Region:Asia

Author(s):Shubham

Product Code:KRAA6194

Pages:91

Published On:September 2025

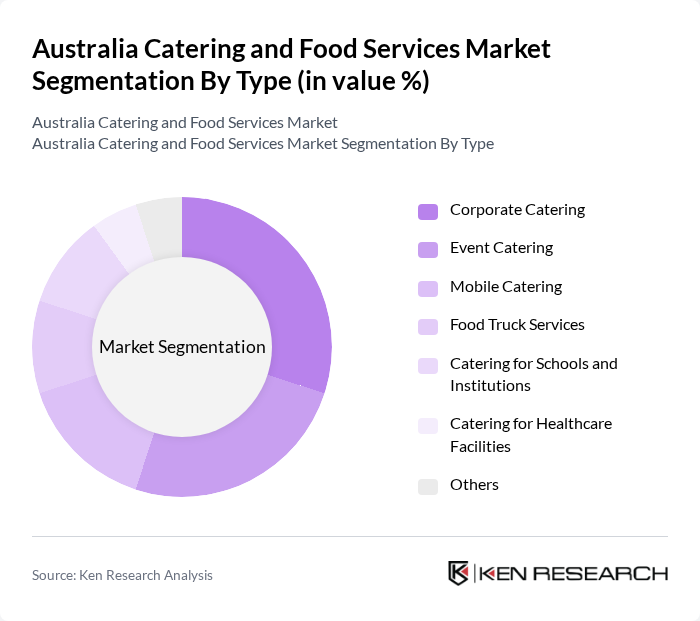

By Type:The catering and food services market can be segmented into various types, including Corporate Catering, Event Catering, Mobile Catering, Food Truck Services, Catering for Schools and Institutions, Catering for Healthcare Facilities, and Others. Each of these segments caters to specific consumer needs and preferences, contributing to the overall market dynamics.

The Corporate Catering segment is currently the leading sub-segment, driven by the increasing number of corporate events and meetings. Businesses are increasingly outsourcing their catering needs to ensure high-quality food and service, which has led to a surge in demand for corporate catering services. Additionally, the trend towards healthier food options in corporate settings has further propelled this segment's growth.

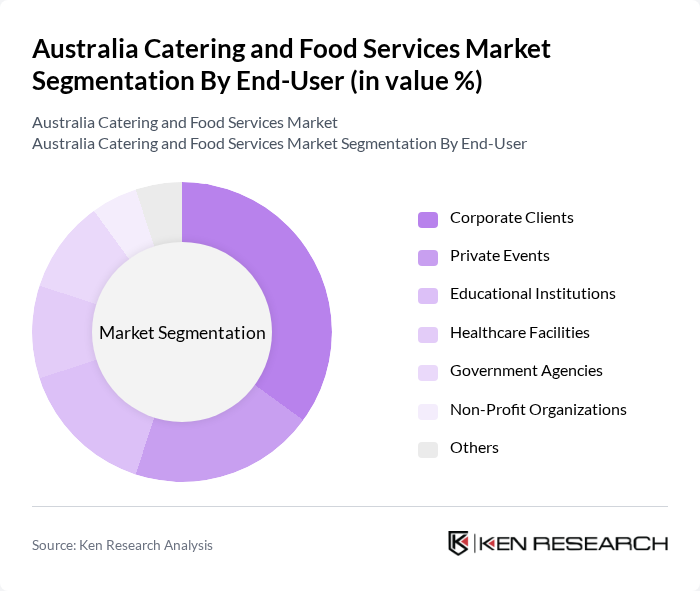

By End-User:The end-user segmentation includes Corporate Clients, Private Events, Educational Institutions, Healthcare Facilities, Government Agencies, Non-Profit Organizations, and Others. Each end-user category has distinct requirements and preferences, influencing the types of catering services offered.

Corporate Clients represent the largest end-user segment, as businesses increasingly recognize the value of professional catering services for events and meetings. The demand for high-quality food and service in corporate settings has led to a robust growth trajectory for this segment. Additionally, the rise of remote work has not diminished the need for catering services, as companies continue to host events to foster team collaboration and engagement.

The Australia Catering and Food Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Compass Group Australia, Spotless Group, Delaware North Companies Australia, Aramark Australia, ISS Facility Services, Sodexo Australia, Civeo Corporation, The Good Food Company, Food & Desire, The Catering Company, A La Carte Catering, The Fresh Collective, Gourmet Food Catering, The Food Co., The Event Catering Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia catering and food services market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for sustainable and personalized catering options grows, businesses are likely to invest in eco-friendly practices and tailored services. Additionally, the integration of technology in food ordering and delivery systems will enhance operational efficiency, allowing companies to better meet customer expectations. This dynamic environment presents opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Catering Event Catering Mobile Catering Food Truck Services Catering for Schools and Institutions Catering for Healthcare Facilities Others |

| By End-User | Corporate Clients Private Events Educational Institutions Healthcare Facilities Government Agencies Non-Profit Organizations Others |

| By Service Model | Full-Service Catering Buffet Catering Drop-off Catering On-Site Catering Meal Prep Services Others |

| By Cuisine Type | Australian Cuisine Asian Cuisine European Cuisine Middle Eastern Cuisine Fusion Cuisine Others |

| By Pricing Model | Premium Catering Mid-Range Catering Budget Catering Custom Pricing Others |

| By Delivery Method | Direct Delivery Third-Party Delivery Services Pickup Services Others |

| By Event Type | Weddings Corporate Events Social Gatherings Conferences and Seminars Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Catering Services | 150 | Catering Managers, HR Directors |

| Event Catering Providers | 100 | Event Planners, Venue Managers |

| Healthcare Food Services | 80 | Dietitians, Facility Managers |

| Educational Institution Catering | 70 | Food Service Directors, School Administrators |

| Mobile Food Services | 60 | Food Truck Owners, Street Food Vendors |

The Australia Catering and Food Services Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by diverse food options, corporate events, and health-conscious eating preferences among consumers.