Region:North America

Author(s):Rebecca

Product Code:KRAD0237

Pages:82

Published On:August 2025

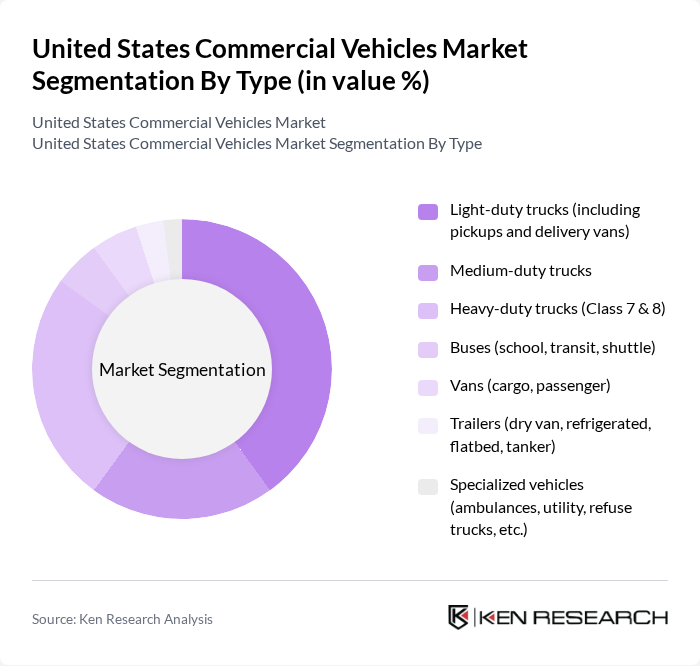

By Type:The commercial vehicles market is segmented into light-duty trucks, medium-duty trucks, heavy-duty trucks, buses, vans, trailers, and specialized vehicles. Among these,light-duty trucks(including pickups and delivery vans) dominate the market due to their versatility and widespread use in urban logistics, last-mile delivery, and personal transportation. The surge in e-commerce and the demand for rapid, flexible delivery options have further propelled the need for these vehicles .

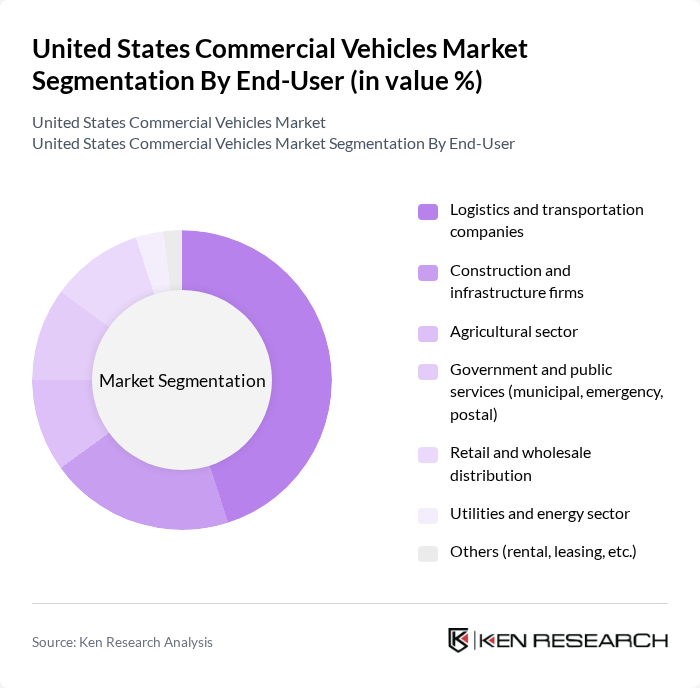

By End-User:End-user segmentation includes logistics and transportation companies, construction and infrastructure firms, the agricultural sector, government and public services, retail and wholesale distribution, utilities and energy sector, and others.Logistics and transportation companiesare the leading end-users, driven by the growing demand for efficient freight transport and the rise of e-commerce, which necessitates robust fleets to meet delivery timelines. Construction and infrastructure firms, as well as government and public service agencies, also represent significant demand drivers due to ongoing investments in public works and essential services .

The United States Commercial Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ford Motor Company, General Motors Company, Daimler Truck North America LLC, PACCAR Inc, Navistar International Corporation, Volvo Group North America, Isuzu Commercial Truck of America, Inc., Hino Motors Manufacturing U.S.A., Inc., Freightliner Trucks, Mitsubishi Fuso Truck of America, Inc., Tesla, Inc., Workhorse Group Inc., BYD Motors Inc., Nikola Corporation, Lordstown Motors Corp., Rivian Automotive, Inc., Mack Trucks, Inc., Peterbilt Motors Company, Kenworth Truck Company, Blue Bird Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. commercial vehicle market appears promising, driven by technological innovations and evolving consumer preferences. The shift towards electric and hybrid vehicles is expected to gain momentum, supported by government incentives and increasing environmental awareness. Additionally, advancements in autonomous vehicle technology will likely reshape logistics operations, enhancing efficiency and safety. As companies adapt to these trends, the market will continue to evolve, presenting new opportunities for growth and investment in sustainable transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Light-duty trucks (including pickups and delivery vans) Medium-duty trucks Heavy-duty trucks (Class 7 & 8) Buses (school, transit, shuttle) Vans (cargo, passenger) Trailers (dry van, refrigerated, flatbed, tanker) Specialized vehicles (ambulances, utility, refuse trucks, etc.) |

| By End-User | Logistics and transportation companies Construction and infrastructure firms Agricultural sector Government and public services (municipal, emergency, postal) Retail and wholesale distribution Utilities and energy sector Others (rental, leasing, etc.) |

| By Fuel Type | Diesel Gasoline Electric (BEV, PHEV) Hybrid (HEV) Alternative fuels (CNG, LNG, hydrogen, propane) |

| By Payload Capacity | Up to 3,000 lbs (Class 1-2) ,001 to 10,000 lbs (Class 3-4) ,001 to 26,000 lbs (Class 5-6) Above 26,000 lbs (Class 7-8) |

| By Application | Freight and goods transport Passenger transport Waste management and sanitation Emergency and public safety services Utility and service operations Others |

| By Sales Channel | Direct sales (OEM to fleet) Authorized dealerships Online platforms and digital marketplaces Auctions and remarketing Rental and leasing companies Others |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light-Duty Commercial Vehicles | 100 | Fleet Managers, Small Business Owners |

| Heavy-Duty Trucks | 80 | Logistics Directors, Fleet Operations Managers |

| Electric Commercial Vehicles | 60 | R&D Managers, Sustainability Officers |

| Bus and Coach Sector | 50 | Transit Authority Officials, Operations Supervisors |

| Commercial Vehicle Parts Suppliers | 70 | Procurement Managers, Supply Chain Analysts |

The United States Commercial Vehicles Market is valued at approximately USD 213 billion, driven by increasing demand for logistics, transportation services, and the growth of e-commerce, alongside ongoing infrastructure development and a shift towards sustainable vehicle technologies.