Region:Asia

Author(s):Shubham

Product Code:KRAA1722

Pages:85

Published On:August 2025

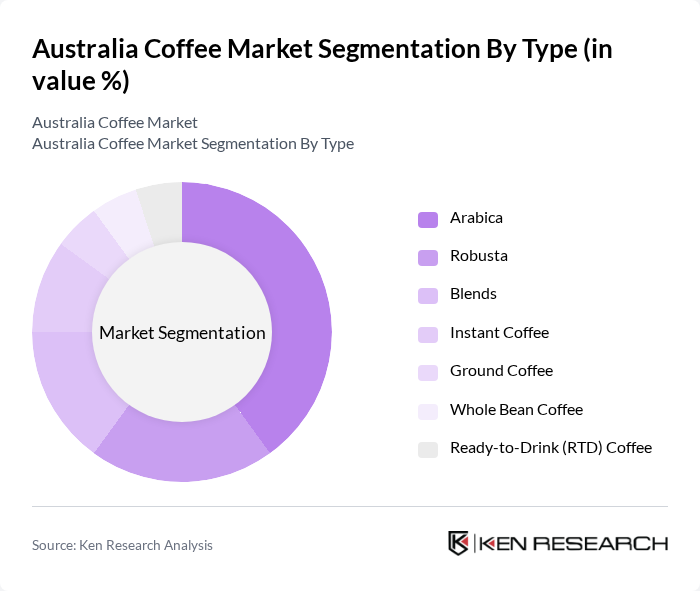

By Type:The coffee market can be segmented into various types, including Arabica, Robusta, Blends, Instant Coffee, Ground Coffee, Whole Bean Coffee, and Ready-to-Drink (RTD) Coffee. Each type caters to different consumer preferences and usage occasions, with Arabica and capsule/pod formats prominent within at-home premium segments, and instant coffee retaining a large share of consumption in Australia’s broader coffee market; RTD coffee continues to gain shelf space and consumer trial in retail .

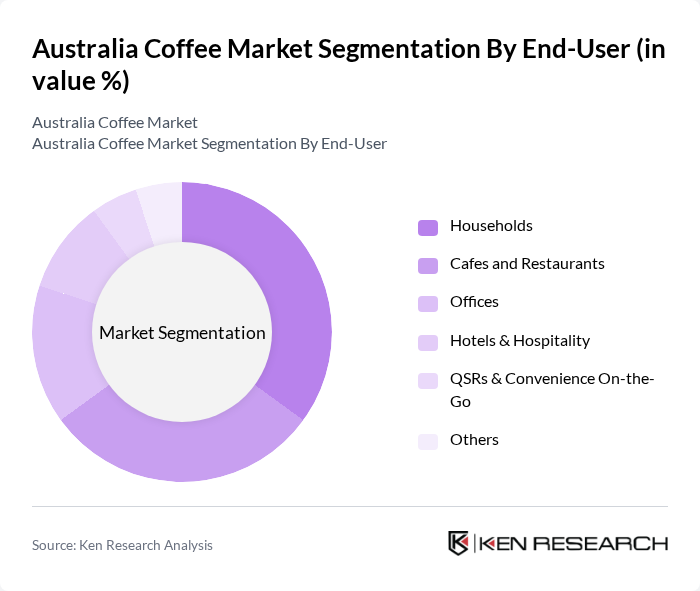

By End-User:The end-user segmentation includes Households, Cafes and Restaurants, Offices, Hotels & Hospitality, QSRs & Convenience On-the-Go, and Others. Households and Cafes and Restaurants are the leading segments, supported by Australia’s entrenched café culture where coffee is the largest product line for cafés and coffee shops, and by strong at-home consumption supported by capsules/pods and instant formats in retail .

The Australia Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Australia (Nescafé, Nespresso), JDE Peet’s Australia (Moccona, L’OR), Vittoria Coffee (Cantarella Bros.), Grinders Coffee (Coca-Cola Europacific Partners), Campos Coffee, Toby’s Estate Coffee Roasters, Five Senses Coffee, Merlo Coffee, Di Bella Coffee, Allpress Espresso, Coffee Supreme, Zarraffa’s Coffee, The Coffee Emporium, St Ali (ST. ALi), Pablo & Rusty’s Coffee Roasters contribute to innovation, geographic expansion, and service delivery in this space .

The Australia coffee market is poised for continued growth, driven by evolving consumer preferences and a focus on sustainability. As the demand for ethically sourced and organic coffee increases, brands are likely to invest in sustainable practices and transparent supply chains. Additionally, the rise of innovative coffee products, such as ready-to-drink options and cold brew, will cater to diverse consumer tastes. The market is expected to adapt to these trends, fostering resilience and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Blends Instant Coffee Ground Coffee Whole Bean Coffee Ready-to-Drink (RTD) Coffee |

| By End-User | Households Cafes and Restaurants Offices Hotels & Hospitality QSRs & Convenience On-the-Go Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online (D2C & Marketplaces) Specialty Coffee Stores On-Trade (Cafés, Restaurants) Others |

| By Price Range | Premium Mid-Range Budget Specialty/Micro-lot |

| By Packaging Type | Bags (Valve & Resealable) Cans & Jars Pods & Capsules RTD Bottles & Cans Others |

| By Flavor Profile | Dark Roast Medium Roast Light Roast Flavored Coffee Decaf Others |

| By Origin | Single Origin (Domestic & Imported) Blended Origin Rainforest/Organic/Fairtrade Certified |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Sales | 120 | Café Owners, Retail Managers |

| Consumer Preferences | 150 | Coffee Drinkers, Specialty Coffee Enthusiasts |

| Wholesale Coffee Distribution | 100 | Distributors, Importers |

| Market Trends in Specialty Coffee | 80 | Baristas, Coffee Roasters |

| Online Coffee Sales | 100 | E-commerce Managers, Digital Marketing Specialists |

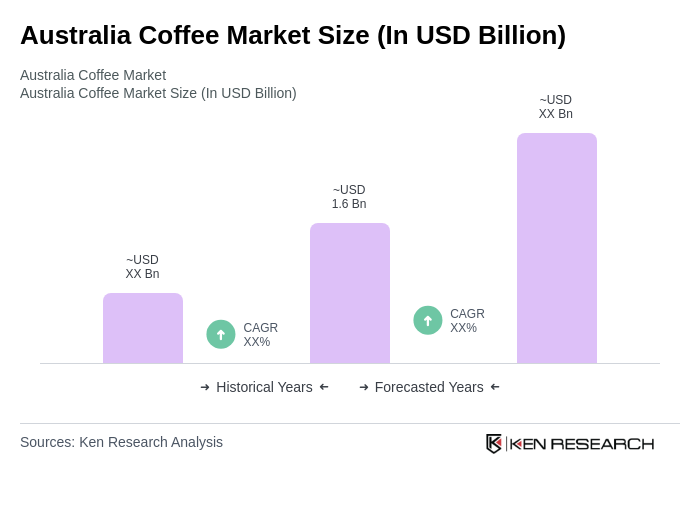

The Australia Coffee Market is valued at approximately USD 1.6 billion, based on a five-year historical analysis. This valuation reflects the growing demand for specialty coffee, capsules, and ready-to-drink coffee options in retail settings.