Region:Asia

Author(s):Rebecca

Product Code:KRAB5928

Pages:95

Published On:October 2025

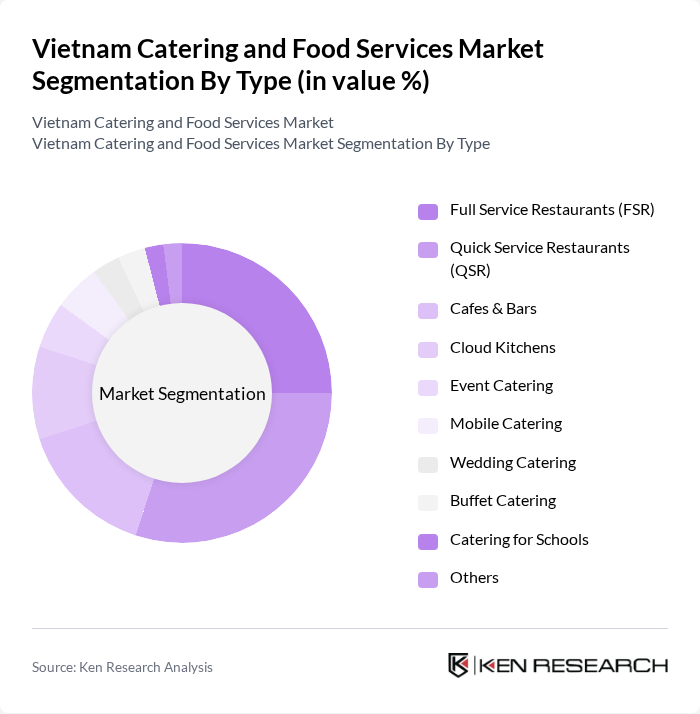

By Type:The catering and food services market can be segmented into various types, including Full Service Restaurants (FSR), Quick Service Restaurants (QSR), Cafes & Bars, Cloud Kitchens, Event Catering, Mobile Catering, Wedding Catering, Buffet Catering, Catering for Schools, and Others. Each of these segments caters to different consumer preferences and occasions, contributing to the overall market dynamics.

The Quick Service Restaurants (QSR) segment is currently dominating the market due to the increasing consumer preference for fast, convenient dining options. The rise of urban lifestyles and busy work schedules has led to a surge in demand for QSRs, which offer quick meals at affordable prices. Additionally, the expansion of international fast-food chains and local QSR brands has further solidified this segment's position in the market. The trend towards online ordering and delivery services has also contributed to the growth of QSRs, making them a preferred choice for many consumers.

By End-User:The end-user segmentation includes Corporate Clients, Individual Consumers, Educational Institutions, Government Agencies, Non-Profit Organizations, and Others. Each of these segments has unique requirements and preferences, influencing the types of catering services offered in the market.

The Corporate Clients segment is leading the market, driven by the increasing number of businesses hosting events, meetings, and conferences that require catering services. Companies are increasingly outsourcing their catering needs to professional services to ensure quality and efficiency. This trend is further supported by the growing corporate culture in Vietnam, where businesses prioritize employee engagement and client relations through catered events.

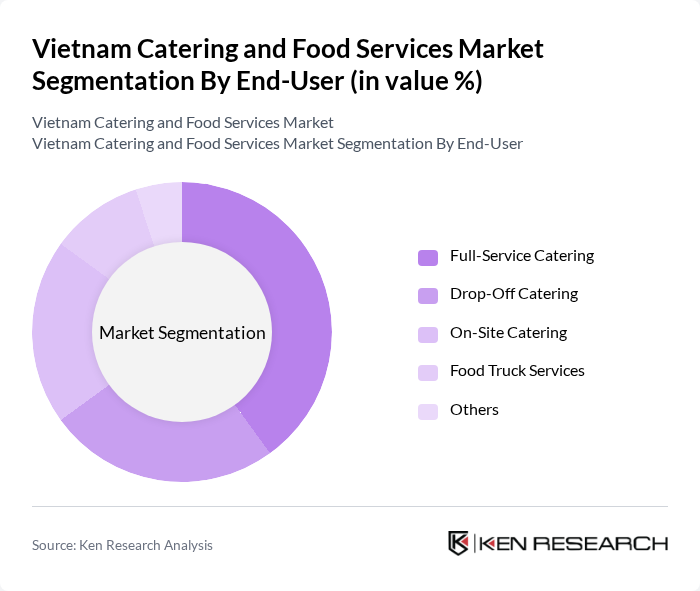

By Service Type:The service type segmentation includes Full-Service Catering, Drop-Off Catering, On-Site Catering, Food Truck Services, and Others. Each service type caters to different consumer needs and preferences, impacting the overall market landscape.

