Region:Asia

Author(s):Geetanshi

Product Code:KRAB0038

Pages:99

Published On:August 2025

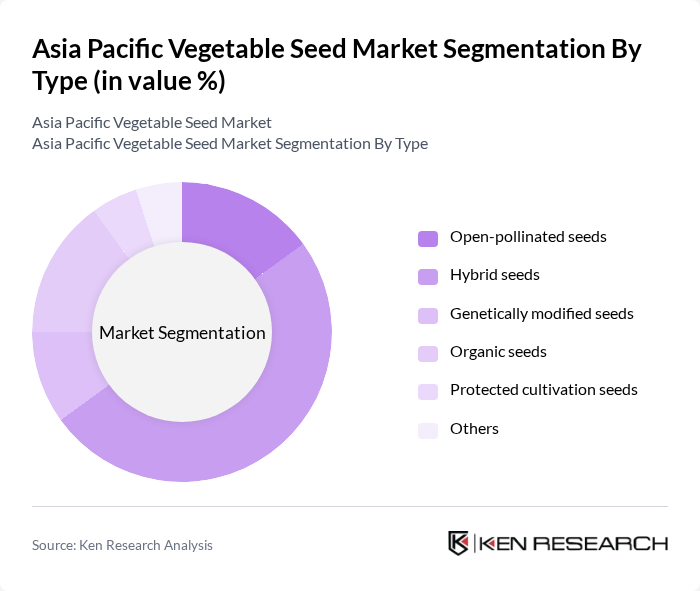

By Type:The vegetable seed market in Asia Pacific is segmented into open-pollinated seeds, hybrid seeds, genetically modified seeds, organic seeds, protected cultivation seeds, and others. Hybrid seeds are experiencing the fastest growth due to their higher yield potential, improved disease resistance, and adaptability to diverse climatic conditions, making them the preferred choice for commercial producers. The demand for organic seeds is also rising, driven by consumer preference for sustainable and chemical-free produce. Protected cultivation seeds are gaining traction as greenhouse and net house farming expands in urban and peri-urban areas .

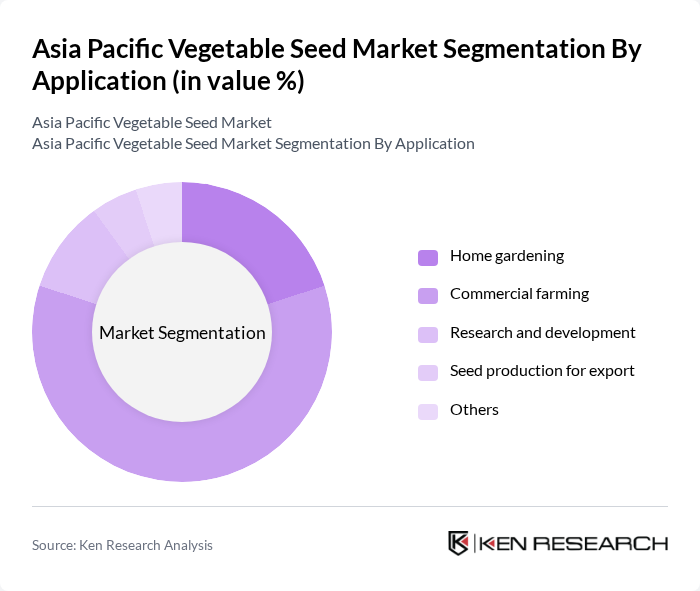

By Application:The vegetable seed market is also segmented by application, including home gardening, commercial farming, research and development, seed production for export, and others. Commercial farming is the dominant application segment, driven by the increasing demand for vegetables in both domestic and export markets. The home gardening segment is expanding as urban consumers seek access to fresh, locally grown produce, reflecting a broader trend toward urban agriculture .

The Asia Pacific Vegetable Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer Crop Science, Syngenta AG, Corteva Agriscience, Groupe Limagrain (Vilmorin & Cie), Sakata Seed Corporation, East-West Seed, Rijk Zwaan Zaadteelt en Zaadhandel B.V., Takii & Co., Ltd., Nunhems (BASF Vegetable Seeds), Seminis (Bayer/Monsanto), Bejo Zaden B.V., Enza Zaden, Known-You Seed Co., Ltd., Advanta Seeds (UPL Ltd.), Mahyco (Maharashtra Hybrid Seeds Company Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific vegetable seed market is poised for significant transformation, driven by the increasing adoption of sustainable farming practices and the integration of digital technologies. As urban gardening gains traction, particularly in densely populated areas, the demand for innovative seed solutions will rise. Additionally, the focus on pest-resistant seed varieties will enhance crop resilience, ensuring food security amidst climate challenges. These trends indicate a dynamic future for the vegetable seed market, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Open-pollinated seeds Hybrid seeds Genetically modified seeds Organic seeds Protected cultivation seeds Others |

| By Application | Home gardening Commercial farming Research and development Seed production for export Others |

| By Crop Type | Leafy vegetables (e.g., spinach, lettuce, cabbage) Root and bulb vegetables (e.g., carrot, onion, radish) Fruit vegetables (e.g., tomato, cucumber, pepper, eggplant) Cucurbits (e.g., melon, watermelon, pumpkin, squash) Brassicas (e.g., broccoli, cauliflower) Others |

| By Distribution Channel | Direct sales Retail stores Online platforms Agricultural cooperatives Others |

| By Region | China India Japan Southeast Asia (e.g., Vietnam, Thailand, Indonesia, Philippines, Malaysia) Australia & New Zealand Rest of Asia Pacific |

| By End-User | Commercial growers Smallholder farmers Research institutions Seed companies Others |

| By Price Range | Low price Mid price High price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegetable Seed Retailers | 100 | Store Managers, Purchasing Agents |

| Commercial Farmers | 80 | Farm Owners, Crop Managers |

| Seed Distributors | 60 | Distribution Managers, Sales Representatives |

| Agricultural Researchers | 40 | Research Scientists, Agronomy Experts |

| Government Agricultural Officials | 40 | Policy Makers, Regulatory Officers |

The Asia Pacific Vegetable Seed Market is valued at approximately USD 2.75 billion, driven by increasing demand for high-yielding and disease-resistant seed varieties, advancements in seed breeding technologies, and a focus on sustainable cultivation practices.