Region:Global

Author(s):Dev

Product Code:KRAC0558

Pages:88

Published On:August 2025

By Type:The coffee market is segmented into various types, including Arabica, Robusta, Liberica, Excelsa, and others. Among these, Arabica coffee dominates value share due to its superior flavor profile, wider use in specialty and premium segments, and higher price point. Robusta follows with strong penetration in instant coffee and espresso blends due to its bold flavor and higher caffeine content. Specialty demand has revived interest in lesser?known varieties such as Liberica and Excelsa, though these remain niche and regionally concentrated .

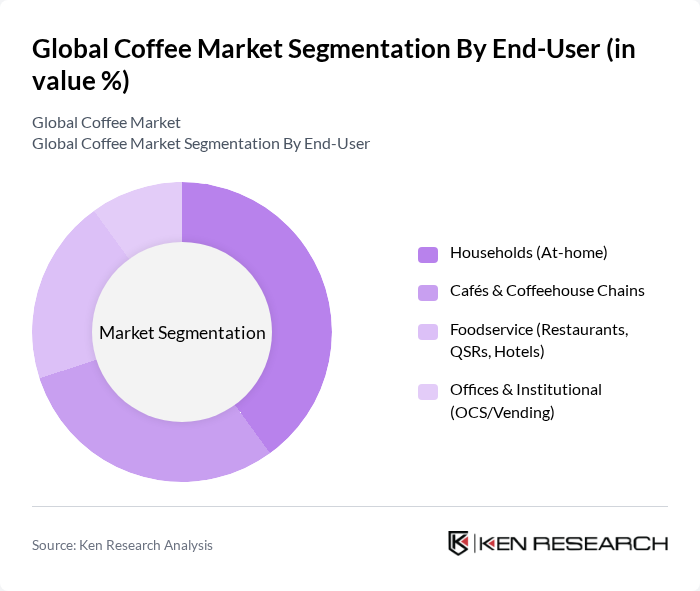

By End-User:The coffee market is segmented by end-user into households (at-home), cafés & coffeehouse chains, foodservice (restaurants, QSRs, hotels), and offices & institutional (OCS/vending). The household segment is the largest by volume and a major value contributor through premium beans, capsules, and ready-to-drink purchased via retail. Cafés and coffeehouse chains remain significant given out-of-home spending and experiential consumption, particularly in Europe, North America, and fast-growing markets in Asia and the Middle East. Foodservice is expanding as restaurants and hotels upgrade coffee programs, while offices and institutional channels continue to recover with the return-to-office trend and OCS/vending system upgrades .

The Global Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Nestlé S.A. (Nescafé, Nespresso), JDE Peet’s N.V., The J.M. Smucker Co. (Folgers, Café Bustelo), Keurig Dr Pepper Inc. (Keurig, Green Mountain), Luigi Lavazza S.p.A., illycaffè S.p.A., Tchibo GmbH, Costa Coffee (The Coca?Cola Company), Tim Hortons (Restaurant Brands International), Peet’s Coffee, Strauss Coffee B.V. (Strauss Group), Trung Nguyên Legend, Massimo Zanetti Beverage Group S.p.A. (Segafredo Zanetti), Blue Bottle Coffee, Inc. (Nestlé) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coffee market appears promising, driven by evolving consumer preferences and innovative product offerings. As specialty coffee continues to gain traction, companies are likely to invest in unique blends and sustainable sourcing practices. Additionally, the rise of e-commerce platforms will facilitate broader access to diverse coffee products, enhancing consumer choice. With increasing health awareness, brands that emphasize the health benefits of coffee are expected to thrive, creating a dynamic and competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Liberica Excelsa Others |

| By End-User | Households (At-home) Cafés & Coffeehouse Chains Foodservice (Restaurants, QSRs, Hotels) Offices & Institutional (OCS/Vending) |

| By Sales Channel | Online Retail (D2C, Marketplaces, Subscriptions) Supermarkets/Hypermarkets Specialty Coffee Stores HoReCa/On-Trade Distributors |

| By Price Range | Premium/Specialty Mid-Range Economy/Value |

| By Product Form | Ground Coffee Whole Bean Coffee Instant/Soluble Coffee Coffee Pods & Capsules Ready-to-Drink (RTD) Coffee |

| By Origin | Single Origin Blends |

| By Certification | Organic Fair Trade Rainforest Alliance/UTZ Carbon/Climate-Friendly and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coffee Producers | 100 | Farm Owners, Production Managers |

| Coffee Retailers | 80 | Store Managers, Franchise Owners |

| Distributors and Wholesalers | 70 | Supply Chain Managers, Sales Directors |

| Consumer Preferences | 120 | Coffee Drinkers, Market Researchers |

| Export and Import Agents | 60 | Trade Analysts, Logistics Coordinators |

The Global Coffee Market is valued at approximately USD 255 billion, reflecting robust demand across retail and foodservice channels. This valuation is supported by historical analysis and industry estimates, indicating a market range between USD 245285 billion in recent years.