Region:Europe

Author(s):Shubham

Product Code:KRAB5587

Pages:83

Published On:October 2025

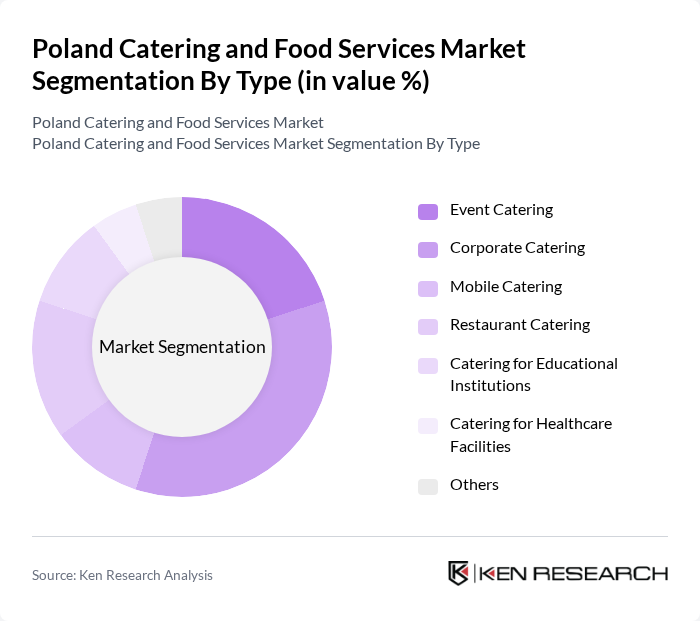

By Type:The catering market can be segmented into various types, including Event Catering, Corporate Catering, Mobile Catering, Restaurant Catering, Catering for Educational Institutions, Catering for Healthcare Facilities, and Others. Among these, Corporate Catering is currently the leading segment, driven by the increasing number of corporate events and meetings. The demand for tailored catering solutions that meet specific dietary needs and preferences is also on the rise, making this segment particularly attractive.

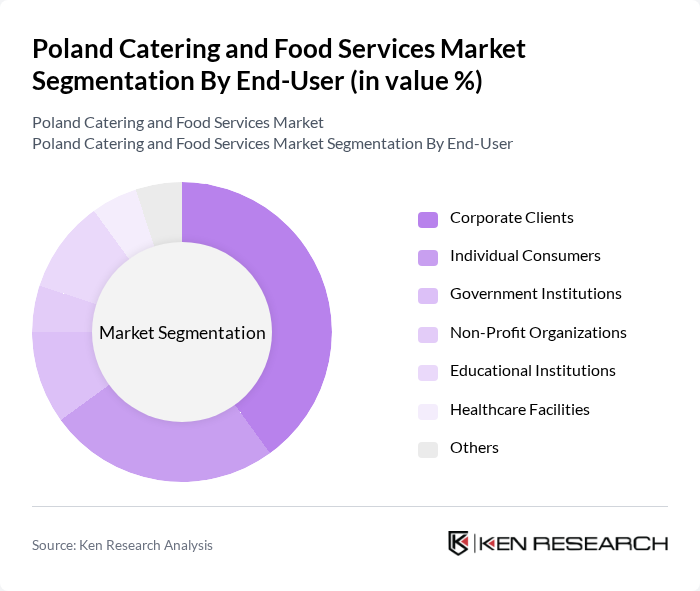

By End-User:This segmentation includes Corporate Clients, Individual Consumers, Government Institutions, Non-Profit Organizations, Educational Institutions, Healthcare Facilities, and Others. The Corporate Clients segment is the most significant, as businesses increasingly outsource catering for meetings, conferences, and events. This trend is driven by the need for convenience and the desire to provide quality food options for employees and clients.

The Poland Catering and Food Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as AmRest Holdings SE, Sodexo Polska Sp. z o.o., Compass Group Poland, Catering Service Sp. z o.o., Bistrot 24, Food Service Group, Makarony Polskie Sp. z o.o., Pyszne.pl, Zajazd Pod Kogutem, Katering na Wysokim Poziomie, Katering Mistrzów, Catering Express, Smaczne Dania, Catering Gusto, Katering Z Pasj? contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland catering and food services market appears promising, driven by evolving consumer preferences and technological advancements. The integration of digital ordering systems is expected to streamline operations, enhancing customer experience and operational efficiency. Additionally, the trend towards sustainability in food sourcing will likely gain momentum, as consumers increasingly prioritize eco-friendly practices. These developments will shape the market landscape, fostering innovation and adaptability among service providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Event Catering Corporate Catering Mobile Catering Restaurant Catering Catering for Educational Institutions Catering for Healthcare Facilities Others |

| By End-User | Corporate Clients Individual Consumers Government Institutions Non-Profit Organizations Educational Institutions Healthcare Facilities Others |

| By Service Model | On-Premise Catering Off-Premise Catering Hybrid Catering Delivery-Only Services Others |

| By Cuisine Type | Traditional Polish Cuisine International Cuisine Vegetarian and Vegan Options Fast Food Others |

| By Pricing Model | Premium Pricing Mid-Range Pricing Budget Pricing Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Delivery Services Others |

| By Occasion | Weddings Corporate Events Social Gatherings Seasonal Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Catering Services | 150 | Catering Managers, Corporate Event Coordinators |

| Event Catering for Weddings | 100 | Wedding Planners, Venue Managers |

| Food Delivery Services | 120 | Restaurant Owners, Delivery Service Operators |

| School and Institutional Catering | 80 | School Administrators, Nutritionists |

| Health and Wellness Catering | 70 | Health Coaches, Dietitians |

The Poland Catering and Food Services Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience, corporate events, and healthier eating options.