Region:Global

Author(s):Shubham

Product Code:KRAA0803

Pages:87

Published On:August 2025

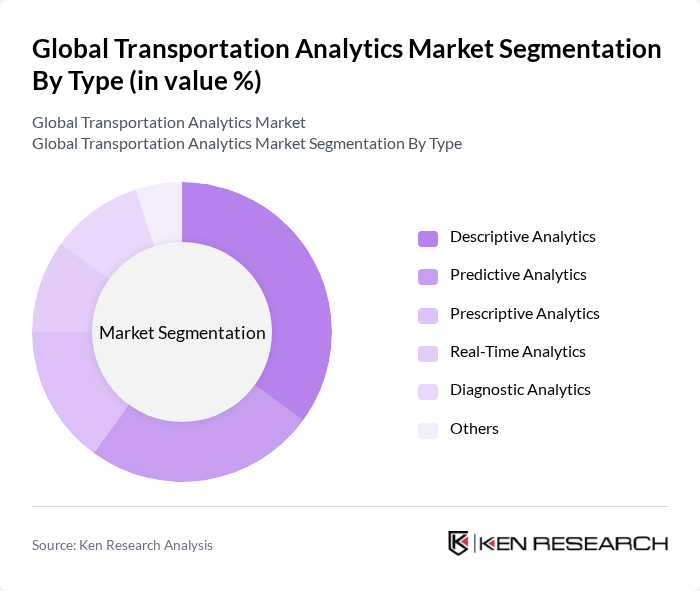

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-Time Analytics, Diagnostic Analytics, and Others. Each type serves distinct purposes, with Descriptive Analytics leading the market due to its ability to provide insights into historical data, helping organizations understand past performance and make informed decisions. Predictive and prescriptive analytics are rapidly gaining traction as organizations seek to forecast trends and optimize transportation operations using advanced modeling and simulation techniques .

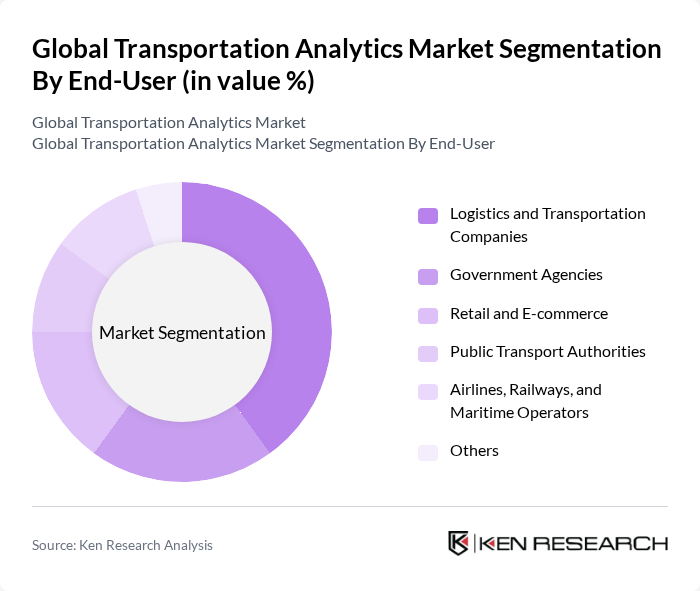

By End-User:The market is segmented by end-users, including Logistics and Transportation Companies, Government Agencies, Retail and E-commerce, Public Transport Authorities, Airlines, Railways, and Maritime Operators, and Others. Logistics and Transportation Companies dominate this segment as they increasingly rely on analytics to optimize operations, reduce costs, improve supply chain visibility, and enhance service delivery. Government agencies are also significant adopters, leveraging analytics for urban mobility planning and traffic management .

The Global Transportation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, SAP, Oracle, Microsoft, SAS Institute, TIBCO Software, HERE Technologies, Geotab, TomTom, Trimble, PTV Group, INRIX, Waze (Google), Fleet Complete, Moovit (Intel), Alteryx, Cubic Transportation Systems, Siemens Mobility, Kapsch TrafficCom, and Hitachi Rail contribute to innovation, geographic expansion, and service delivery in this space .

The future of transportation analytics is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As organizations increasingly prioritize data-driven decision-making, the integration of AI and machine learning will enhance predictive capabilities, enabling more efficient operations. Additionally, the focus on sustainability will drive innovations in analytics solutions, aligning with global environmental goals. The rise of Mobility-as-a-Service (MaaS) will further reshape the landscape, creating new opportunities for data utilization and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-Time Analytics Diagnostic Analytics Others |

| By End-User | Logistics and Transportation Companies Government Agencies Retail and E-commerce Public Transport Authorities Airlines, Railways, and Maritime Operators Others |

| By Application | Fleet Management Route Optimization Traffic Management Supply Chain Management Incident Management Planning & Maintenance Remote Sensing Others |

| By Component | Software Hardware Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Data Source | GPS Data Traffic Sensors Social Media Data Video Analytics Mobile Device Data |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Analytics | 100 | Fleet Managers, Data Analysts |

| Rail Freight Optimization | 50 | Logistics Coordinators, Operations Managers |

| Air Cargo Analytics | 40 | Airline Operations Directors, Cargo Managers |

| Maritime Shipping Analytics | 40 | Port Authorities, Shipping Line Executives |

| Last-Mile Delivery Solutions | 50 | eCommerce Logistics Managers, Delivery Service Providers |

The Global Transportation Analytics Market is valued at approximately USD 14 billion, reflecting a significant growth trend driven by the increasing demand for data-driven decision-making and advancements in technology such as IoT and artificial intelligence.