Region:Europe

Author(s):Shubham

Product Code:KRAC0818

Pages:84

Published On:August 2025

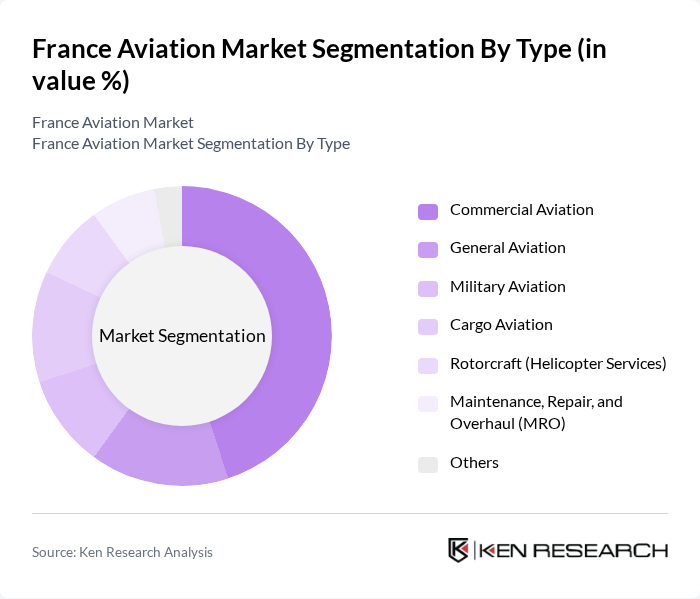

By Type:The aviation market can be segmented into various types, including Commercial Aviation, General Aviation, Military Aviation, Cargo Aviation, Rotorcraft (Helicopter Services), Maintenance, Repair, and Overhaul (MRO), and Others. Each of these segments plays a crucial role in the overall market dynamics, with Commercial Aviation being the most significant contributor due to the high volume of passenger traffic .

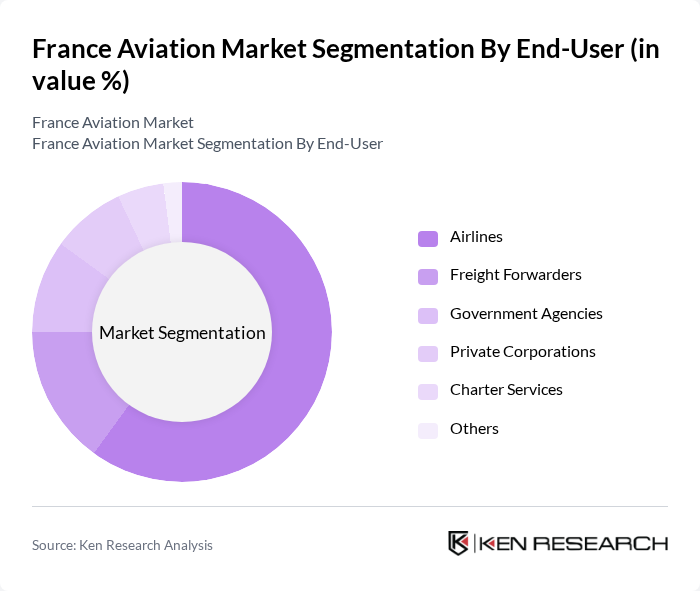

By End-User:The end-user segmentation includes Airlines, Freight Forwarders, Government Agencies, Private Corporations, Charter Services, and Others. Airlines are the dominant end-user segment, driven by the increasing demand for air travel and the expansion of airline networks .

The France Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air France-KLM Group, Airbus S.A.S., Dassault Aviation S.A., Safran S.A., Thales Group, ATR (Avions de Transport Régional), Groupe ADP (Aéroports de Paris), Air France Cargo, Corsair International, Transavia France, HOP! (subsidiary of Air France), Chalair Aviation, ASL Airlines France, Luxair S.A., Vinci Airports contribute to innovation, geographic expansion, and service delivery in this space .

The future of the aviation market in France appears promising, driven by increasing air travel demand and significant government investments in infrastructure. As the industry adapts to technological advancements, airlines are likely to enhance operational efficiency and passenger experience. Furthermore, the focus on sustainability will shape future developments, with eco-friendly initiatives gaining traction. Overall, the market is poised for growth, supported by a favorable economic environment and evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Aviation General Aviation Military Aviation Cargo Aviation Rotorcraft (Helicopter Services) Maintenance, Repair, and Overhaul (MRO) Others |

| By End-User | Airlines Freight Forwarders Government Agencies Private Corporations Charter Services Others |

| By Service Type | Passenger Services Cargo Services Ground Handling Services In-Flight Services Others |

| By Aircraft Size | Narrow-Body Aircraft Wide-Body Aircraft Regional Aircraft Business Jets Others |

| By Distribution Channel | Direct Sales Online Booking Platforms Travel Agencies Corporate Contracts Others |

| By Customer Type | Individual Travelers Business Travelers Tour Operators Government Contracts Others |

| By Price Range | Economy Class Business Class First Class Premium Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Operations | 120 | Airline Executives, Operations Managers |

| Airport Management Insights | 70 | Airport Directors, Facility Managers |

| Cargo and Freight Services | 50 | Cargo Managers, Logistics Coordinators |

| Aviation Regulatory Compliance | 40 | Regulatory Officers, Compliance Managers |

| Tourism and Travel Agencies | 60 | Travel Agency Owners, Marketing Directors |

The France Aviation Market is valued at approximately USD 6.5 billion, reflecting a significant recovery in air travel and increased demand for cargo services following the pandemic. This growth is supported by advancements in aviation technology and infrastructure investments.