Region:Europe

Author(s):Shubham

Product Code:KRAA0949

Pages:86

Published On:August 2025

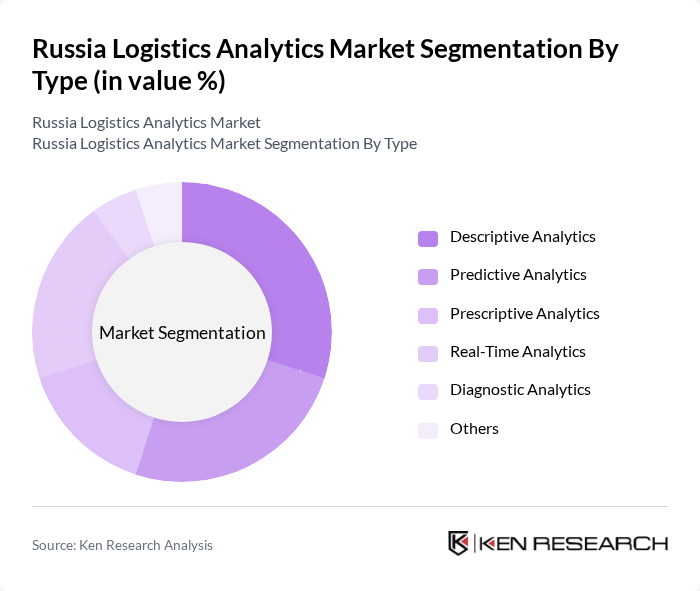

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-Time Analytics, Diagnostic Analytics, and Others. Each type serves a unique purpose in enhancing logistics operations. Descriptive and Predictive Analytics are particularly prominent due to their ability to provide actionable insights and forecasts that drive strategic decision-making and operational improvements .

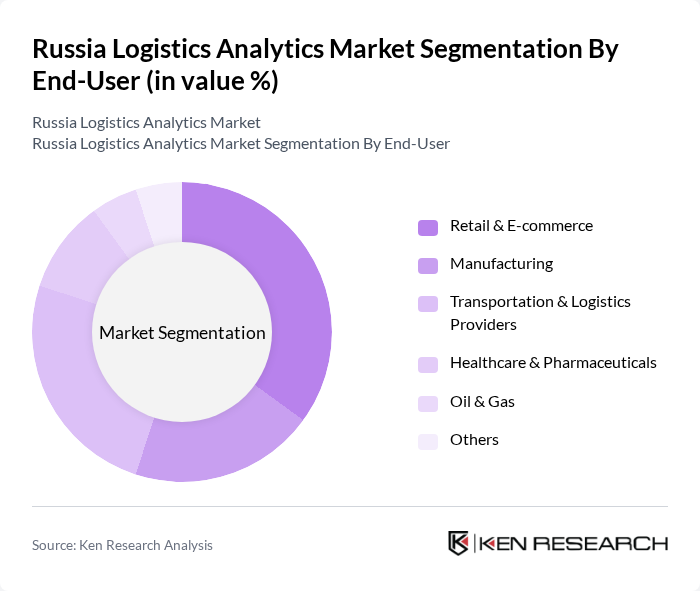

By End-User:The logistics analytics market is further segmented by end-users, including Retail & E-commerce, Manufacturing, Transportation & Logistics Providers, Healthcare & Pharmaceuticals, Oil & Gas, and Others. Retail & E-commerce and Transportation & Logistics Providers are leading segments, driven by the need for efficient supply chain management, real-time data analytics, and the rapid expansion of e-commerce, which has significantly increased demand for advanced logistics solutions to enhance customer satisfaction and operational efficiency .

The Russia Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Yandex LLC, C.H. Robinson Worldwide, Inc., TransContainer PJSC, Globaltruck Management JSC, RZD Logistics JSC, DPD Russia (DPDgroup), Kuehne + Nagel Russia, FM Logistic Russia, Delovye Linii (Business Lines LLC), Major Express, and Transporeon Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics analytics market in Russia appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to invest in AI and machine learning, the integration of these technologies into logistics operations is expected to enhance predictive capabilities. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly logistics solutions, positioning analytics as a crucial tool for optimizing resource use and reducing environmental impact in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-Time Analytics Diagnostic Analytics Others |

| By End-User | Retail & E-commerce Manufacturing Transportation & Logistics Providers Healthcare & Pharmaceuticals Oil & Gas Others |

| By Application | Supply Chain Optimization Inventory & Warehouse Management Fleet & Asset Management Demand Forecasting & Planning Route Optimization Risk & Compliance Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales |

| By Distribution Mode | Road Rail Air Sea |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Analytics | 100 | Logistics Directors, Data Analysts |

| Manufacturing Supply Chain Analytics | 80 | Operations Managers, Supply Chain Analysts |

| E-commerce Logistics Optimization | 90 | E-commerce Operations Managers, IT Specialists |

| Transportation Analytics Solutions | 60 | Fleet Managers, Data Scientists |

| Warehouse Management Analytics | 50 | Warehouse Managers, Inventory Control Specialists |

The Russia Logistics Analytics Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing demand for data-driven decision-making and the adoption of advanced technologies in logistics operations.