Region:Global

Author(s):Geetanshi

Product Code:KRAC0058

Pages:95

Published On:August 2025

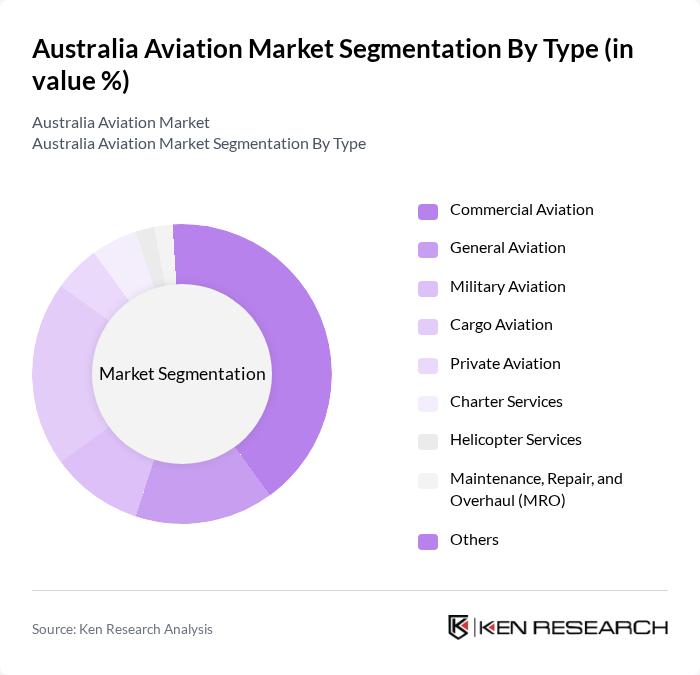

By Type:The aviation market can be segmented into Commercial Aviation, General Aviation, Military Aviation, Cargo Aviation, Private Aviation, Charter Services, Helicopter Services, and Maintenance, Repair, and Overhaul (MRO). Commercial aviation includes scheduled and non-scheduled passenger and cargo services. General aviation covers non-commercial and recreational flying, pilot training, and support for industries such as agriculture and tourism. Military aviation encompasses defense-related operations and procurement, while cargo aviation addresses freight and logistics. Private and charter services cater to business and high-net-worth individuals, and helicopter services support emergency, resource, and tourism sectors. MRO services ensure ongoing airworthiness and operational reliability of fleets.

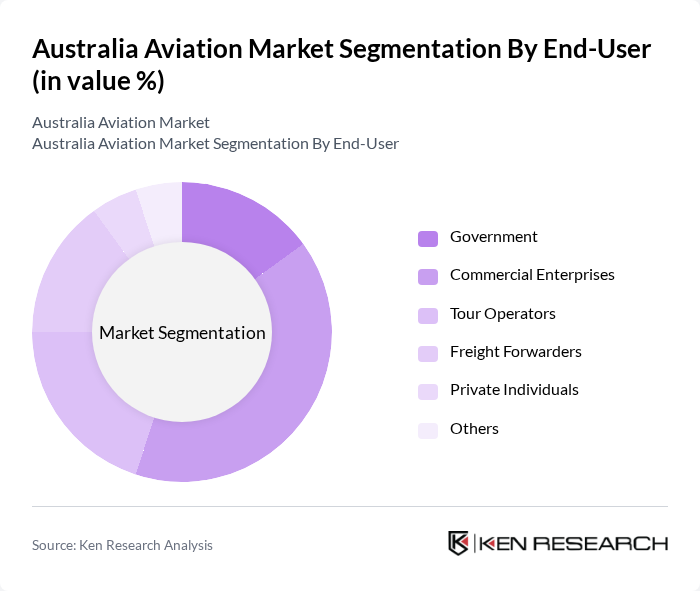

By End-User:The end-user segmentation includes Government, Commercial Enterprises, Tour Operators, Freight Forwarders, Private Individuals, and Others. Government users primarily include defense and public service aviation. Commercial enterprises represent airlines, logistics companies, and corporate operators. Tour operators leverage aviation for travel packages and destination management. Freight forwarders utilize air cargo for time-sensitive shipments. Private individuals access business jets and charter services, while 'Others' include aviation schools and emergency services.

The Australia Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qantas Airways Limited, Virgin Australia Airlines Pty Ltd, Regional Express Holdings Limited (Rex), Alliance Aviation Services Limited, Air New Zealand Limited, Cobham Aviation Services Australia Pty Ltd, Skytrans Pty Ltd, Airnorth (Airnorth Regional Pty Ltd), FlyPelican (Pelican Airlines Pty Ltd), Jetstar Airways Pty Ltd, Bonza Aviation Pty Ltd, Sharp Airlines Pty Ltd, Cathay Pacific Airways Limited, Singapore Airlines Limited, Emirates Airline contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian aviation market appears promising, driven by a combination of increasing air travel demand and significant government investments in infrastructure. As the sector adapts to technological advancements, airlines are likely to enhance operational efficiencies and customer experiences. However, challenges such as regulatory compliance and environmental sustainability will require ongoing attention. The focus on regional tourism and smart airport development will create new avenues for growth, positioning the industry for a robust recovery and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Aviation General Aviation Military Aviation Cargo Aviation Private Aviation Charter Services Helicopter Services Maintenance, Repair, and Overhaul (MRO) Others |

| By End-User | Government Commercial Enterprises Tour Operators Freight Forwarders Private Individuals Others |

| By Service Type | Scheduled Passenger Services Scheduled Cargo Services Non-Scheduled/Charter Services Ground Handling Services In-Flight Services Others |

| By Distribution Channel | Direct Sales Travel Agencies Online Booking Platforms Corporate Contracts Others |

| By Aircraft Size | Small Aircraft (e.g., Light Jets, Turboprops) Medium Aircraft (e.g., Narrowbody Jets) Large Aircraft (e.g., Widebody Jets) Regional Aircraft Others |

| By Flight Range | Short-Haul Flights Medium-Haul Flights Long-Haul Flights Others |

| By Customer Segment | Business Travelers Leisure Travelers Cargo Customers Government Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Operations | 100 | Airline Executives, Operations Managers |

| Airport Management and Services | 60 | Airport Directors, Ground Services Managers |

| Cargo and Freight Services | 50 | Cargo Managers, Logistics Coordinators |

| Aviation Regulatory Bodies | 40 | Regulatory Officials, Policy Advisors |

| Aviation Technology Providers | 40 | Technology Developers, Innovation Managers |

The Australia Aviation Market is valued at approximately USD 4 billion, reflecting a significant recovery post-pandemic, driven by increasing passenger traffic, tourism growth, and the expansion of air cargo services.