Region:Asia

Author(s):Shubham

Product Code:KRAB0821

Pages:84

Published On:August 2025

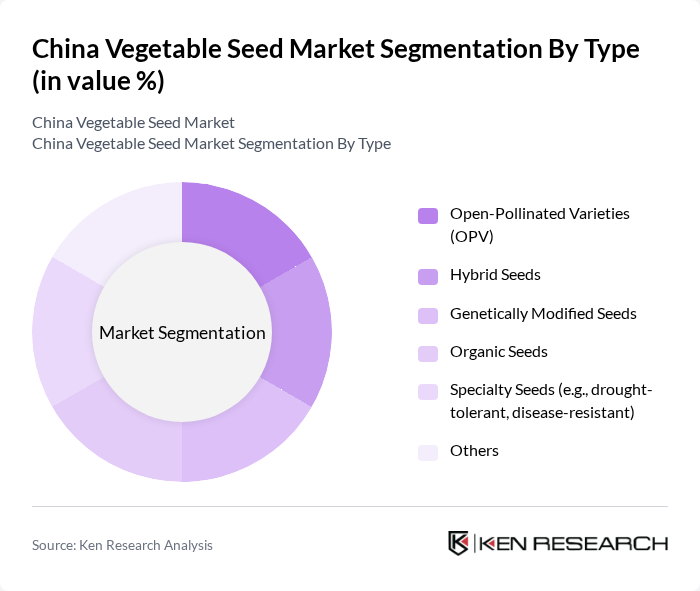

By Type:The market is segmented into Open-Pollinated Varieties (OPV), Hybrid Seeds, Genetically Modified Seeds, Organic Seeds, Specialty Seeds, and Others. Each type serves distinct agricultural needs and consumer preferences. Hybrid seeds currently lead the market due to their superior yield potential, improved disease resistance, and widespread adoption in commercial farming. Genetically modified seeds are gaining traction, especially for crops requiring enhanced pest resistance and adaptability to climate stress .

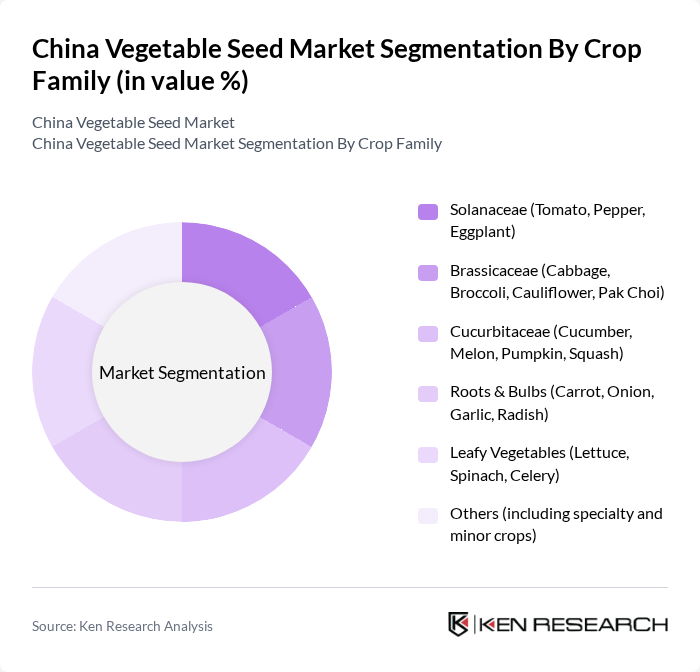

By Crop Family:The market is also categorized by crop family, including Solanaceae (Tomato, Pepper, Eggplant), Brassicaceae (Cabbage, Broccoli, Cauliflower, Pak Choi), Cucurbitaceae (Cucumber, Melon, Pumpkin, Squash), Roots & Bulbs (Carrot, Onion, Garlic, Radish), Leafy Vegetables (Lettuce, Spinach, Celery), and Others. The Solanaceae family is particularly dominant, reflecting high domestic and export demand for tomatoes and peppers. Brassicaceae and Cucurbitaceae also hold significant shares due to their importance in Chinese diets and protected cultivation practices .

The China Vegetable Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as China National Seed Group Corporation, Beijing Zhongshu Seed Co., Ltd., Jiangsu Provincial Seed Group Co., Ltd., Yuan Longping High-Tech Agriculture Co., Ltd., Huazhong Agricultural University Seed Co., Ltd., Yunnan Academy of Agricultural Sciences Seed Co., Ltd., Shandong Denghai Seeds Co., Ltd., Zhejiang Qianjiang Seed Co., Ltd., Hunan Xiangyan Seed Industry Co., Ltd., Xinjiang Production and Construction Corps Seed Company, Inner Mongolia Xinhui Seed Industry Co., Ltd., Shanghai Huizhong Seed Co., Ltd., Guangdong Academy of Agricultural Sciences Seed Co., Ltd., Tianjin Kenfeng Seed Co., Ltd., Anhui Agricultural University Seed Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China vegetable seed market appears promising, driven by increasing investments in agricultural research and development, which are projected to exceed 12 billion USD by in future. Additionally, the rise of urban farming initiatives is expected to create new demand for innovative seed varieties tailored for small-scale cultivation. As consumer preferences shift towards sustainability, the market is likely to see a growing emphasis on organic and locally adapted seed varieties, enhancing food security and environmental sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Open-Pollinated Varieties (OPV) Hybrid Seeds Genetically Modified Seeds Organic Seeds Specialty Seeds (e.g., drought-tolerant, disease-resistant) Others |

| By Crop Family | Solanaceae (Tomato, Pepper, Eggplant) Brassicaceae (Cabbage, Broccoli, Cauliflower, Pak Choi) Cucurbitaceae (Cucumber, Melon, Pumpkin, Squash) Roots & Bulbs (Carrot, Onion, Garlic, Radish) Leafy Vegetables (Lettuce, Spinach, Celery) Others (including specialty and minor crops) |

| By Cultivation Mechanism | Open Field Protected Cultivation (Greenhouse, Net House, Hydroponics) |

| By Application | Home Gardening Commercial Farming Research and Development Educational Institutions |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Agricultural Cooperatives |

| By End-User | Farmers (Smallholder, Commercial) Agricultural Companies Government Agencies NGOs |

| By Region | North China South China East China West China |

| By Price Range | Low Price Mid Price High Price |

| By Seed Size | Small Seeds Medium Seeds Large Seeds |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegetable Seed Retailers | 60 | Store Managers, Sales Representatives |

| Commercial Vegetable Farmers | 100 | Farm Owners, Agronomists |

| Seed Distributors | 50 | Distribution Managers, Supply Chain Coordinators |

| Research Institutions | 40 | Research Scientists, Agricultural Extension Officers |

| Government Agricultural Officials | 40 | Policy Makers, Agricultural Advisors |

The China Vegetable Seed Market is valued at approximately USD 1 billion, driven by increasing demand for high-quality seeds, advancements in seed technology, and a shift towards organic farming practices.