Region:Central and South America

Author(s):Dev

Product Code:KRAA1687

Pages:97

Published On:August 2025

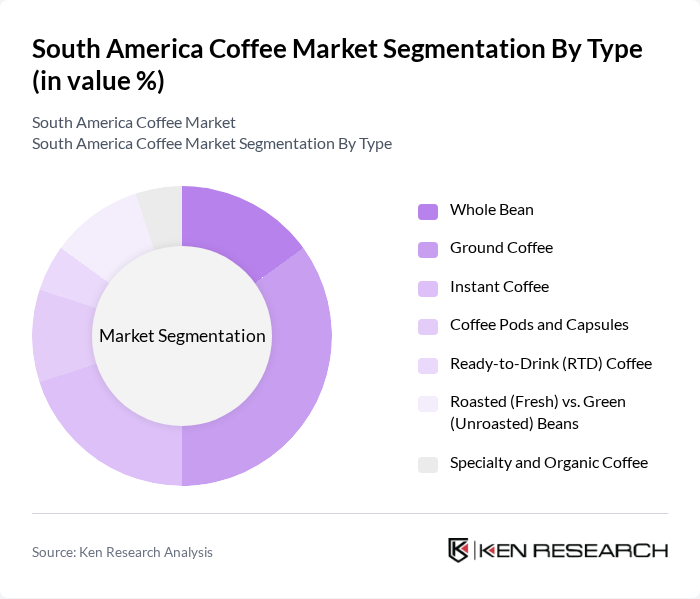

By Type:The coffee market in South America is segmented into various types, including Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules, Ready-to-Drink (RTD) Coffee, Roasted (Fresh) vs. Green (Unroasted) Beans, and Specialty and Organic Coffee. Among these, Ground Coffee is the leading subsegment in retail due to convenience and preference for at-home brewing, while roasted formats hold the largest share within Latin America overall by value. Specialty and organic coffee are gaining traction, supported by café culture, premiumization, and sustainability certifications.

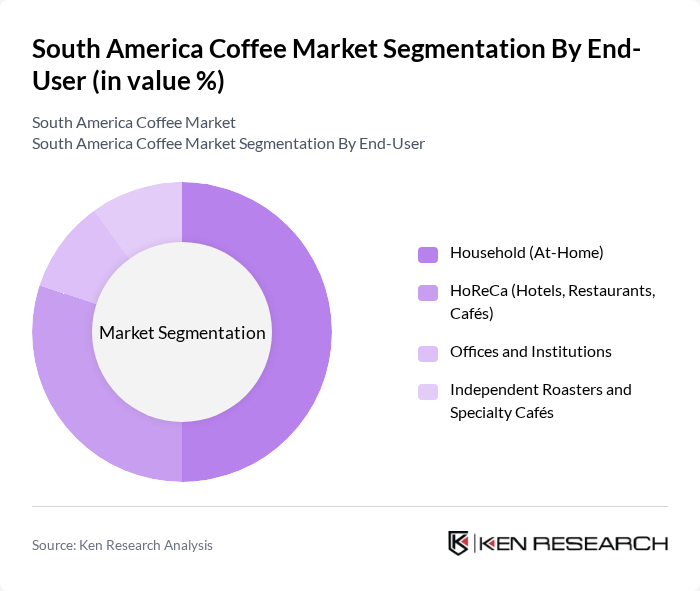

By End-User:The end-user segmentation of the coffee market includes Household (At-Home), HoReCa (Hotels, Restaurants, Cafés), Offices and Institutions, and Independent Roasters and Specialty Cafés. The Household segment remains the largest on the back of strong retail sales and at-home brewing trends established during the pandemic and sustained by convenience. The HoReCa segment continues to expand alongside urban café culture and premium out-of-home experiences, while specialty roasters capitalize on quality-focused consumers.

The South America Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Nescafé, Nespresso, Dolce Gusto), JDE Peet’s (Pilão, L’OR, Café Pelé), Starbucks Corporation, Luigi Lavazza S.p.A. (Lavazza), Grupo 3corações (Três Corações, Santa Clara), Illycaffè S.p.A. (illy), Grupo Nutresa S.A. (Colcafé, Sello Rojo), Melitta Group (Melitta, Café Bom Jesus), Café do Mercado (Brasil), Café Pilão (Brand of JDE in Brazil), Café Britt (Costa Rica) – regional presence in South America, Juan Valdez (Procafecol S.A.), O’Coffee – Brazilian Coffee Roasters (Cocarive/O’Coffee), Três Corações – RTD & Capsules (owned by Grupo 3corações), Havanna (Argentina) – coffee and café chain contribute to innovation, geographic expansion, and service delivery in this space.

The South American coffee market is poised for dynamic growth, driven by increasing consumer demand for specialty and organic coffee products. Innovations in brewing technology and a focus on sustainability will likely shape the market landscape. Additionally, the rise of e-commerce platforms is expected to enhance accessibility for consumers, allowing for greater market penetration. As the region adapts to climate challenges, investments in sustainable practices will be crucial for maintaining production levels and ensuring long-term viability in the coffee sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Ground Coffee Instant Coffee Coffee Pods and Capsules Ready-to-Drink (RTD) Coffee Roasted (Fresh) vs. Green (Unroasted) Beans Specialty and Organic Coffee |

| By End-User | Household (At-Home) HoReCa (Hotels, Restaurants, Cafés) Offices and Institutions Independent Roasters and Specialty Cafés |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialist Retailers (Gourmet/Specialty Stores) Online Retail Other Channels (Direct-to-Consumer, Cash & Carry) |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bags/Pouches Cans/Tins Glass/Plastic Bottles (RTD) Pods and Capsules Bulk/Valve Bags (Foodservice/Roasters) |

| By Region | Brazil Colombia Argentina Peru Chile Rest of South America |

| By Consumer Preference | Taste and Roast Profile (Light/Medium/Dark) Brand Loyalty Sustainability and Certifications (Fairtrade, Rainforest Alliance) Convenience (Single-Serve/Instant) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coffee Producers | 120 | Farm Owners, Agricultural Managers |

| Coffee Exporters | 100 | Export Managers, Trade Compliance Officers |

| Coffee Retailers | 100 | Store Managers, Purchasing Agents |

| Coffee Consumers | 150 | Regular Coffee Drinkers, Specialty Coffee Enthusiasts |

| Coffee Industry Experts | 60 | Market Analysts, Coffee Consultants |

The South America Coffee Market is valued at approximately USD 28 billion, reflecting a robust market scale driven by increasing consumer demand for specialty coffee and the expansion of coffee culture across the region.