Asia Pacific Transportation Analytics Market Overview

- The Asia Pacific Transportation Analytics Market is valued at USD 2.4 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing demand for data-driven decision-making in transportation, enhanced operational efficiency, and the rising need for real-time analytics to manage traffic congestion and improve safety. The integration of advanced technologies such as AI, IoT, and cloud computing has further propelled the market, enabling stakeholders to leverage data for strategic planning, route optimization, and operational improvements .

- Countries like China, Japan, and India dominate the Asia Pacific Transportation Analytics Market due to their large populations, rapid urbanization, and significant investments in infrastructure development. China has made substantial advancements in smart city initiatives, Japan is recognized for its focus on technological innovation, and India’s expanding logistics sector contributes to their market leadership. These nations are also home to major transportation hubs and are at the forefront of adopting intelligent transportation systems, further enhancing their market presence .

- In 2023, the Indian government implemented the National Logistics Policy, issued by the Ministry of Commerce & Industry, aiming to promote seamless movement of goods and enhance the efficiency of the logistics sector. This policy emphasizes the use of technology and data analytics to optimize supply chain operations, reduce costs, and improve service delivery, thereby fostering growth in the transportation analytics market .

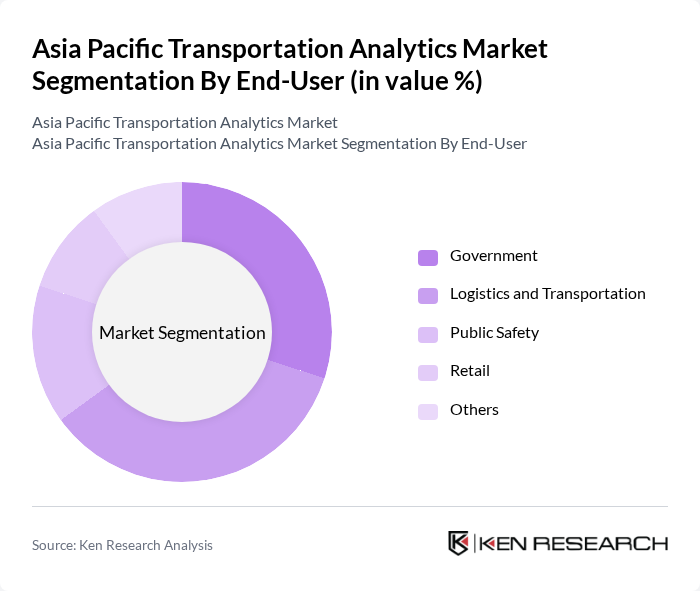

Asia Pacific Transportation Analytics Market Segmentation

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-time Analytics, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and decision-making processes within the transportation sector. Descriptive analytics remains the largest segment, driven by the need for historical data analysis and reporting, while predictive and real-time analytics are gaining traction for their ability to forecast trends and enable dynamic response to traffic and logistics challenges .

By End-User:The end-user segmentation includes Government, Logistics and Transportation, Public Safety, Retail, and Others. Each segment utilizes transportation analytics to enhance operational efficiency, improve safety, and optimize resource allocation. The logistics and transportation segment leads due to the widespread adoption of analytics for fleet management, route optimization, and supply chain visibility, while government agencies increasingly deploy analytics for urban mobility and infrastructure planning .

Asia Pacific Transportation Analytics Market Competitive Landscape

The Asia Pacific Transportation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, SAS Institute Inc., TIBCO Software Inc., Tableau Software, LLC, Cisco Systems, Inc., Siemens AG, HERE Technologies, TomTom International BV, Geotab Inc., INRIX, Inc., Waze, Inc., PTV Group, Hitachi, Ltd., NEC Corporation, Alibaba Cloud (Alibaba Group), Huawei Technologies Co., Ltd., Ito World Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

Asia Pacific Transportation Analytics Market Industry Analysis

Growth Drivers

- Increasing Demand for Real-Time Data Analytics:The Asia Pacific region is witnessing a surge in demand for real-time data analytics, driven by the need for efficient transportation management. In future, the region is expected to generate approximately $14 billion in revenue from transportation analytics solutions. This growth is fueled by the increasing volume of data generated by transportation systems, with estimates suggesting that data generation will reach 44 zettabytes globally, enhancing decision-making capabilities for transportation authorities.

- Government Investments in Smart Transportation:Governments across Asia Pacific are investing heavily in smart transportation initiatives, with projected expenditures exceeding $60 billion by future. This investment is aimed at developing infrastructure that integrates advanced analytics, IoT, and AI technologies. For instance, Singapore's Smart Nation initiative allocates significant funds to enhance public transport systems, which is expected to improve operational efficiency and reduce congestion, thereby driving the demand for analytics solutions.

- Rising Urbanization and Traffic Congestion:Urbanization in Asia Pacific is accelerating, with urban populations projected to reach 1.3 billion by future. This rapid growth is leading to increased traffic congestion, which is estimated to cost cities around $250 billion annually in lost productivity. Consequently, transportation analytics is becoming essential for urban planners to optimize traffic flow and improve public transport systems, thereby driving market growth in the region.

Market Challenges

- Data Privacy and Security Concerns:As transportation analytics relies heavily on data collection, concerns regarding data privacy and security are significant challenges. In future, it is estimated that data breaches could cost the transportation sector over $4 billion in losses. Regulatory frameworks, such as the General Data Protection Regulation (GDPR), impose strict compliance requirements, which can hinder the adoption of analytics solutions due to the complexities involved in data management and protection.

- High Implementation Costs:The initial costs associated with implementing transportation analytics solutions can be prohibitive, particularly for smaller municipalities. In future, the average cost of deploying a comprehensive analytics system is projected to be around $1.8 million. This financial barrier can deter investment in necessary technologies, limiting the ability of cities to leverage data-driven insights for improving transportation systems and infrastructure.

Asia Pacific Transportation Analytics Market Future Outlook

The future of the Asia Pacific transportation analytics market is poised for significant transformation, driven by technological advancements and increasing urbanization. As cities continue to expand, the integration of smart technologies will become essential for managing transportation systems effectively. The focus on sustainability and the development of autonomous vehicles will further shape the landscape, creating a demand for innovative analytics solutions that enhance operational efficiency and reduce environmental impact.

Market Opportunities

- Expansion of Smart City Initiatives:The growth of smart city initiatives presents a substantial opportunity for transportation analytics. With over 120 smart city projects planned across Asia Pacific in future, there is a significant demand for analytics solutions that can optimize urban mobility and enhance public transport efficiency, potentially impacting millions of commuters.

- Growth in E-Commerce Logistics:The rise of e-commerce is driving demand for advanced logistics solutions. In future, the e-commerce logistics market in Asia Pacific is expected to exceed $350 billion, creating opportunities for transportation analytics to streamline supply chain operations and improve delivery efficiency, ultimately benefiting both businesses and consumers.