Region:North America

Author(s):Shubham

Product Code:KRAA0833

Pages:91

Published On:August 2025

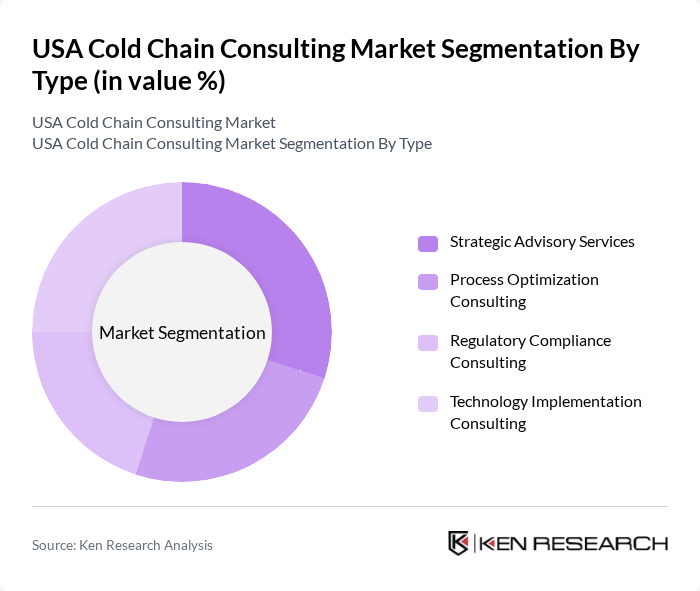

By Type:The market is segmented into four main types of consulting services: Strategic Advisory Services, Process Optimization Consulting, Regulatory Compliance Consulting, and Technology Implementation Consulting. Each of these sub-segments plays a crucial role in enhancing the efficiency and effectiveness of cold chain operations. Strategic Advisory Services focus on long-term planning and risk mitigation; Process Optimization Consulting targets operational efficiency and cost reduction; Regulatory Compliance Consulting ensures alignment with evolving standards; and Technology Implementation Consulting supports the integration of IoT, automation, and digital monitoring solutions .

The Strategic Advisory Services sub-segment is currently dominating the market due to the increasing complexity of supply chains and the need for expert guidance in navigating regulatory landscapes. Companies are seeking strategic insights to optimize their cold chain logistics, ensuring compliance and efficiency. This trend is further fueled by the growing emphasis on sustainability, digital transformation, and cost reduction, prompting businesses to invest in advisory services that can provide tailored solutions to their unique challenges .

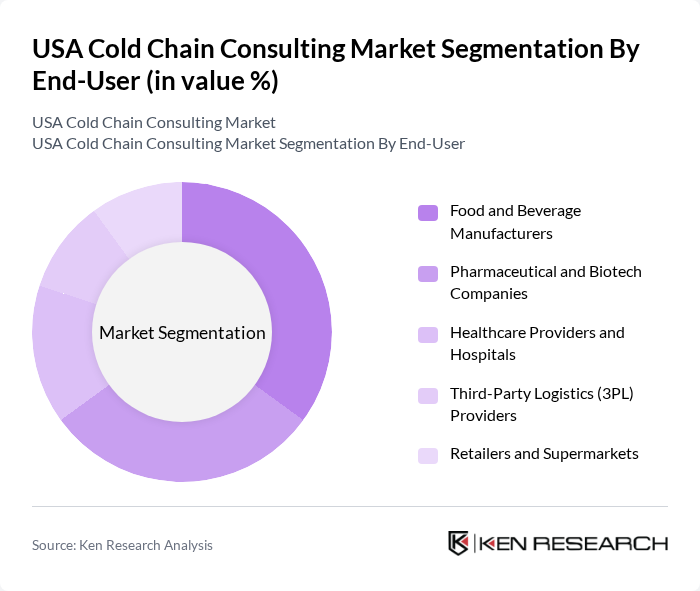

By End-User:The market is segmented by end-users, including Food and Beverage Manufacturers, Pharmaceutical and Biotech Companies, Healthcare Providers and Hospitals, Third-Party Logistics (3PL) Providers, and Retailers and Supermarkets. Each end-user category has distinct requirements and challenges that consulting services aim to address. Food and Beverage Manufacturers require robust cold chain solutions for perishables; Pharmaceutical and Biotech Companies need validated temperature control for sensitive products; Healthcare Providers and Hospitals focus on vaccine and biologic safety; 3PL Providers seek operational efficiency; and Retailers and Supermarkets prioritize freshness and compliance .

Food and Beverage Manufacturers represent the largest end-user segment, driven by the increasing demand for fresh and perishable goods. The need for effective cold chain solutions to maintain product quality and safety is paramount in this sector. Additionally, the rise in consumer awareness regarding food safety and quality, as well as regulatory scrutiny, has led to greater investments in consulting services that can help manufacturers optimize their cold chain processes .

The USA Cold Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cold Chain Technologies, Lineage Logistics, Americold Logistics, DHL Supply Chain, XPO Logistics, UPS Supply Chain Solutions, McKinsey & Company, Deloitte Consulting LLP, KPMG LLP, PwC Advisory Services LLC, A.T. Kearney (now Kearney), Boston Consulting Group (BCG), Frost & Sullivan, Accenture, and Armstrong & Associates, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the USA cold chain consulting market is poised for significant transformation, driven by technological innovations and evolving consumer demands. As the market adapts to the increasing reliance on e-commerce and the need for sustainable practices, companies will likely invest in automated solutions and data analytics. Furthermore, the integration of blockchain technology is expected to enhance transparency and traceability, addressing regulatory challenges while improving operational efficiency across the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Advisory Services Process Optimization Consulting Regulatory Compliance Consulting Technology Implementation Consulting |

| By End-User | Food and Beverage Manufacturers Pharmaceutical and Biotech Companies Healthcare Providers and Hospitals Third-Party Logistics (3PL) Providers Retailers and Supermarkets |

| By Service Model | Project-Based Consulting Retainer-Based Consulting Turnkey Solution Consulting |

| By Geographic Focus | Nationwide Coverage Regional/State-Specific Consulting |

| By Client Size | Large Enterprises Mid-Sized Enterprises Small Businesses |

| By Compliance Requirement | FDA/USDA Compliance GxP (Good Practice) Compliance ISO 9001/22000 Compliance |

| By Technology Focus | IoT and Real-Time Monitoring Solutions Automation and Robotics Consulting Data Analytics and Predictive Maintenance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 120 | Logistics Managers, Supply Chain Executives |

| Pharmaceutical Cold Chain Management | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Biotechnology Product Distribution | 60 | Operations Directors, Product Managers |

| Retail Cold Chain Solutions | 50 | Inventory Managers, Procurement Officers |

| Temperature-Controlled Logistics Technology | 70 | IT Managers, Technology Officers |

The USA Cold Chain Consulting Market is valued at approximately USD 2.7 billion, reflecting a robust growth driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, alongside stringent regulatory compliance requirements.