Region:Global

Author(s):Shubham

Product Code:KRAA0802

Pages:95

Published On:August 2025

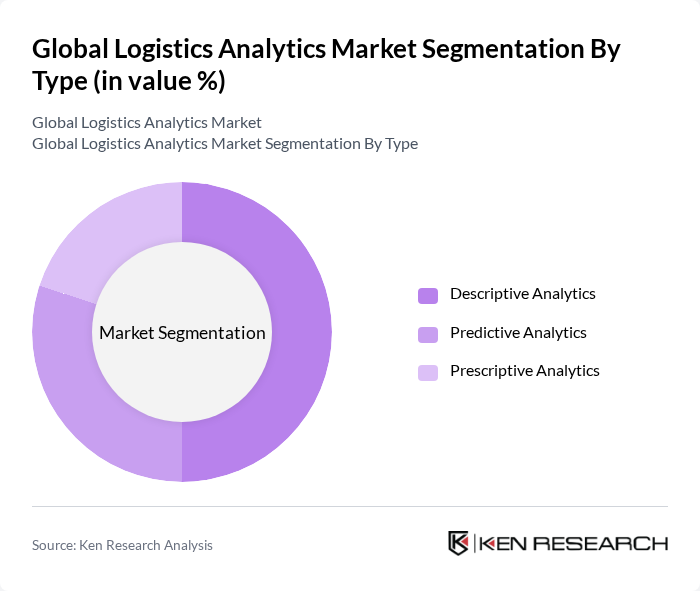

By Type:The market is segmented into three main types: Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics. Descriptive Analytics remains the leading sub-segment, as it provides essential insights into historical logistics data, enabling organizations to monitor performance and identify inefficiencies. Predictive Analytics is gaining momentum due to its ability to forecast demand, optimize inventory, and anticipate disruptions. Prescriptive Analytics is emerging as organizations seek to automate decision-making and optimize logistics operations through advanced simulation and recommendation engines .

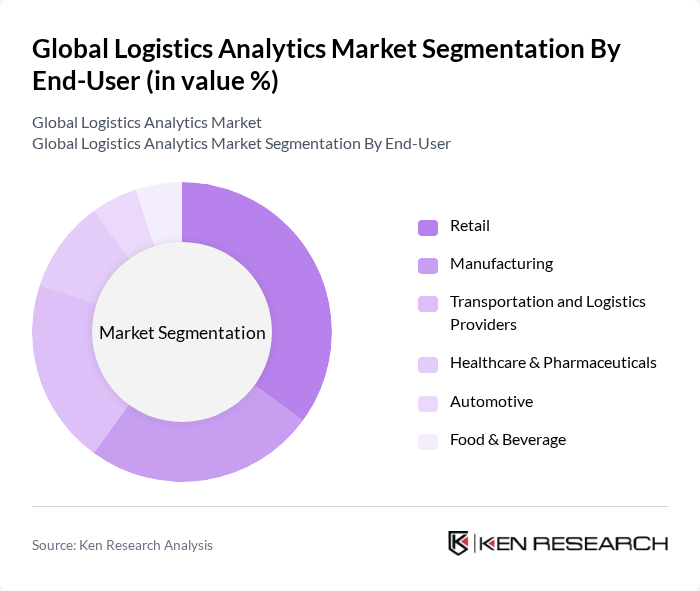

By End-User:The market is segmented by end-users, including Retail, Manufacturing, Transportation and Logistics Providers, Healthcare & Pharmaceuticals, Automotive, and Food & Beverage. The Retail sector is the dominant end-user, driven by the need for efficient inventory management, demand forecasting, and rapid order fulfillment. Manufacturing is a close follower, with companies leveraging analytics to streamline production and supply chain processes. Transportation and Logistics Providers are also significant adopters, using analytics to optimize routes, reduce fuel consumption, and enhance service reliability. Healthcare & Pharmaceuticals, Automotive, and Food & Beverage sectors are increasingly adopting logistics analytics to ensure compliance, improve traceability, and manage complex supply chains .

The Global Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Kinaxis Inc., Infor, Inc., C.H. Robinson Worldwide, Inc., Descartes Systems Group Inc., FourKites, Inc., Project44, Inc., Locus.sh, ClearMetal, Inc. (acquired by Project44), FedEx Corporation, Deutsche Post DHL Group, XPO Logistics, Inc., DSV A/S, United Parcel Service, Inc. (UPS), Ceva Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The logistics analytics market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt AI and machine learning, predictive analytics will become a standard practice, enhancing operational efficiency. Furthermore, the emphasis on sustainability will push logistics firms to innovate, integrating eco-friendly practices into their analytics strategies. This shift will not only improve efficiency but also align with global sustainability goals, creating a more resilient logistics ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics |

| By End-User | Retail Manufacturing Transportation and Logistics Providers Healthcare & Pharmaceuticals Automotive Food & Beverage |

| By Application | Inventory Management Demand Forecasting Route Optimization Supply Chain Visibility Transportation Management Warehouse Management |

| By Component | Software Services |

| By Deployment Mode | On-premise Cloud-based |

| By Transportation Mode | Road Rail Air Sea |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Analytics in Retail | 100 | Supply Chain Managers, Data Analysts |

| Transportation Management Systems | 60 | Operations Directors, IT Managers |

| Warehouse Management Solutions | 50 | Warehouse Managers, Logistics Coordinators |

| Last-Mile Delivery Analytics | 40 | Delivery Managers, Customer Experience Leads |

| Supply Chain Visibility Tools | 50 | Procurement Officers, Business Analysts |

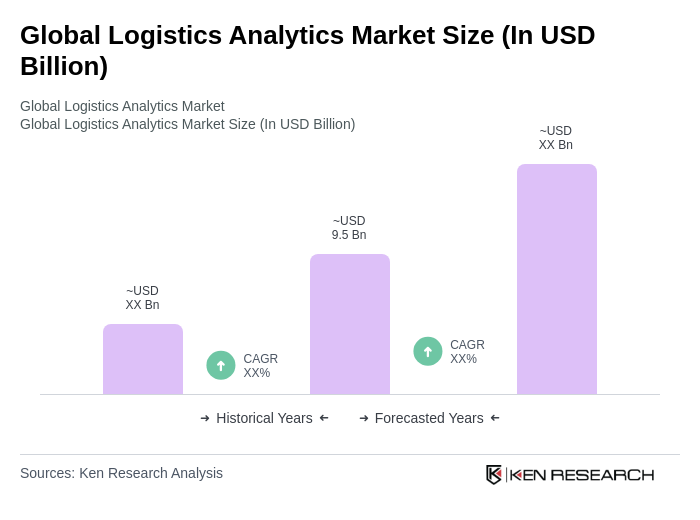

The Global Logistics Analytics Market is valued at approximately USD 9.5 billion, driven by the increasing need for data-driven decision-making and enhanced supply chain visibility, along with the adoption of advanced technologies like AI and IoT.