Region:Asia

Author(s):Dev

Product Code:KRAB0515

Pages:84

Published On:August 2025

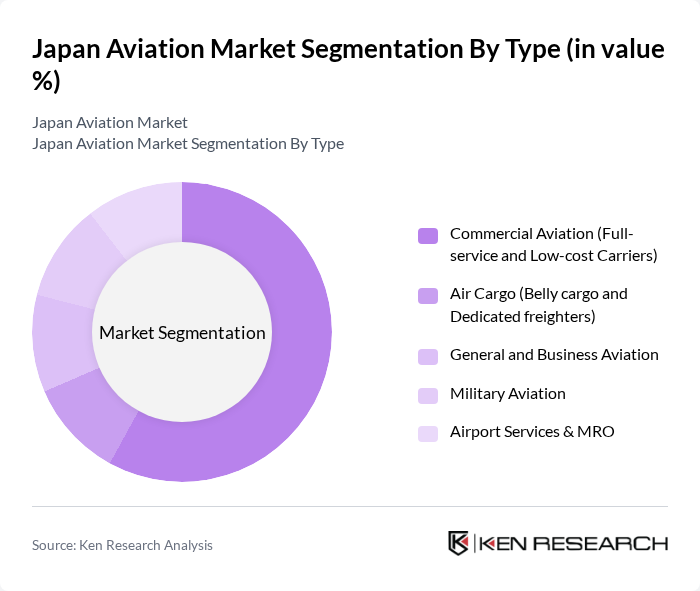

By Type:The aviation market can be segmented into various types, including Commercial Aviation, Air Cargo, General and Business Aviation, Military Aviation, and Airport Services & MRO. Each of these segments plays a crucial role in the overall market dynamics, catering to different consumer needs and operational requirements.

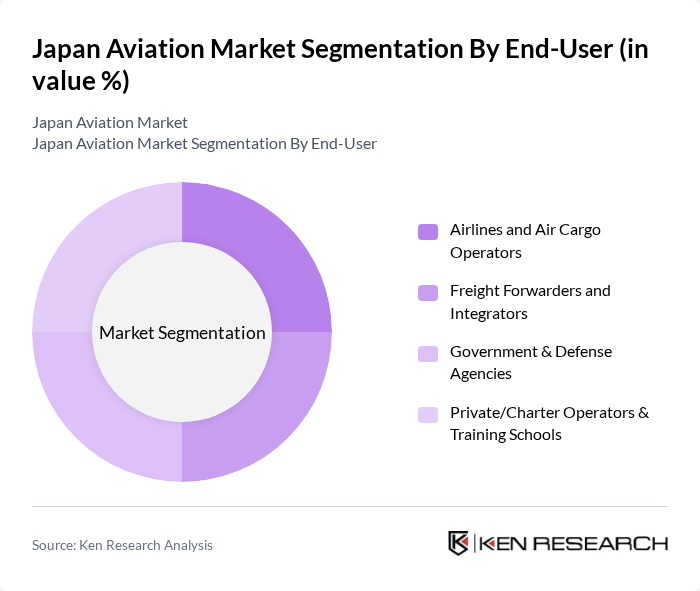

By End-User:The end-user segmentation includes Airlines and Air Cargo Operators, Freight Forwarders and Integrators, Government & Defense Agencies, and Private/Charter Operators & Training Schools. Each of these end-users has distinct requirements and contributes to the market's growth in unique ways.

The Japan Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as All Nippon Airways Co., Ltd. (ANA), Japan Airlines Co., Ltd. (JAL), Peach Aviation Limited, ANA Holdings Inc., Skymark Airlines Inc., Japan Air Commuter Co., Ltd., Star Flyer Inc., Solaseed Air Inc., Japan Transocean Air Co., Ltd., Fuji Dream Airlines Co., Ltd., Airdo Co., Ltd., Narita International Airport Corporation (NAA), Kansai Airports (Kansai, Osaka, Kobe), Nippon Cargo Airlines Co., Ltd. (NCA), Yamato Holdings Co., Ltd. (Express Air Cargo Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan aviation market is poised for significant growth, driven by increasing air travel demand and substantial government investments in infrastructure. As the tourism sector rebounds, airlines are expected to enhance their service offerings, focusing on passenger experience and operational efficiency. Furthermore, the adoption of green technologies and digital transformation initiatives will play a crucial role in shaping the future landscape of the aviation industry, ensuring sustainability and competitiveness in a rapidly evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Aviation (Full-service and Low-cost Carriers) Air Cargo (Belly cargo and Dedicated freighters) General and Business Aviation Military Aviation Airport Services & MRO |

| By End-User | Airlines and Air Cargo Operators Freight Forwarders and Integrators Government & Defense Agencies Private/Charter Operators & Training Schools |

| By Aircraft Size | Narrow-Body Aircraft Wide-Body Aircraft Regional Jets & Turboprops |

| By Service Type | Scheduled Passenger Services Charter & ACMI Services Maintenance, Repair, and Overhaul (MRO) Ground Handling & Airport Services |

| By Distribution Channel | Direct Sales (Airline Websites/Apps) Online Travel Agencies (OTAs) Travel Agents & Corporate Travel Management |

| By Region | Kanto (Tokyo, Narita, Haneda) Kansai (Osaka, Kobe) Chubu (Nagoya, Chubu Centrair) Hokkaido/Tohoku Kyushu/Okinawa |

| By Customer Segment | Business Travelers Leisure Travelers Government and Military SMEs and Corporates (managed travel) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines | 120 | Airline Executives, Operations Managers |

| Airport Authorities | 90 | Airport Directors, Infrastructure Planners |

| Cargo Services | 70 | Cargo Managers, Logistics Coordinators |

| Aviation Regulatory Bodies | 50 | Regulatory Officials, Policy Advisors |

| Travel Agencies | 60 | Travel Agents, Sales Directors |

The Japan Aviation Market is valued at approximately USD 17 billion, reflecting a robust recovery in passenger volumes and increased demand for both domestic and international air travel, alongside significant investments in airport infrastructure.