The increasing adoption of electric vehicles is expected to reshape the market landscape, with the government targeting 30% electric vehicle penetration in future. Additionally, the integration of smart logistics solutions will enhance operational efficiency, enabling companies to optimize their supply chains and reduce costs, thereby fostering growth in the commercial vehicle sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Commercial Vehicles (LCVs) Medium Commercial Vehicles (MCVs) Heavy Commercial Vehicles (HCVs) Electric Commercial Vehicles (ECVs) CNG & Alternative Fuel Commercial Vehicles Others (e.g., Hybrid, Fuel Cell Vehicles) |

| By End-User | Logistics and Transportation Construction & Infrastructure Agriculture & Rural Applications Government and Public Sector (e.g., State Transport Undertakings, Municipal Fleets) Mining & Industrial Others (e.g., School Buses, Emergency Services) |

| By Region | North India (Delhi, Uttar Pradesh, Haryana, Punjab, etc.) South India (Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, etc.) East India (West Bengal, Odisha, Bihar, Jharkhand, etc.) West India (Maharashtra, Gujarat, Rajasthan, etc.) Central India (Madhya Pradesh, Chhattisgarh, etc.) Others (Union Territories, North-East States) |

| By Application | Freight Transport (Goods Carriers, Tippers, Tankers) Passenger Transport (Buses, Vans, Staff Carriers) Construction Activities (Concrete Mixers, Dumpers, etc.) Emergency & Utility Services (Ambulances, Fire Trucks, etc.) Others (Refrigerated Vehicles, Mobile Shops, etc.) |

| By Sales Channel | Direct Sales (OEM to Fleet/Institutional Buyers) Dealerships & Authorized Distributors Online Sales Platforms Used Vehicle Sales Others |

| By Distribution Mode | Urban Distribution Rural Distribution Cross-Border Distribution (Exports) Others |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light Commercial Vehicles | 120 | Fleet Managers, Small Business Owners |

| Medium Commercial Vehicles | 90 | Logistics Coordinators, Transport Managers |

| Heavy Commercial Vehicles | 60 | Operations Directors, Procurement Managers |

| Electric Commercial Vehicles | 50 | Fleet Sustainability Managers, Environmental Compliance Officers |

| Commercial Vehicle Financing | 70 | Credit Managers, Financial Analysts |

The India Commercial Vehicles Market is valued at approximately USD 51 billion, driven by increasing demand for logistics, transportation services, and significant infrastructure development projects across the country.