Region:Central and South America

Author(s):Shubham

Product Code:KRAA0921

Pages:89

Published On:August 2025

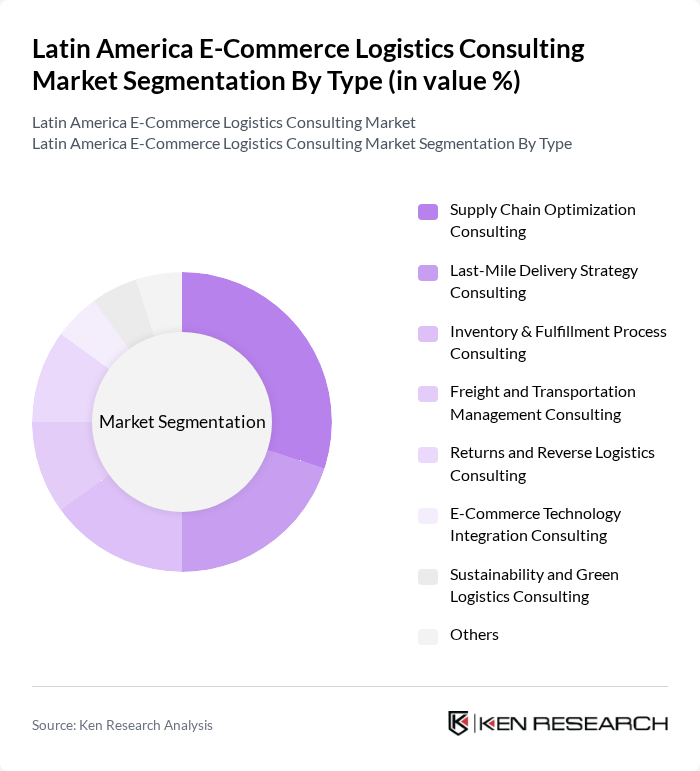

By Type:The market is segmented into various types of consulting services that cater to the specific needs of e-commerce businesses. The subsegments include Supply Chain Optimization Consulting, Last-Mile Delivery Strategy Consulting, Inventory & Fulfillment Process Consulting, Freight and Transportation Management Consulting, Returns and Reverse Logistics Consulting, E-Commerce Technology Integration Consulting, Sustainability and Green Logistics Consulting, and Others. Among these, Supply Chain Optimization Consulting is the leading subsegment, driven by the increasing need for businesses to enhance operational efficiency and reduce costs in their supply chains .

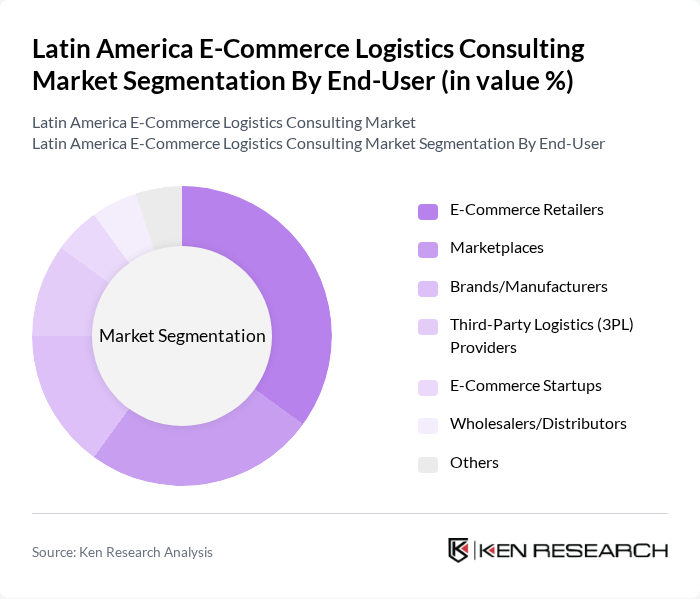

By End-User:The end-user segmentation includes E-Commerce Retailers, Marketplaces, Brands/Manufacturers, Third-Party Logistics (3PL) Providers, E-Commerce Startups, Wholesalers/Distributors, and Others. E-Commerce Retailers represent the largest segment, as they require comprehensive logistics consulting services to manage their supply chains effectively and meet customer expectations for fast and reliable delivery .

The Latin America E-Commerce Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, FedEx Logistics, UPS Supply Chain Solutions, CEVA Logistics, Geodis, Loggi, B2W Digital (Americanas S.A.), Mercado Libre (Mercado Envios), GEFCO Logistics, Bolloré Logistics, Kerry Logistics, CH Robinson Worldwide Inc., Nippon Express contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Latin America e-commerce logistics consulting market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and automation, logistics processes will become more efficient, reducing operational costs. Additionally, the focus on sustainability will shape logistics strategies, with companies seeking eco-friendly solutions. The rise of omnichannel retailing will further necessitate innovative logistics consulting services, ensuring that businesses can meet diverse consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Supply Chain Optimization Consulting Last-Mile Delivery Strategy Consulting Inventory & Fulfillment Process Consulting Freight and Transportation Management Consulting Returns and Reverse Logistics Consulting E-Commerce Technology Integration Consulting Sustainability and Green Logistics Consulting Others |

| By End-User | E-Commerce Retailers Marketplaces Brands/Manufacturers Third-Party Logistics (3PL) Providers E-Commerce Startups Wholesalers/Distributors Others |

| By Service Model | Strategic Consulting Services Implementation & Managed Services Technology Advisory & Integration Training and Change Management Others |

| By Distribution Channel | Direct Engagement Online Consulting Platforms Partnerships with Logistics Providers Resellers/Consulting Networks Others |

| By Geographic Focus | Brazil Mexico Argentina Chile Colombia Peru Regional/Cross-Border Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Government/Institutional Clients Others |

| By Pricing Model | Fixed Project Fee Hourly Consulting Rates Performance-Based Fees Subscription/Retainer Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Managers |

| Cross-Border E-Commerce Logistics | 60 | International Trade Specialists, Customs Brokers |

| Warehouse Management Systems | 50 | Warehouse Operations Managers, IT Directors |

| Returns Management Strategies | 40 | Customer Experience Managers, Returns Analysts |

| Third-Party Logistics Providers | 60 | Business Development Managers, Operations Executives |

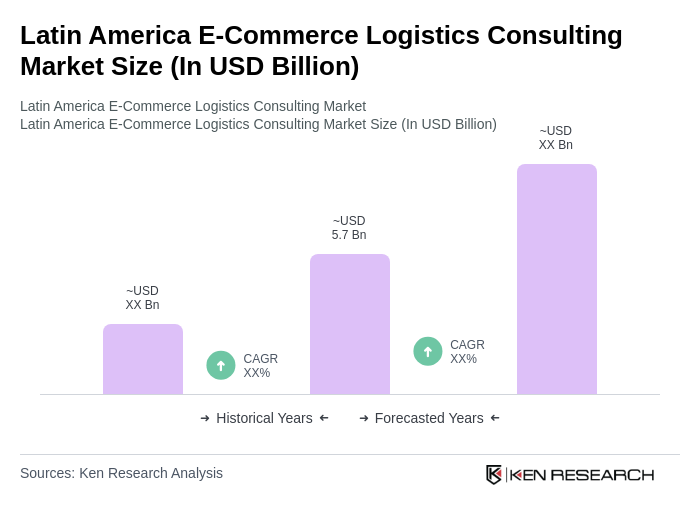

The Latin America E-Commerce Logistics Consulting Market is valued at approximately USD 5.7 billion, reflecting significant growth driven by the expansion of e-commerce platforms and increased consumer preference for online shopping.