Region:Asia

Author(s):Geetanshi

Product Code:KRAA1978

Pages:100

Published On:August 2025

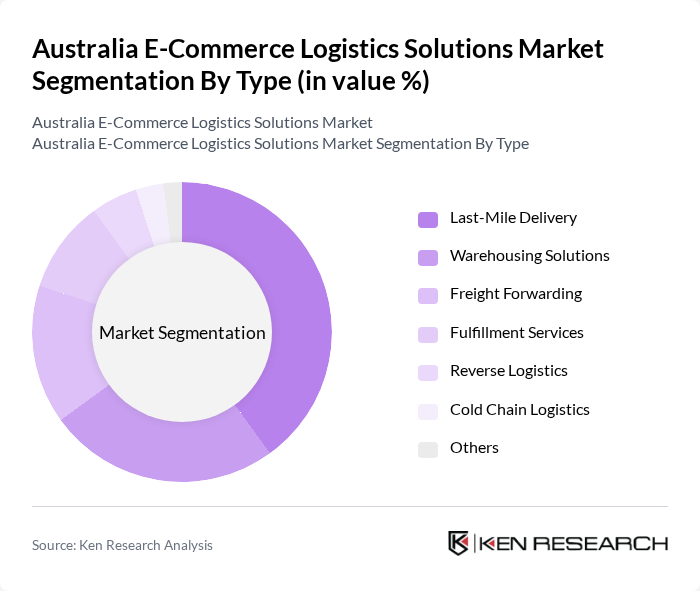

By Type:The logistics solutions market is segmented into Last-Mile Delivery, Warehousing Solutions, Freight Forwarding, Fulfillment Services, Reverse Logistics, Cold Chain Logistics, and Others. Each segment plays a vital role in the logistics ecosystem, addressing different operational needs of e-commerce businesses. Last-Mile Delivery remains particularly significant due to heightened consumer expectations for rapid and flexible delivery, while Warehousing Solutions are essential for effective inventory management and seamless order fulfillment.

By End-User:The end-user segmentation includes Retail, Consumer Electronics, Fashion and Apparel, Food and Beverage, Health and Pharmaceuticals, Automotive Products, Books and Media, Personal Care and Baby Products, Home Furnishings, and Others. Retail is the dominant segment, propelled by the surge in online shopping and omnichannel retail strategies. Sectors such as Food and Beverage and Health and Pharmaceuticals are increasingly reliant on specialized logistics solutions, including cold chain and express delivery, to ensure product integrity and timely fulfillment.

The Australia E-Commerce Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Australia Post, Toll Group, StarTrack, DHL Supply Chain, FedEx Express, Aramex Australia, CouriersPlease, Sendle, TNT Express, Linfox, DB Schenker Australia, CEVA Logistics Australia, Kuehne + Nagel Australia, Qantas Freight, Direct Freight Express, Allied Express, Mainfreight Australia, Seko Logistics Australia, Hunter Express, Fastway Couriers (now Aramex) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia e-commerce logistics market appears promising, driven by ongoing technological innovations and evolving consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the rise of sustainable logistics practices will likely reshape the industry, with a focus on reducing carbon footprints. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in meeting consumer expectations and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Warehousing Solutions Freight Forwarding Fulfillment Services Reverse Logistics Cold Chain Logistics Others |

| By End-User | Retail Consumer Electronics Fashion and Apparel Food and Beverage Health and Pharmaceuticals Automotive Products Books and Media Personal Care and Baby Products Home Furnishings Others |

| By Sales Channel | Direct Sales Online Marketplaces Third-Party Logistics Providers Others |

| By Distribution Mode | Road Transport Air Transport Rail Transport Sea Transport Others |

| By Packaging Type | Standard Packaging Custom Packaging Eco-Friendly Packaging Others |

| By Delivery Speed | Standard Delivery Express Delivery Same-Day Delivery Next-Day Delivery Others |

| By Customer Segment | B2B B2C C2C Others |

| By Parcel Weight | Lightweight Parcels (<3kg) Heavyweight Parcels (?3kg) |

| By Operational Area | Domestic International |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Logistics | 120 | Logistics Coordinators, E-commerce Directors |

| Last-Mile Delivery Solutions | 90 | Operations Managers, Delivery Service Providers |

| Returns Management Strategies | 60 | Customer Experience Managers, Supply Chain Analysts |

| Warehouse Automation in E-commerce | 50 | Warehouse Managers, Technology Integration Specialists |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

The Australia E-Commerce Logistics Solutions Market is valued at approximately USD 12 billion, reflecting significant growth driven by the expansion of online retail and advancements in logistics technology.