Region:Middle East

Author(s):Dev

Product Code:KRAA0422

Pages:91

Published On:August 2025

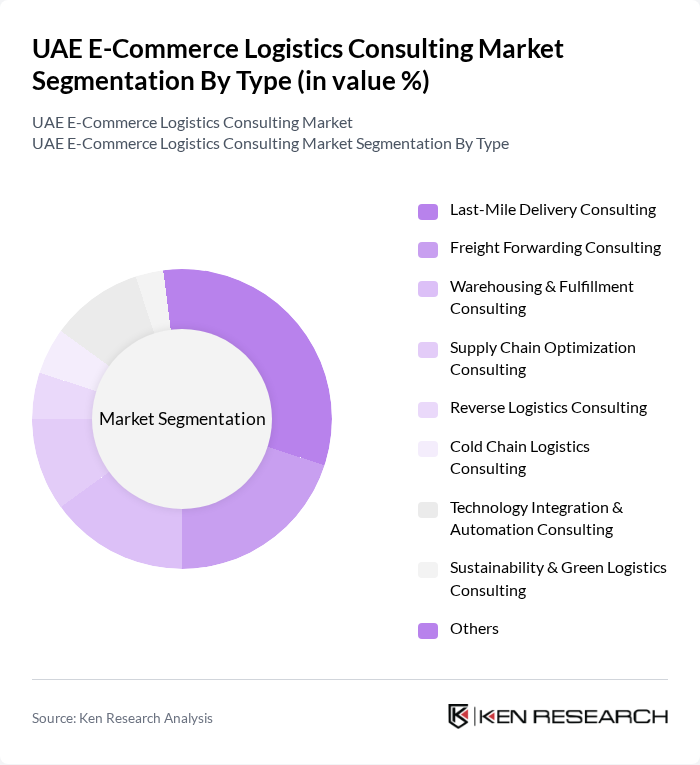

By Type:The market is segmented into various types of consulting services that cater to the diverse needs of e-commerce businesses. The subsegments include Last-Mile Delivery Consulting, Freight Forwarding Consulting, Warehousing & Fulfillment Consulting, Supply Chain Optimization Consulting, Reverse Logistics Consulting, Cold Chain Logistics Consulting, Technology Integration & Automation Consulting, Sustainability & Green Logistics Consulting, and Others. Each of these subsegments plays a crucial role in enhancing operational efficiency and customer satisfaction. Last-mile delivery and technology integration are particularly critical as e-commerce players focus on speed, traceability, and automation .

The Last-Mile Delivery Consulting subsegment is currently dominating the market due to the increasing demand for efficient and timely delivery services in the e-commerce sector. As consumers expect faster delivery times, businesses are investing heavily in optimizing their last-mile logistics. This trend is further fueled by the rise of online shopping, high mobile penetration, and the need for personalized delivery solutions. The focus on enhancing customer experience and reducing delivery costs has made this subsegment a critical area for logistics consulting. Technology integration, including real-time tracking and automation, is also a key enabler for last-mile efficiency .

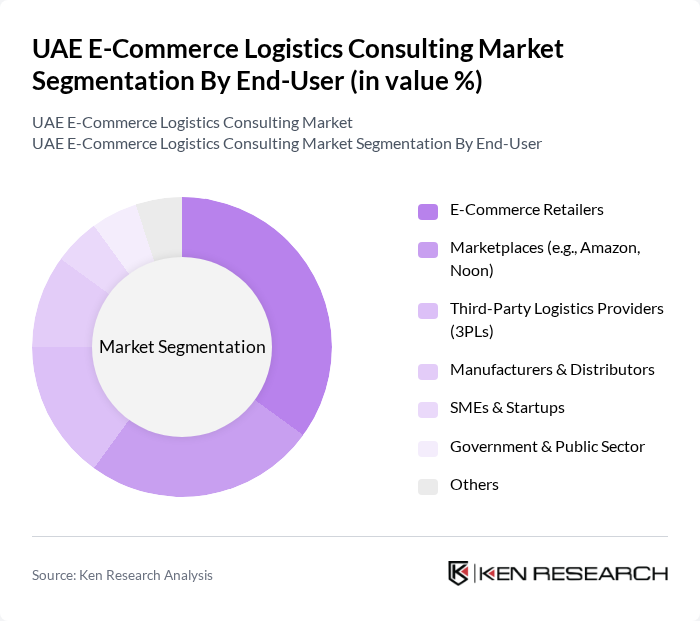

By End-User:The market is segmented based on the end-users of logistics consulting services, which include E-Commerce Retailers, Marketplaces (e.g., Amazon, Noon), Third-Party Logistics Providers (3PLs), Manufacturers & Distributors, SMEs & Startups, Government & Public Sector, and Others. Each end-user segment has unique requirements and challenges that logistics consulting services aim to address. E-commerce retailers and marketplaces are the primary drivers, leveraging consulting to optimize fulfillment, delivery, and customer experience .

