Region:Global

Author(s):Rebecca

Product Code:KRAA0351

Pages:93

Published On:August 2025

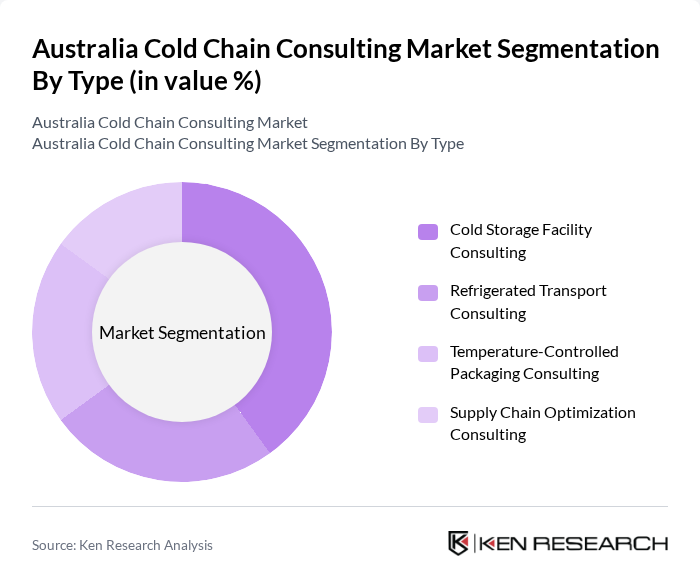

By Type:The market is segmented into four main types: Cold Storage Facility Consulting, Refrigerated Transport Consulting, Temperature-Controlled Packaging Consulting, and Supply Chain Optimization Consulting. Each segment plays a critical role in maintaining the integrity of temperature-sensitive products throughout the supply chain. Cold Storage Facility Consulting is particularly dominant due to the increasing need for modern, compliant storage solutions that meet stringent safety and efficiency regulations .

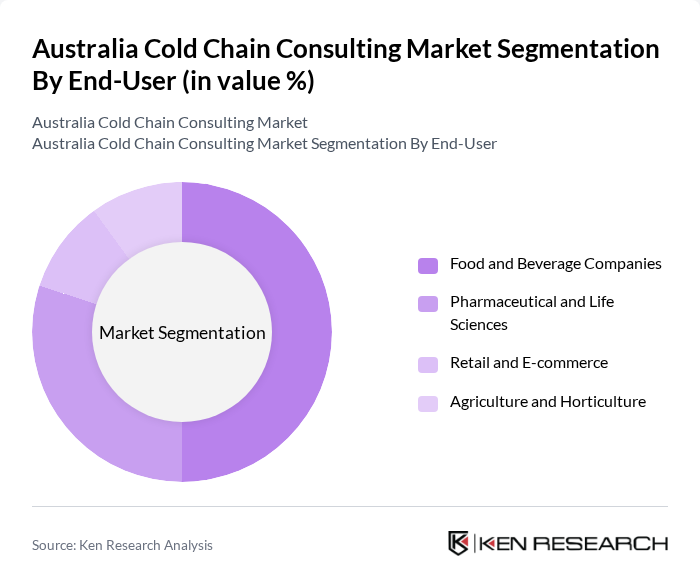

By End-User:The end-user segmentation includes Food and Beverage Companies, Pharmaceutical and Life Sciences, Retail and E-commerce, and Agriculture and Horticulture. The Food and Beverage sector is the largest end-user, driven by the need for stringent temperature control to maintain product quality and safety, especially in perishable goods. The Pharmaceutical and Life Sciences segment is rapidly expanding due to increased demand for biopharmaceuticals, vaccines, and regulatory compliance requirements .

The Australia Cold Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Karras Cold Logistics, NewCold Coöperatief UA, Transdyer Management Pty Ltd., Kerry Logistics Cold Chain (Australia) Pty Ltd., Americold Logistics LLC, QMC Logistics Pty Ltd., Yusen Logistics Australia Pty Ltd., Linfox Australia Pty Ltd., SCG Logistics Australia, TM Insight (now part of CBRE Group), SCL Cold Chain Solutions, Cold Chain Logistics Australia Pty Ltd., RealCold Pty Ltd., Linfox Armaguard Group, and Silk Logistics Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Australia cold chain consulting market appears promising, driven by increasing investments in technology and sustainability. As businesses prioritize efficiency and compliance, the adoption of automated solutions and IoT for real-time monitoring will likely become standard practice. Additionally, the focus on sustainable practices, such as eco-friendly refrigerants, will shape the industry landscape. These trends indicate a shift towards more integrated and transparent cold chain solutions, enhancing operational efficiency and reducing environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Storage Facility Consulting Refrigerated Transport Consulting Temperature-Controlled Packaging Consulting Supply Chain Optimization Consulting |

| By End-User | Food and Beverage Companies Pharmaceutical and Life Sciences Retail and E-commerce Agriculture and Horticulture |

| By Sector | Private Sector Public Sector Non-Profit and Industry Associations Others |

| By Service Type | Strategy Consulting Implementation Consulting Compliance & Regulatory Advisory Technology Integration Consulting |

| By Technology | IoT and Real-Time Monitoring Solutions Warehouse Automation & Robotics Cloud-Based Cold Chain Management Data Analytics & Predictive Maintenance |

| By Geographic Coverage | Metropolitan Areas Regional Hubs Remote and Rural Areas Cross-Border/Export Consulting |

| By Duration of Service | Short-Term Engagements Long-Term Partnerships Project-Based Consulting Retainer-Based Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Storage | 60 | Quality Assurance Managers, Operations Managers |

| Temperature-Controlled Transport | 50 | Fleet Managers, Compliance Officers |

| Retail Cold Chain Management | 40 | Store Managers, Inventory Control Specialists |

| Cold Chain Technology Solutions | 40 | IT Managers, Technology Implementation Leads |

The Australia Cold Chain Consulting Market is valued at approximately USD 2.3 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with advancements in technology and supply chain management solutions.