Region:Asia

Author(s):Shubham

Product Code:KRAA1074

Pages:89

Published On:August 2025

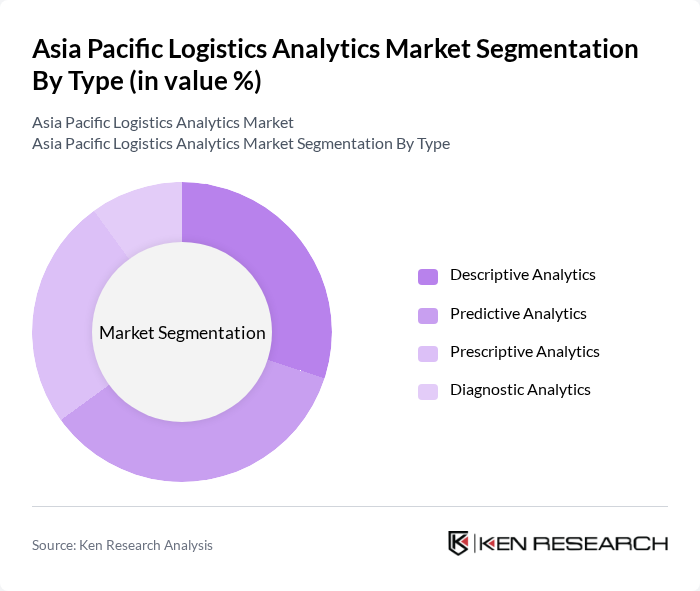

By Type:The market is segmented into four types of analytics: Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Diagnostic Analytics. Each type serves a unique purpose in enhancing logistics operations, with Descriptive Analytics focusing on historical data analysis, Predictive Analytics forecasting future trends, Prescriptive Analytics recommending actions, and Diagnostic Analytics identifying root causes of issues. Descriptive Analytics remains the largest and fastest-growing segment, driven by the need for real-time visibility and operational transparency .

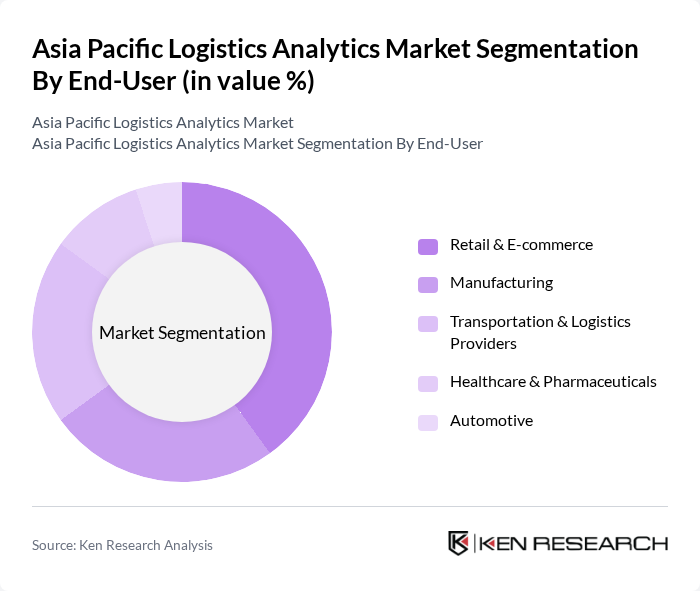

By End-User:The logistics analytics market is segmented by end-users, including Retail & E-commerce, Manufacturing, Transportation & Logistics Providers, Healthcare & Pharmaceuticals, and Automotive. Each sector utilizes analytics to improve efficiency, reduce costs, and enhance customer satisfaction. Retail & E-commerce is a significant driver due to the surge in online shopping and the need for advanced last-mile delivery and inventory optimization solutions .

The Asia Pacific Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Nippon Express Holdings, Hitachi Transport System, SF Express, Yusen Logistics, CJ Logistics, Kerry Logistics Network, FedEx Logistics, UPS Supply Chain Solutions, DSV, CEVA Logistics, Agility Logistics, Sinotrans Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific logistics analytics market appears promising, driven by technological advancements and evolving consumer demands. Companies are increasingly focusing on integrating predictive analytics to enhance operational efficiency and customer satisfaction. Additionally, the emphasis on sustainability is prompting logistics firms to adopt eco-friendly practices, which will likely shape the market landscape. As organizations continue to invest in innovative solutions, the logistics analytics sector is expected to evolve, fostering greater collaboration and efficiency across supply chains.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics |

| By End-User | Retail & E-commerce Manufacturing Transportation & Logistics Providers Healthcare & Pharmaceuticals Automotive |

| By Application | Supply Chain Management Inventory & Warehouse Management Demand Forecasting Route & Network Optimization Risk & Compliance Management |

| By Transportation Mode | Road Rail Air Sea |

| By Deployment Model | On-Premise Cloud-Based |

| By Organization Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By Country | China Japan India South Korea Australia Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Analytics | 60 | Logistics Coordinators, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 50 | Operations Managers, Production Planners |

| E-commerce Logistics Solutions | 45 | eCommerce Operations Managers, Data Analysts |

| Freight and Shipping Analytics | 40 | Logistics Directors, Freight Managers |

| Technology Adoption in Logistics | 45 | IT Managers, Digital Transformation Leads |

The Asia Pacific Logistics Analytics Market is valued at approximately USD 2.4 billion, reflecting a significant growth driven by the demand for data-driven decision-making and enhanced supply chain visibility among logistics providers.