Region:Asia

Author(s):Geetanshi

Product Code:KRAA0194

Pages:96

Published On:August 2025

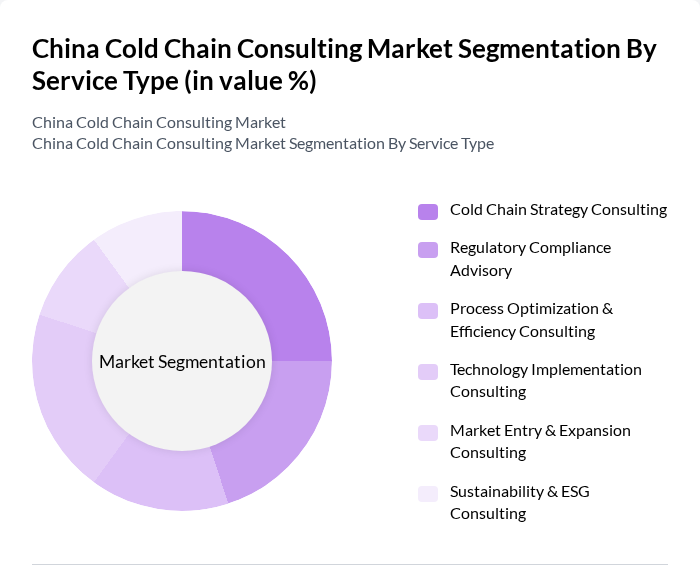

By Service Type:The service type segmentation includes consulting services tailored to the operational, regulatory, and strategic needs of cold chain businesses. The subsegments are Cold Chain Strategy Consulting, Regulatory Compliance Advisory, Process Optimization & Efficiency Consulting, Technology Implementation Consulting, Market Entry & Expansion Consulting, and Sustainability & ESG Consulting. These services are essential for improving operational efficiency, ensuring regulatory compliance, integrating new technologies, supporting market expansion, and advancing sustainability initiatives in cold chain systems .

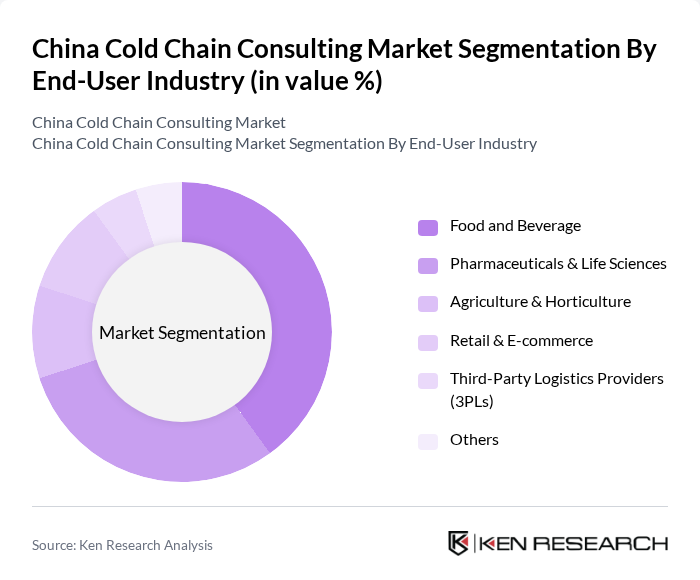

By End-User Industry:The end-user industry segmentation covers sectors that utilize cold chain consulting services to address their unique requirements for temperature-controlled logistics. The subsegments include Food and Beverage, Pharmaceuticals & Life Sciences, Agriculture & Horticulture, Retail & E-commerce, Third-Party Logistics Providers (3PLs), and Others. Each industry segment faces distinct challenges in cold chain management, influencing the demand for specialized consulting services to ensure product integrity, regulatory compliance, and operational efficiency .

The China Cold Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sinotrans Limited, SF Express (????), CJ Rokin Logistics, Kerry Logistics Network Limited, China Merchants Logistics (?????), Shanghai Zhengming Modern Logistics, Chengdu Silverplow Cold Chain Logistics, JD Logistics (????), GLP (Global Logistic Properties), COSCO Shipping Logistics, Beijing Changjiu Logistics, YTO Express Group (????), ZTO Express (????), Deppon Logistics (????), and China Railway Express (????) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China cold chain consulting market appears promising, driven by technological advancements and increasing consumer demand for quality perishable goods. As e-commerce continues to expand, the need for efficient cold chain logistics will intensify, prompting investments in infrastructure and technology. Additionally, the government's focus on food safety and sustainability will further shape the market landscape, encouraging stakeholders to adopt innovative solutions that enhance operational efficiency and reduce waste in the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Cold Chain Strategy Consulting Regulatory Compliance Advisory Process Optimization & Efficiency Consulting Technology Implementation Consulting Market Entry & Expansion Consulting Sustainability & ESG Consulting |

| By End-User Industry | Food and Beverage Pharmaceuticals & Life Sciences Agriculture & Horticulture Retail & E-commerce Third-Party Logistics Providers (3PLs) Others |

| By Client Type | Multinational Corporations State-Owned Enterprises Small and Medium Enterprises (SMEs) Government Agencies |

| By Region | North China South China East China West China |

| By Application | Network Design & Optimization Regulatory Compliance & Certification Technology Selection & Implementation Sustainability & Energy Efficiency Risk Management & Business Continuity Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 120 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Chain Management | 80 | Logistics Coordinators, Regulatory Affairs Specialists |

| Floral and Horticultural Logistics | 50 | Operations Managers, Distribution Supervisors |

| Biotechnology Product Distribution | 40 | Product Managers, Cold Chain Analysts |

| Retail Cold Chain Solutions | 60 | Retail Operations Managers, Inventory Control Specialists |

The China Cold Chain Consulting Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the rising demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the expansion of e-commerce and logistics infrastructure.