Full-Service Catering is the leading segment, as it provides a comprehensive solution for events, including food preparation, serving, and cleanup. This service is particularly popular for weddings, corporate events, and large gatherings, where clients prefer a hassle-free experience. The demand for personalized menus and high-quality service has further solidified the position of full-service catering in the market.

By Cuisine Type:The cuisine type segmentation includes Vietnamese Cuisine, Asian Cuisine, Western Cuisine, Fusion Cuisine, and Others. This segmentation reflects the diverse culinary preferences of consumers in the market.

Vietnamese Cuisine is the dominant segment, as it resonates deeply with local consumers and tourists alike. The rich flavors and variety of traditional dishes have made Vietnamese cuisine a staple in the catering market. Additionally, the growing interest in authentic local experiences among tourists has further boosted the demand for Vietnamese catering services.

By Pricing Model:The pricing model segmentation includes Premium Pricing, Mid-Range Pricing, Budget Pricing, and Others. This segmentation highlights the different pricing strategies employed by catering services to attract various consumer segments.

The Mid-Range Pricing segment is leading the market, as it appeals to a broad audience looking for quality services at reasonable prices. This pricing strategy is particularly effective in urban areas where consumers are willing to spend on catering services for events while still being price-conscious. The balance between quality and affordability has made mid-range pricing a popular choice among consumers.

By Distribution Channel:The distribution channel segmentation includes Direct Sales, Online Platforms, Partnerships with Event Planners, and Others. This segmentation reflects the various methods through which catering services reach their customers.

The Direct Sales segment is currently leading the market, as many catering services rely on personal relationships and direct communication with clients to secure contracts. However, the rise of online platforms has significantly changed the landscape, allowing for greater visibility and accessibility for catering services. The convenience of online ordering is becoming increasingly popular among consumers, especially in urban areas. Online food delivery revenue reached USD 1.93 billion in 2023, with GrabFood dominating over 50% of the delivery sector.

By Occasion:The occasion segmentation includes Corporate Events, Social Gatherings, Weddings, Festivals, and Others. This segmentation highlights the various events for which catering services are utilized.

The Corporate Events segment is leading the market, driven by the increasing number of businesses hosting meetings, conferences, and other events that require catering services. Companies are increasingly recognizing the importance of quality catering in enhancing their corporate image and employee satisfaction, leading to a growing demand for professional catering services in this segment.

The Vietnam Catering and Food Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Golden Gate Group, Vietcatering, The Caterers Vietnam, Red Apron Events & Catering, Huu Nghi Catering, Saigon Catering Company, An Phu Catering, Lotus Catering, Vietfood Catering, Phu Quoc Catering, Hanoi Gourmet Catering, Nam An Market (Catering Division), Binh Minh Catering, Thanh Hoa Food Services, Mekong Catering Services contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam catering and food services market is poised for significant transformation driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for diverse catering options will rise, particularly in metropolitan areas. Additionally, the integration of technology in service delivery, such as online ordering and payment systems, will enhance customer experiences. Sustainability practices will also gain traction, influencing menu offerings and operational strategies, positioning the market for robust growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Service Restaurants (FSR) Quick Service Restaurants (QSR) Cafes & Bars Cloud Kitchens Event Catering Mobile Catering Wedding Catering Buffet Catering Catering for Schools Others |

| By End-User | Corporate Clients Individual Consumers Educational Institutions Government Agencies Non-Profit Organizations Others |

| By Service Type | Full-Service Catering Drop-Off Catering On-Site Catering Food Truck Services Others |

| By Cuisine Type | Vietnamese Cuisine Asian Cuisine Western Cuisine Fusion Cuisine Others |

| By Pricing Model | Premium Pricing Mid-Range Pricing Budget Pricing Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Event Planners Others |

| By Occasion | Corporate Events Social Gatherings Weddings Festivals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Catering Services | 60 | Catering Managers, HR Managers |

| Wedding and Event Catering | 50 | Event Planners, Venue Managers |

| Food Delivery Services | 45 | Operations Managers, Delivery Supervisors |

| Institutional Catering (Schools, Hospitals) | 40 | Facility Managers, Nutritionists |

| Consumer Preferences in Food Services | 100 | General Consumers, Food Enthusiasts |

The Vietnam Catering and Food Services Market is valued at approximately USD 22 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for dining out among consumers.