Region:Asia

Author(s):Rebecca

Product Code:KRAC0329

Pages:84

Published On:August 2025

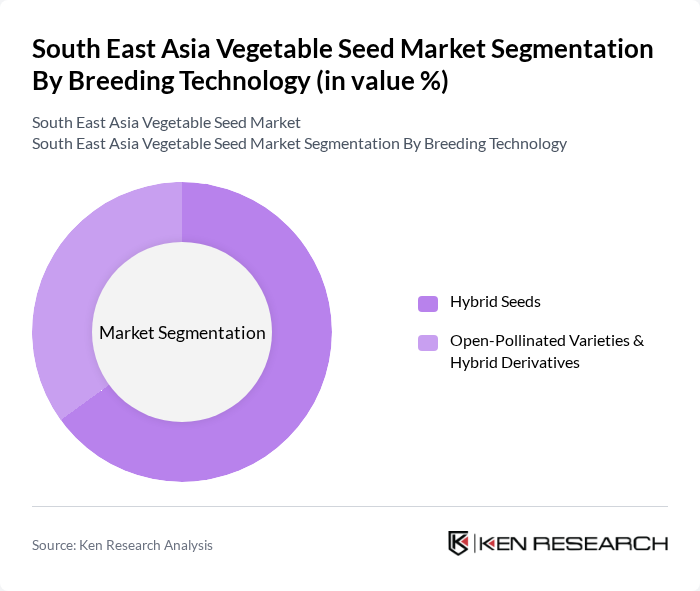

By Breeding Technology:This segmentation includes various methods of seed production, focusing on the genetic makeup of the seeds. The primary subsegments are Hybrid Seeds and Open-Pollinated Varieties & Hybrid Derivatives. Hybrid seeds are increasingly popular due to their higher yield potential, superior disease resistance, and uniform crop quality, while open-pollinated varieties are favored for their adaptability to local conditions and lower input costs .

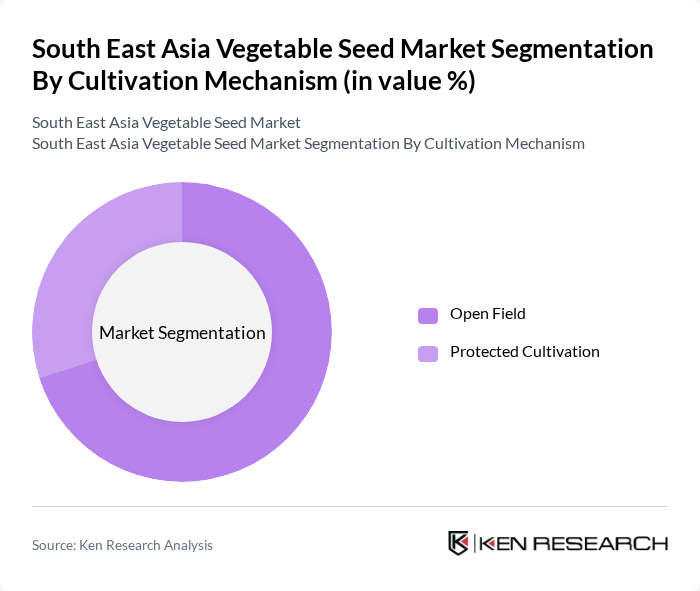

By Cultivation Mechanism:This segmentation focuses on the methods used for growing vegetables, which can be categorized into Open Field and Protected Cultivation. Open field cultivation remains the most common method due to its cost-effectiveness and suitability for staple crops, while protected cultivation (such as greenhouses and net houses) is gaining traction for its ability to extend growing seasons, improve yield quality, and support high-value crops in urban and peri-urban areas .

The South East Asia Vegetable Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta AG, Bayer Crop Science, BASF SE, East-West Seed, Limagrain (Vilmorin & Cie), Sakata Seed Corporation, Takii & Co., Ltd., Rijk Zwaan, Bejo Zaden, Nunhems (BASF Vegetable Seeds), Seminis Vegetable Seeds (Bayer), Known-You Seed Co., Ltd., Chia Tai Co., Ltd. (Thailand), Indo-American Hybrid Seeds, Advanta Seeds contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South East Asia vegetable seed market appears promising, driven by technological advancements and a growing focus on sustainability. As urban agriculture gains traction, more consumers are expected to engage in local food production, increasing demand for diverse seed varieties. Additionally, the development of genetically modified seeds is anticipated to enhance crop resilience and yield, addressing food security challenges. Collaborative efforts between private companies and research institutions will likely foster innovation, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Breeding Technology | Hybrid Seeds Open-Pollinated Varieties & Hybrid Derivatives |

| By Cultivation Mechanism | Open Field Protected Cultivation |

| By Type | Conventional Seeds Genetically Modified Seeds Organic Seeds Others |

| By Application | Home Gardening Commercial Farming Research and Development Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Others |

| By Crop Type | Leafy Vegetables (e.g., Lettuce, Spinach) Root Vegetables (e.g., Carrot, Radish) Fruit Vegetables (e.g., Tomato, Pepper, Cucumber) Bulb Vegetables (e.g., Onion, Garlic) Others |

| By Region | Indonesia Thailand Vietnam Malaysia Philippines Singapore Others |

| By Price Range | Low Price Mid Price High Price |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegetable Seed Retailers | 120 | Store Managers, Sales Representatives |

| Seed Production Companies | 90 | Production Managers, Quality Control Officers |

| Agricultural Research Institutions | 60 | Research Scientists, Agronomists |

| Government Agricultural Departments | 50 | Policy Makers, Agricultural Extension Officers |

| Exporters of Vegetable Seeds | 40 | Export Managers, Logistics Coordinators |

The South East Asia Vegetable Seed Market is valued at approximately USD 560 million, driven by increasing demand for high-quality seeds, advancements in agricultural technology, and a focus on sustainable farming practices.