The E-Commerce Retailers segment is leading the market as these businesses are increasingly reliant on logistics consulting to enhance their supply chain efficiency and customer service. The growth of online shopping has necessitated the need for tailored logistics solutions that can accommodate varying consumer demands. Retailers are focusing on improving their delivery capabilities and inventory management, making this segment a key driver of the logistics consulting market. Marketplaces and 3PLs are also investing in consulting to support scalable, tech-enabled logistics operations .

The UAE E-Commerce Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx Logistics Consulting, UPS Supply Chain Solutions, Agility Logistics, Emirates Logistics LLC, Naqel Express, Fetchr, Zajel, Q-Express (Qatar Airways Cargo), TCS Logistics, Al-Futtaim Logistics, Kuehne + Nagel, DB Schenker, Logistics Executive Group, Accenture Middle East, PwC Middle East, EY (Ernst & Young) Middle East, Bain & Company Middle East, Roland Berger Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE e-commerce logistics consulting market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt omnichannel strategies, logistics providers will need to enhance their service offerings to meet diverse customer demands. Additionally, the integration of AI and IoT technologies is expected to streamline operations, improve efficiency, and reduce costs, positioning logistics consulting firms as essential partners in navigating this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Consulting Freight Forwarding Consulting Warehousing & Fulfillment Consulting Supply Chain Optimization Consulting Reverse Logistics Consulting Cold Chain Logistics Consulting Technology Integration & Automation Consulting Sustainability & Green Logistics Consulting Others |

| By End-User | E-Commerce Retailers Marketplaces (e.g., Amazon, Noon) Third-Party Logistics Providers (3PLs) Manufacturers & Distributors SMEs & Startups Government & Public Sector Others |

| By Service Model | Strategy Consulting Operations Consulting Technology & Digital Transformation Consulting Compliance & Regulatory Consulting Training & Change Management Project Implementation Support Others |

| By Delivery Method | On-Site Consulting Remote/Virtual Consulting Hybrid Consulting Retainer-Based Advisory Project-Based Consulting Others |

| By Geographic Coverage | Dubai Abu Dhabi Sharjah Northern Emirates Free Zones GCC/Regional International Others |

| By Technology Utilization | Automation & Robotics Consulting Data Analytics & AI Consulting IoT & Real-Time Tracking Consulting Blockchain & Supply Chain Transparency Consulting Cloud-Based Logistics Solutions Consulting Others |

| By Customer Segment | Large Enterprises SMEs Startups Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 60 | Logistics Coordinators, Delivery Operations Managers |

| Warehouse Management Systems | 45 | Warehouse Managers, IT Systems Analysts |

| Cross-Border E-Commerce Logistics | 40 | International Trade Managers, Customs Compliance Officers |

| Returns Management Strategies | 40 | Customer Experience Managers, Returns Analysts |

| Technology Integration in Logistics | 50 | IT Managers, Logistics Technology Consultants |

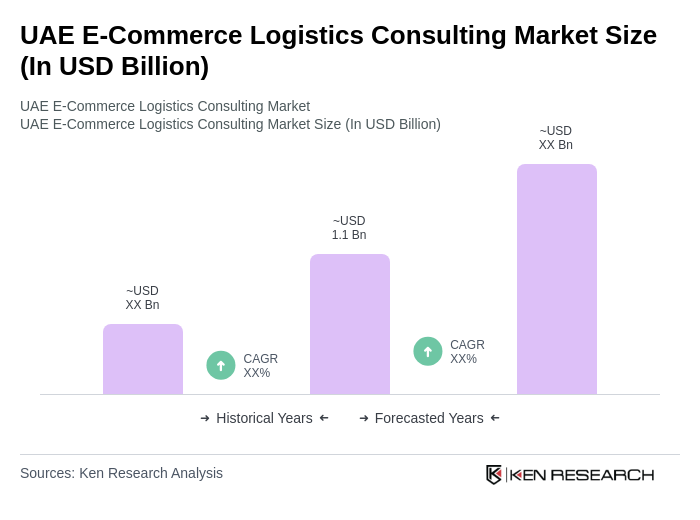

The UAE E-Commerce Logistics Consulting Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the expansion of e-commerce activities, consumer demand for faster delivery, and advancements in logistics technologies.