Region:Central and South America

Author(s):Shubham

Product Code:KRAA1032

Pages:92

Published On:August 2025

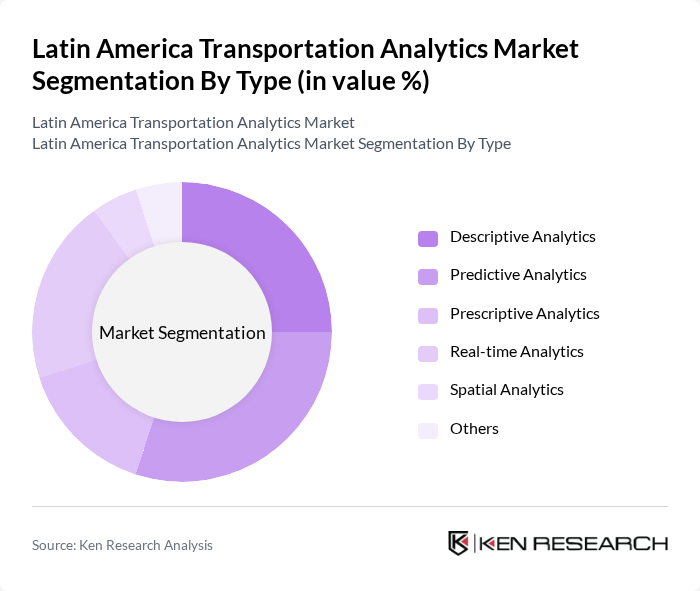

By Type:The market is segmented into various types of analytics solutions that cater to different needs within the transportation sector. The key subsegments include Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-time Analytics, Spatial Analytics, and Others. Each of these subsegments plays a crucial role in enhancing operational efficiency and decision-making processes. Predictive and real-time analytics are increasingly prioritized due to their ability to support dynamic route planning, congestion forecasting, and real-time event detection .

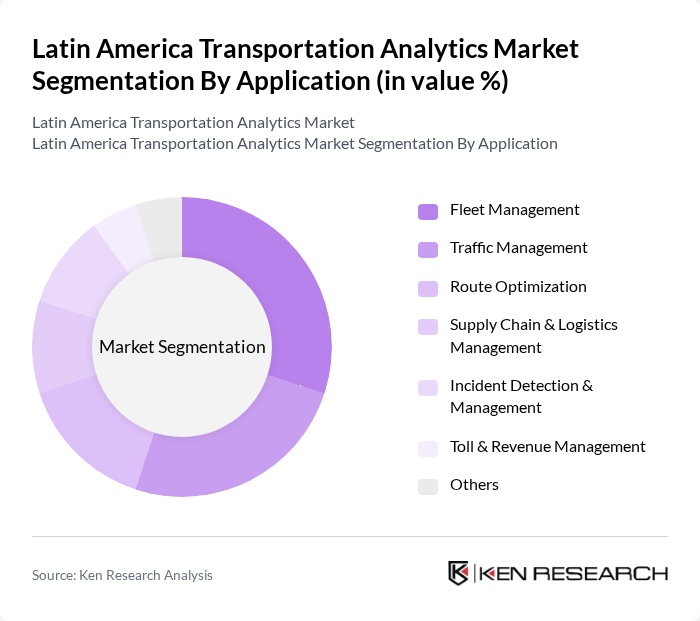

By Application:The applications of transportation analytics are diverse, addressing various operational needs. Key applications include Fleet Management, Traffic Management, Route Optimization, Supply Chain & Logistics Management, Incident Detection & Management, Toll & Revenue Management, and Others. Each application serves to enhance efficiency and improve service delivery in the transportation sector. Fleet management and traffic management remain the largest application areas, driven by the need for real-time visibility, route optimization, and reduction of operational costs .

The Latin America Transportation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, IBM, Oracle, Microsoft, SAS Institute, TIBCO Software, Tableau Software (Salesforce), Qlik, Cisco Systems, Siemens Mobility, Trimble, Geotab, HERE Technologies, TomTom, Esri, Indra Sistemas, Cubic Transportation Systems, NEC Corporation, Scipopulis, Dataprom contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Latin America transportation analytics market appears promising, driven by technological advancements and increasing investments in smart transportation solutions. As urbanization continues to rise, the demand for efficient logistics and public transport systems will grow, prompting further integration of data analytics. Additionally, the focus on sustainability will encourage the adoption of green technologies, fostering innovation and collaboration among stakeholders. This evolving landscape presents opportunities for companies to enhance their service offerings and improve operational efficiencies.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-time Analytics Spatial Analytics Others |

| By Application | Fleet Management Traffic Management Route Optimization Supply Chain & Logistics Management Incident Detection & Management Toll & Revenue Management Others |

| By End-User | Public Transportation Operators Logistics & Freight Companies Ride-sharing & Mobility Service Providers Government & Municipal Agencies Airports & Ports Others |

| By Region | Brazil Mexico Argentina Chile Colombia Peru Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Pricing Model | Subscription-based Pay-per-use One-time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Transportation Analytics | 100 | City Planners, Transportation Analysts |

| Logistics and Supply Chain Optimization | 80 | Logistics Managers, Supply Chain Analysts |

| Fleet Management Solutions | 60 | Fleet Managers, Operations Managers |

| Public Transportation Systems | 90 | Transit Authority Officials, Policy Makers |

| Smart Transportation Technologies | 70 | Technology Officers, Innovation Managers |

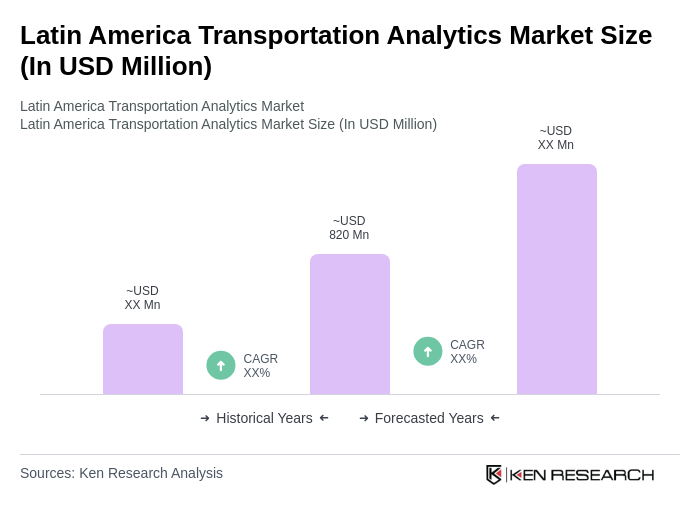

The Latin America Transportation Analytics Market is valued at approximately USD 820 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for data-driven decision-making and enhanced operational efficiency in the transportation sector.