Region:Global

Author(s):Shubham

Product Code:KRAA0717

Pages:82

Published On:August 2025

By Type:The market is segmented into various types of logistics consulting services, including Freight Forwarding, Last-Mile Delivery, Warehousing Solutions, Supply Chain Management Consulting, E-Commerce Fulfillment Consulting, Technology Integration & Digital Transformation, Sustainability & Green Logistics Consulting, Cross-Border Logistics Consulting, and Others. Each of these segments plays a crucial role in addressing specific needs within the e-commerce logistics landscape .

The Last-Mile Delivery segment is currently dominating the market due to the increasing consumer expectation for rapid and reliable delivery services. As e-commerce continues to grow, businesses are focusing on optimizing their last-mile logistics to enhance customer satisfaction and reduce delivery times. This segment has seen significant investment in technology and infrastructure, enabling companies to offer innovative solutions such as same-day delivery and real-time tracking. The demand for efficient last-mile delivery solutions remains strong as online shopping becomes more prevalent .

By End-User:The market is segmented by end-users, including Retailers (Online & Omnichannel), E-Commerce Platforms & Marketplaces, Third-Party Logistics Providers (3PLs), Manufacturers & Distributors, SMEs & Startups, Government & Public Sector, and Others. Each end-user segment has unique requirements and challenges that logistics consulting services aim to address .

The Retailers (Online & Omnichannel) segment is leading the market as these businesses increasingly rely on logistics consulting to streamline their operations and enhance customer experiences. The shift towards online shopping has prompted retailers to seek expert guidance in optimizing their supply chains, improving inventory management, and implementing effective delivery solutions. This segment's growth is fueled by the need for retailers to adapt to changing consumer preferences and the competitive landscape of e-commerce .

The Australia E-Commerce Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Linfox, DB Schenker Australia, StarTrack (Australia Post Group), Aramex Australia, Australia Post, TNT Express (FedEx Express Australia), Ceva Logistics Australia, Kuehne + Nagel Australia, DSV Solutions Australia, Mainfreight Australia, Qube Holdings, Direct Freight Express, Allied Express, TM Insight (now part of FTI Consulting), Prological Consulting, GRA Supply Chain Consultants, Argon & Co Australia, Bastian Consulting, Logistics Bureau contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia e-commerce logistics consulting market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt omnichannel strategies, logistics providers will need to enhance their service offerings to meet diverse customer needs. Furthermore, the integration of AI and automation in logistics operations is expected to streamline processes, reduce costs, and improve delivery times, positioning companies for sustained growth in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Last-Mile Delivery Warehousing Solutions Supply Chain Management Consulting E-Commerce Fulfillment Consulting Technology Integration & Digital Transformation Sustainability & Green Logistics Consulting Cross-Border Logistics Consulting Others |

| By End-User | Retailers (Online & Omnichannel) E-Commerce Platforms & Marketplaces Third-Party Logistics Providers (3PLs) Manufacturers & Distributors SMEs & Startups Government & Public Sector Others |

| By Service Model | B2B Logistics Consulting B2C Logistics Consulting C2C Logistics Consulting Hybrid & Omnichannel Consulting Others |

| By Delivery Speed | Same-Day Delivery Consulting Next-Day Delivery Consulting Standard Delivery Consulting Scheduled Delivery Consulting Express & Time-Definite Consulting Others |

| By Geographic Coverage | Urban Logistics Consulting Suburban Logistics Consulting Rural & Remote Area Consulting Cross-Border & International Consulting Others |

| By Customer Segment | Small Businesses Medium Enterprises Large Corporations Startups Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 60 | Logistics Coordinators, Delivery Managers |

| E-commerce Fulfillment Strategies | 50 | Operations Directors, Supply Chain Analysts |

| Returns Management Practices | 40 | Customer Experience Managers, Returns Specialists |

| Technology Adoption in Logistics | 40 | IT Managers, Innovation Leads |

| Consumer Preferences in Delivery | 100 | End Consumers, Online Shoppers |

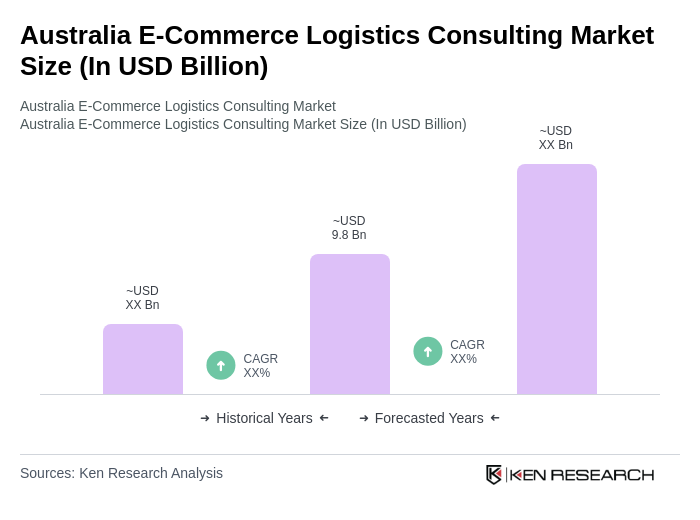

The Australia E-Commerce Logistics Consulting Market is valued at approximately USD 9.8 billion, reflecting significant growth driven by the expansion of online retail and the demand for efficient supply chain management solutions.