Region:Europe

Author(s):Dev

Product Code:KRAB0653

Pages:98

Published On:August 2025

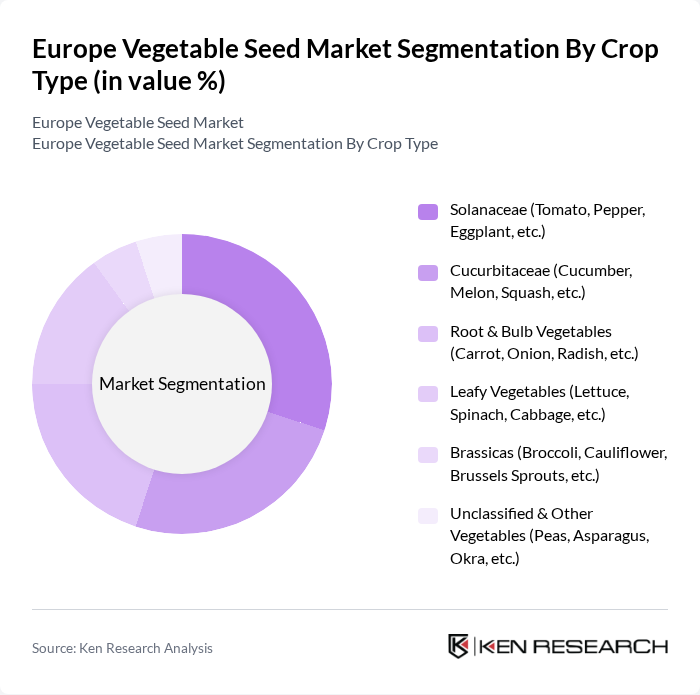

By Crop Type:The crop type segmentation includes various categories of vegetables cultivated for consumption. The primary subsegments are Solanaceae, Cucurbitaceae, Root & Bulb Vegetables, Leafy Vegetables, Brassicas, and Unclassified & Other Vegetables. Each of these subsegments plays a crucial role in the overall market dynamics, driven by consumer preferences for nutritional value, culinary versatility, and seasonal availability, as well as agricultural trends such as the adoption of improved seed varieties and protected cultivation methods.

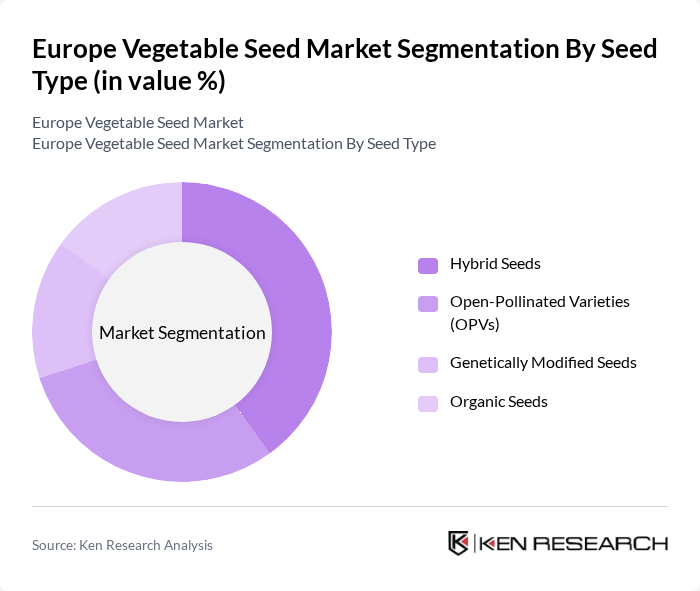

By Seed Type:The seed type segmentation encompasses categories of seeds utilized in vegetable cultivation, including Hybrid Seeds, Open-Pollinated Varieties (OPVs), Genetically Modified Seeds, and Organic Seeds. Each seed type has distinct characteristics and applications, influencing market dynamics based on consumer preferences for yield, disease resistance, and sustainability, as well as regulatory frameworks governing seed certification and the use of genetically modified organisms.

The Europe Vegetable Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer Crop Science, Syngenta AG, BASF SE (Nunhems), Corteva Agriscience, Limagrain (Vilmorin & Cie), Rijk Zwaan Zaadteelt en Zaadhandel B.V., Sakata Seed Corporation, Enza Zaden Beheer B.V., DLF Seeds A/S, Seminis Vegetable Seeds, Inc. (Bayer), Bejo Zaden B.V., East-West Seed International Ltd., Takii & Co., Ltd., Harris Seeds (Ivor Davis & Sons Ltd.), Clause (HM.CLAUSE, Groupe Limagrain) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe vegetable seed market appears promising, driven by technological advancements and a growing emphasis on sustainability. As precision agriculture techniques gain traction, farmers are expected to adopt innovative seed solutions that enhance productivity and resource efficiency. Additionally, the rise of e-commerce platforms for seed distribution is likely to reshape market dynamics, making high-quality seeds more accessible to a broader audience, thus fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Crop Type | Solanaceae (Tomato, Pepper, Eggplant, etc.) Cucurbitaceae (Cucumber, Melon, Squash, etc.) Root & Bulb Vegetables (Carrot, Onion, Radish, etc.) Leafy Vegetables (Lettuce, Spinach, Cabbage, etc.) Brassicas (Broccoli, Cauliflower, Brussels Sprouts, etc.) Unclassified & Other Vegetables (Peas, Asparagus, Okra, etc.) |

| By Seed Type | Hybrid Seeds Open-Pollinated Varieties (OPVs) Genetically Modified Seeds Organic Seeds |

| By Application | Commercial Farming Protected Cultivation (Greenhouse/Glasshouse) Home Gardening Research and Development |

| By Distribution Channel | Direct Sales Distributors/Dealers Retail Outlets Online Sales |

| By Country/Region | Western Europe (Germany, France, UK, Netherlands, etc.) Eastern Europe (Poland, Russia, etc.) Northern Europe (Denmark, Sweden, etc.) Southern Europe (Spain, Italy, Greece, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Vegetable Seed Producers | 80 | Production Managers, Business Development Executives |

| Retail Seed Distributors | 60 | Sales Managers, Category Buyers |

| Research Institutions in Agriculture | 40 | Agricultural Researchers, Seed Technology Experts |

| Farmers and Growers | 90 | Vegetable Farmers, Cooperative Leaders |

| Government Agricultural Agencies | 50 | Policy Makers, Agricultural Extension Officers |

The Europe Vegetable Seed Market is valued at approximately USD 2.6 billion, reflecting a significant growth trend driven by consumer demand for fresh produce, advancements in seed technology, and a focus on sustainable agricultural practices.