Region:Central and South America

Author(s):Shubham

Product Code:KRAA0909

Pages:85

Published On:August 2025

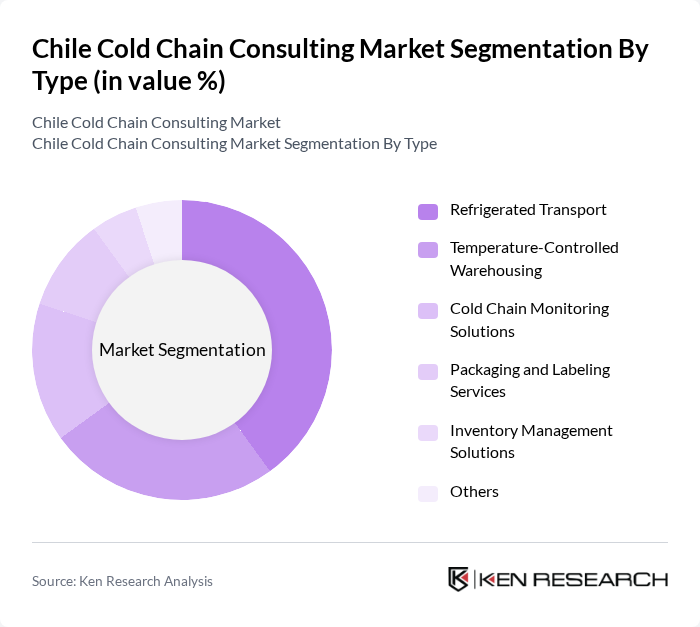

By Type:The market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging and Labeling Services, Inventory Management Solutions, and Others. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for fresh produce and perishable goods. The need for efficient logistics solutions to maintain product integrity during transit has led to significant investments in refrigerated transport infrastructure .

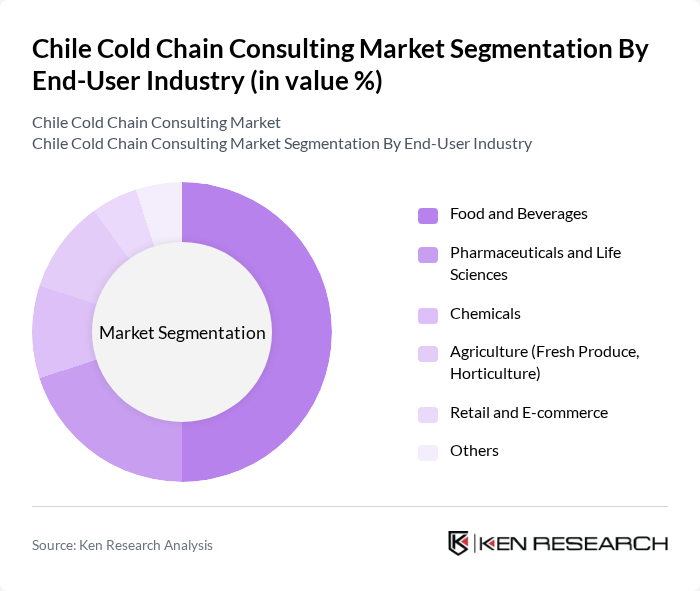

By End-User Industry:The cold chain consulting market is segmented by end-user industries, including Food and Beverages, Pharmaceuticals and Life Sciences, Chemicals, Agriculture (Fresh Produce, Horticulture), Retail and E-commerce, and Others. The Food and Beverages sector is the dominant segment, driven by the rising consumer demand for fresh and safe food products. The increasing focus on food safety regulations and quality assurance further propels the growth of this segment .

The Chile Cold Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emergent Cold LatAm, Megafrio Chile SA, Transportes Nazar, Empresas Taylor, FrioPac, Logística Fría, Tudefrigo SA, Transfrio, Frío Express, Cold Chain Solutions, Cencosud, Walmart Chile, Nestlé Chile, Dole Chile, and Unilever Chile contribute to innovation, geographic expansion, and service delivery in this space.

The Chile cold chain consulting market is poised for significant transformation, driven by technological advancements and a heightened focus on sustainability. As businesses increasingly adopt IoT solutions for real-time monitoring, operational efficiencies are expected to improve. Additionally, the integration of AI for predictive analytics will enhance decision-making processes. With government support for sustainable practices, the market is likely to see a shift towards eco-friendly cold chain solutions, aligning with global trends in environmental responsibility and food safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging and Labeling Services Inventory Management Solutions Others |

| By End-User Industry | Food and Beverages Pharmaceuticals and Life Sciences Chemicals Agriculture (Fresh Produce, Horticulture) Retail and E-commerce Others |

| By Temperature Range | Chilled Frozen |

| By Mode of Transportation | Road Sea Air Others |

| By Value-Added Services | Packaging and Labeling Real-Time Temperature Monitoring Inventory Management Quality Control Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Officers |

| Pharmaceutical Cold Chain Logistics | 60 | Logistics Coordinators, Compliance Managers |

| Biotechnology Product Distribution | 40 | Operations Directors, Regulatory Affairs Specialists |

| Retail Cold Storage Solutions | 50 | Warehouse Managers, Inventory Control Analysts |

| Cold Chain Technology Providers | 40 | Product Development Managers, Technical Sales Representatives |

The Chile Cold Chain Consulting Market is valued at approximately USD 300 million, reflecting the broader cold chain logistics sector's growth driven by increasing demand for temperature-sensitive products in food and pharmaceuticals, as well as the expansion of e-commerce.