Region:Asia

Author(s):Dev

Product Code:KRAA5658

Pages:90

Published On:September 2025

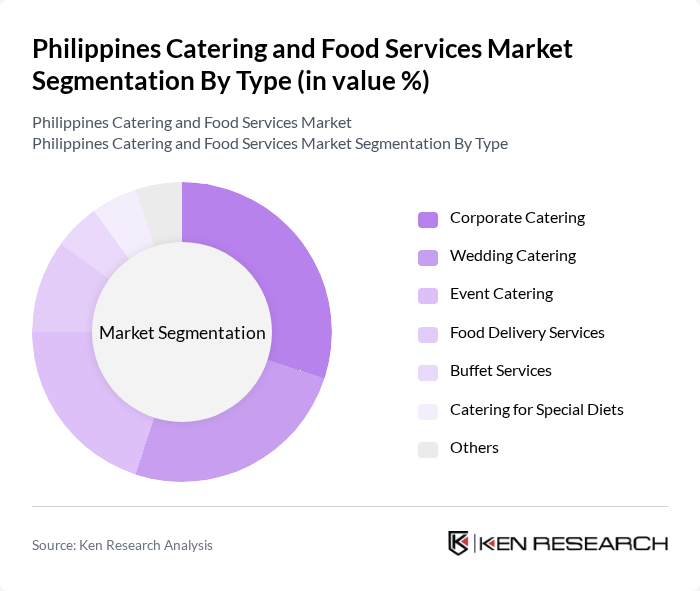

By Type:The catering and food services market can be segmented into various types, including Corporate Catering, Wedding Catering, Event Catering, Food Delivery Services, Buffet Services, Catering for Special Diets, and Others. Each of these segments caters to specific consumer needs and preferences, reflecting the diverse culinary landscape of the Philippines.

The Corporate Catering segment is currently dominating the market due to the increasing number of businesses hosting events and meetings that require professional catering services. This segment benefits from the growing trend of companies outsourcing their food services to enhance employee satisfaction and productivity. Additionally, the rise of remote work has led to a demand for catering services that can accommodate virtual events, further solidifying its market leadership.

By End-User:The end-user segmentation includes Corporate Clients, Individual Consumers, Government Agencies, Educational Institutions, Non-Profit Organizations, and Others. Each segment has unique requirements and preferences that influence the catering services they seek.

The Corporate Clients segment is leading the market, driven by the increasing number of corporate events, conferences, and meetings that require catering services. Companies are increasingly recognizing the importance of providing quality food to enhance employee morale and create a positive work environment. This trend is further supported by the growing demand for customized catering solutions that cater to specific dietary needs and preferences.

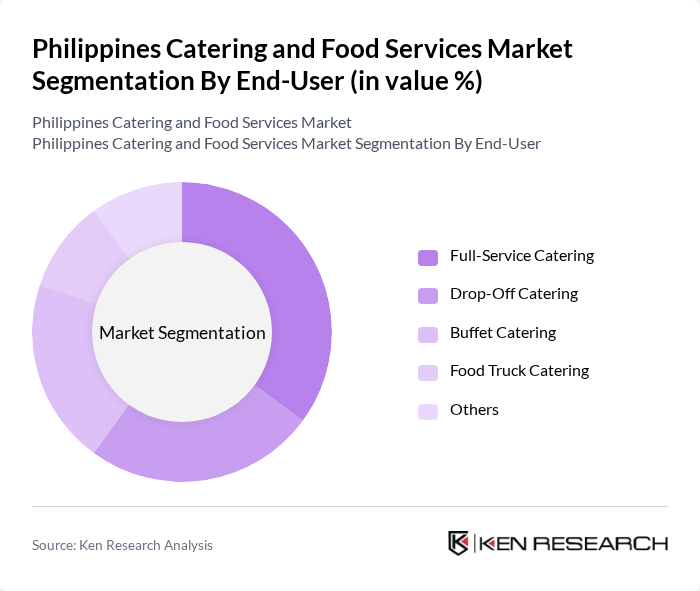

By Service Model:The service model segmentation includes Full-Service Catering, Drop-Off Catering, Buffet Catering, Food Truck Catering, and Others. Each model offers different levels of service and convenience to meet the diverse needs of consumers.

