Region:Europe

Author(s):Shubham

Product Code:KRAA0912

Pages:89

Published On:August 2025

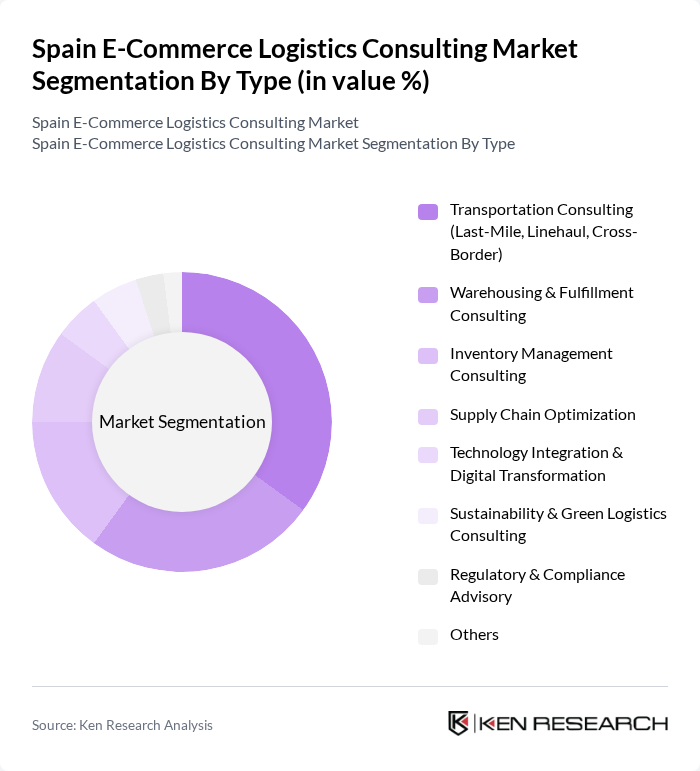

By Type:The market is segmented into various types of consulting services that cater to the diverse needs of e-commerce businesses. The subsegments include Transportation Consulting (Last-Mile, Linehaul, Cross-Border), Warehousing & Fulfillment Consulting, Inventory Management Consulting, Supply Chain Optimization, Technology Integration & Digital Transformation, Sustainability & Green Logistics Consulting, Regulatory & Compliance Advisory, and Others. Among these, Transportation Consulting is currently the leading subsegment due to the increasing demand for efficient last-mile delivery solutions and the growing complexity of logistics networks .

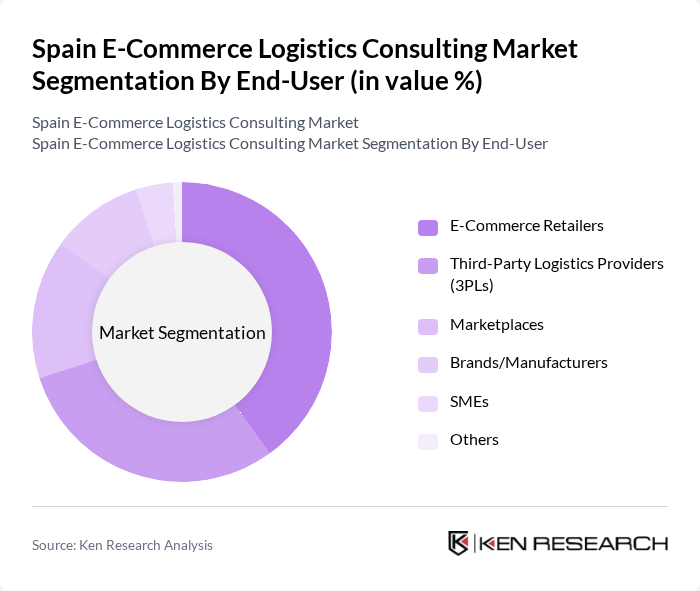

By End-User:The end-user segmentation includes E-Commerce Retailers, Third-Party Logistics Providers (3PLs), Marketplaces, Brands/Manufacturers, SMEs, and Others. E-Commerce Retailers are the dominant end-user segment, driven by the rapid growth of online shopping and the need for tailored logistics solutions to meet customer expectations for fast and reliable delivery .

The Spain E-Commerce Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as SEUR, MRW, Correos, DHL Supply Chain Spain, UPS Spain, XPO Logistics Spain, Geodis Spain, Kuehne + Nagel Spain, DPD España, Amazon Logistics Spain, Celeritas, Nacex, Logista, Zeleris, Amphora Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Spain e-commerce logistics consulting market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt AI and automation, logistics efficiency will improve, reducing operational costs. Furthermore, the rise of omnichannel strategies will necessitate integrated logistics solutions, enhancing customer experiences. With the anticipated growth in cross-border e-commerce, logistics consulting firms will play a crucial role in helping businesses navigate international markets and regulatory landscapes effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Consulting (Last-Mile, Linehaul, Cross-Border) Warehousing & Fulfillment Consulting Inventory Management Consulting Supply Chain Optimization Technology Integration & Digital Transformation Sustainability & Green Logistics Consulting Regulatory & Compliance Advisory Others |

| By End-User | E-Commerce Retailers Third-Party Logistics Providers (3PLs) Marketplaces Brands/Manufacturers SMEs Others |

| By Service Type | Strategic Consulting Operational Consulting Technology Consulting Implementation Support Training & Change Management Others |

| By Delivery Model | Onsite Consulting Remote/Virtual Consulting Hybrid Consulting Others |

| By Logistics Mode | Road Transport Air Transport Rail Transport Sea Transport Multimodal Solutions Others |

| By Customer Segment | Large Enterprises SMEs Startups Others |

| By Pricing Model | Project-Based Pricing Retainer-Based Pricing Performance-Based Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Strategies | 100 | Logistics Coordinators, E-commerce Directors |

| Last-Mile Delivery Solutions | 80 | Operations Managers, Delivery Service Providers |

| Returns Management Practices | 70 | Customer Service Managers, Returns Analysts |

| Warehouse Automation Trends | 50 | Warehouse Managers, Technology Officers |

| Impact of Sustainability on Logistics | 90 | Sustainability Managers, Supply Chain Analysts |

The Spain E-Commerce Logistics Consulting Market is valued at approximately USD 5.3 billion, reflecting significant growth driven by the expansion of the e-commerce sector and the increasing demand for efficient logistics solutions.