Region:North America

Author(s):Shubham

Product Code:KRAC0895

Pages:82

Published On:August 2025

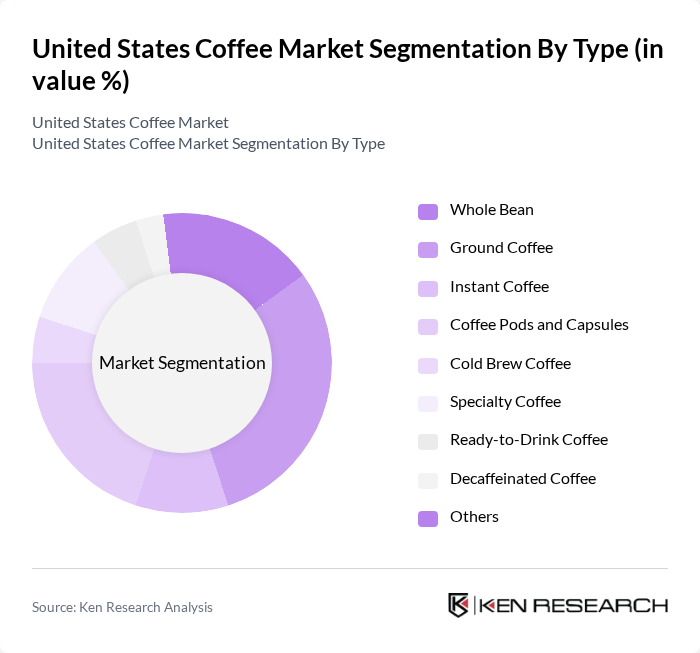

By Type:The coffee market can be segmented into various types, including Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules, Cold Brew Coffee, Specialty Coffee, Ready-to-Drink Coffee, Decaffeinated Coffee, and Others. Among these, Ground Coffee remains the most popular choice among consumers due to its convenience and versatility in preparation. The trend towards specialty and ready-to-drink coffee has gained significant traction, reflecting a shift in consumer preferences towards high-quality, ethically sourced, and convenient options. Coffee pods and capsules are experiencing rapid growth, driven by their ease of use and premium positioning, while cold brew and plant-based beverages are expanding among younger demographics seeking innovative flavors and formats .

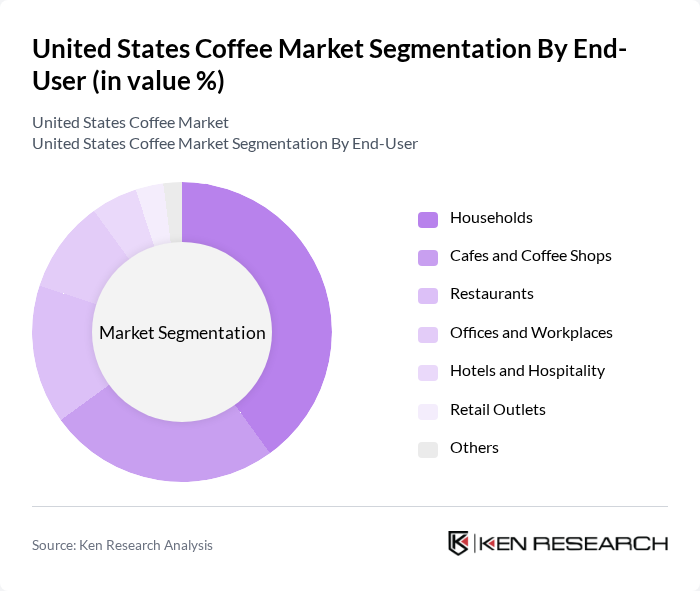

By End-User:The coffee market is segmented by end-users, including Households, Cafes and Coffee Shops, Restaurants, Offices and Workplaces, Hotels and Hospitality, Retail Outlets, and Others. Households represent the largest segment, driven by the increasing trend of home brewing and the convenience of coffee consumption at home. Cafes and coffee shops also play a significant role, catering to the growing demand for specialty coffee and social experiences. Offices and workplaces continue to be important end-users, with rising adoption of premium coffee solutions and single-serve formats. Hotels, restaurants, and retail outlets contribute to the market by offering diverse coffee experiences and expanding product portfolios .

The United States Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Dunkin' Brands Group, Inc., Keurig Dr Pepper Inc., Nestlé S.A., The J.M. Smucker Company, Lavazza S.p.A., Peet's Coffee, Inc., Caribou Coffee Company, Inc., Blue Bottle Coffee, Inc., Illycaffè S.p.A., Stumptown Coffee Roasters, Tim Hortons Inc., Costa Coffee, Intelligentsia Coffee, Inc., Dutch Bros Inc., La Colombe Coffee Roasters, Community Coffee Company, L.L.C., Eight O'Clock Coffee Company, Death Wish Coffee Company, Green Mountain Coffee Roasters contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. coffee market is poised for continued growth, driven by evolving consumer preferences and innovative product offerings. The increasing popularity of cold brew and nitro coffee is reshaping traditional consumption patterns, while subscription services are enhancing convenience for consumers. Additionally, the focus on sustainability and ethical sourcing is expected to influence purchasing decisions, prompting brands to adapt their strategies. As the market evolves, companies that embrace these trends will likely capture a larger share of the growing consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Ground Coffee Instant Coffee Coffee Pods and Capsules Cold Brew Coffee Specialty Coffee Ready-to-Drink Coffee Decaffeinated Coffee Others |

| By End-User | Households Cafes and Coffee Shops Restaurants Offices and Workplaces Hotels and Hospitality Retail Outlets Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Convenience Stores Foodservice (HoReCa) Direct Sales Others |

| By Price Range | Premium Coffee Mid-Range Coffee Budget Coffee Others |

| By Packaging Type | Bags Cans Pods Bottles Cartons Others |

| By Flavor Profile | Classic Flavored Organic Single-Origin Others |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers Occasional Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 150 | Café Owners, Baristas, Store Managers |

| Wholesale Coffee Distributors | 100 | Distribution Managers, Sales Representatives |

| Consumer Coffee Preferences | 150 | Coffee Drinkers, Brand Loyalists, Casual Consumers |

| Specialty Coffee Roasters | 80 | Roasting Facility Managers, Product Developers |

| Online Coffee Retailers | 70 | E-commerce Managers, Digital Marketing Specialists |

The United States Coffee Market is valued at approximately USD 101 billion, reflecting a significant growth trend driven by consumer preferences for specialty coffee and innovative beverage options, particularly among younger demographics like Millennials and Generation Z.