Full-Service Catering is the leading model in the market, as it provides a comprehensive solution for events, including food preparation, service staff, and cleanup. This model is particularly popular for weddings and corporate events, where clients prefer a hassle-free experience. The demand for Full-Service Catering is expected to remain strong as consumers increasingly seek convenience and quality in their catering experiences.

By Cuisine Type:The cuisine type segmentation includes Filipino Cuisine, Asian Cuisine, Western Cuisine, Fusion Cuisine, and Others. Each type reflects the culinary preferences of consumers and the cultural diversity of the Philippines.

Filipino Cuisine is the dominant segment, as it resonates with local consumers and is often preferred for various events. The rich flavors and traditional dishes of Filipino cuisine make it a popular choice for weddings, corporate events, and social gatherings. Additionally, the growing interest in Filipino food among international consumers is contributing to its market leadership.

By Event Type:The event type segmentation includes Corporate Events, Social Gatherings, Weddings, Festivals, and Others. Each event type has distinct catering requirements that influence service offerings.

Corporate Events are the leading segment, driven by the increasing number of business functions that require catering services. Companies are investing in high-quality catering to enhance their corporate image and provide a pleasant experience for attendees. This trend is expected to continue as businesses recognize the value of professional catering in creating successful events.

By Pricing Model:The pricing model segmentation includes Premium Catering, Mid-Range Catering, Budget Catering, and Others. Each model caters to different consumer segments based on their budget and preferences.

Mid-Range Catering is the dominant model, appealing to a broad range of consumers who seek quality services at reasonable prices. This segment is particularly popular among corporate clients and individual consumers who want to balance quality and cost. The demand for Mid-Range Catering is expected to grow as more consumers look for value-for-money options in their catering choices.

By Distribution Channel:The distribution channel segmentation includes Direct Sales, Online Platforms, Partnerships with Event Planners, and Others. Each channel offers different advantages and reaches various consumer segments.

Direct Sales is the leading distribution channel, as many catering services rely on personal relationships and direct communication with clients to secure contracts. This approach allows for tailored services and builds trust with customers. However, the rise of Online Platforms is also significant, as more consumers are turning to digital solutions for convenience and ease of access.

The Philippines Catering and Food Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jollibee Foods Corporation, Max's Group, Inc., The Bistro Group, Shakey's Pizza Asia Ventures, Inc., Mang Inasal, Red Ribbon Bakeshop, Goldilocks Bakeshop, Gerry's Grill, Via Mare, The Alley by Vikings, Cibo, Ramen Nagi, The Coffee Bean & Tea Leaf, KFC Philippines, Starbucks Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines catering and food services market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The integration of online platforms for catering orders is expected to streamline operations and enhance customer experience. Additionally, the trend towards health-conscious catering options will likely gain traction, reflecting a broader societal shift towards wellness. As businesses adapt to these trends, the market will continue to evolve, presenting new opportunities for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Catering Wedding Catering Event Catering Food Delivery Services Buffet Services Catering for Special Diets Others |

| By End-User | Corporate Clients Individual Consumers Government Agencies Educational Institutions Non-Profit Organizations Others |

| By Service Model | Full-Service Catering Drop-Off Catering Buffet Catering Food Truck Catering Others |

| By Cuisine Type | Filipino Cuisine Asian Cuisine Western Cuisine Fusion Cuisine Others |

| By Event Type | Corporate Events Social Gatherings Weddings Festivals Others |

| By Pricing Model | Premium Catering Mid-Range Catering Budget Catering Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Event Planners Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Catering Services | 150 | Catering Managers, Corporate Event Planners |

| Wedding and Event Catering | 100 | Wedding Planners, Venue Managers |

| Food Delivery Services | 120 | Restaurant Owners, Delivery Service Operators |

| Institutional Catering | 80 | Facility Managers, School Administrators |

| Consumer Preferences in Catering | 200 | General Consumers, Food Enthusiasts |

The Philippines Catering and Food Services Market is valued at approximately USD 5 billion, reflecting a significant growth driven by increasing demand for diverse food options and the rise of corporate events, particularly in urban areas.