Region:Global

Author(s):Geetanshi

Product Code:KRAA0236

Pages:91

Published On:August 2025

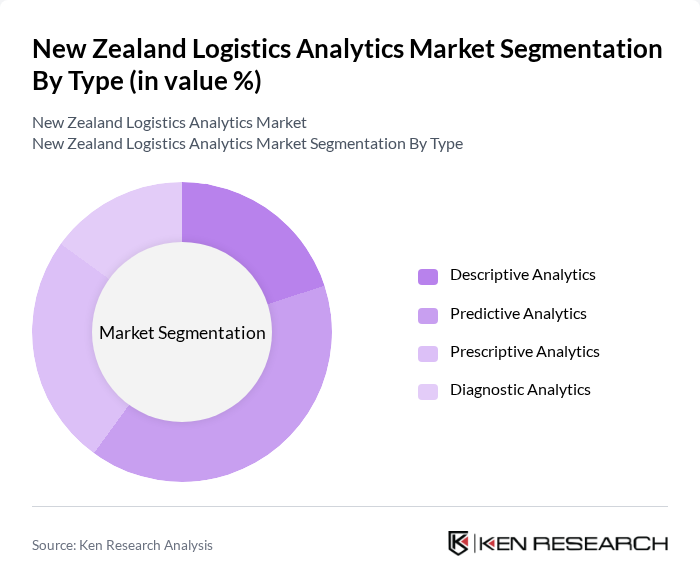

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Diagnostic Analytics. Each of these sub-segments plays a crucial role in helping businesses understand their logistics operations, forecast future trends, and make informed decisions. Predictive Analytics is currently the most widely adopted, as it enables companies to forecast demand, optimize inventory, and streamline supply chain operations by leveraging historical and real-time data .

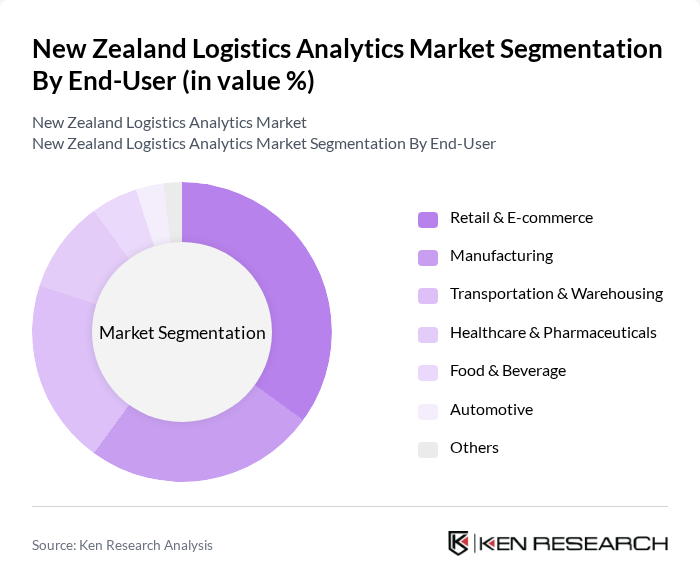

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Transportation & Warehousing, Healthcare & Pharmaceuticals, Food & Beverage, Automotive, and Others. Retail & E-commerce is the leading segment, driven by the rapid growth of online shopping and the need for efficient logistics solutions to meet consumer demands. The increasing complexity of supply chains in this sector necessitates advanced analytics to enhance operational efficiency and customer satisfaction. Manufacturing and agriculture also represent significant end-user segments, reflecting New Zealand's economic structure .

The New Zealand Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, New Zealand Post Ltd., Toll Group, Deutsche Post DHL Group, FedEx Corporation, Fliway Group Limited, Coda Group, Kuehne + Nagel New Zealand, Mondiale VGL, Linfox New Zealand, Owens Transport, StraitNZ, Sorted Logistics, Cardinal Logistics, DB Schenker New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand logistics analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace data-driven decision-making, the integration of AI and machine learning will enhance predictive analytics capabilities. Furthermore, the focus on sustainability will push logistics firms to adopt greener practices, leveraging analytics to optimize resource use and reduce environmental impact. This evolving landscape will create new opportunities for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics |

| By End-User | Retail & E-commerce Manufacturing Transportation & Warehousing Healthcare & Pharmaceuticals Food & Beverage Automotive Others |

| By Industry Vertical | Automotive Consumer Goods Food and Beverage Pharmaceuticals Agriculture Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Analytics Type | Real-Time Analytics Batch Analytics |

| By Geographic Distribution | North Island South Island |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 60 | Logistics Managers, Supply Chain Coordinators |

| Manufacturing Supply Chain | 50 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 70 | eCommerce Directors, Warehouse Managers |

| Healthcare Logistics Management | 40 | Supply Chain Directors, Compliance Officers |

| Freight Forwarding Insights | 50 | Logistics Analysts, Freight Managers |

The New Zealand Logistics Analytics Market is valued at approximately USD 17.7 billion, reflecting a five-year historical analysis. This growth is driven by the demand for data-driven decision-making and advanced technologies like AI and real-time tracking.