Region:Central and South America

Author(s):Shubham

Product Code:KRAA0929

Pages:96

Published On:August 2025

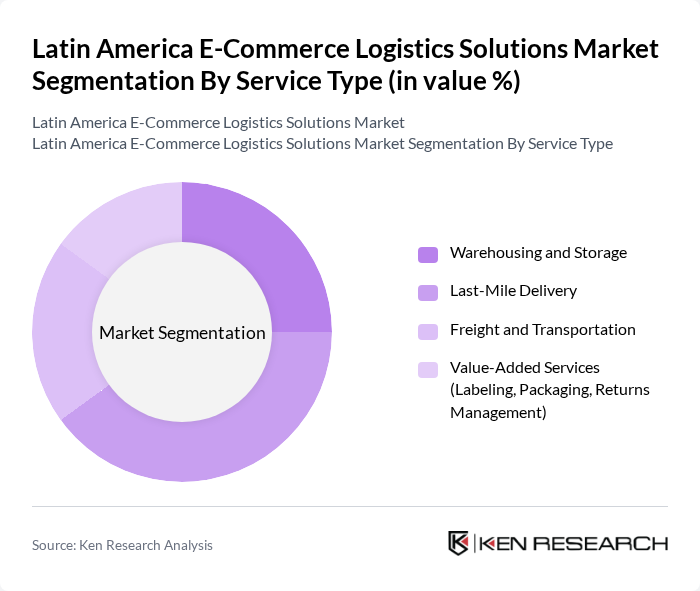

By Service Type:The service type segmentation includes various subsegments such as Warehousing and Storage, Last-Mile Delivery, Freight and Transportation, and Value-Added Services (Labeling, Packaging, Returns Management). Among these, Last-Mile Delivery is currently the leading subsegment due to the increasing demand for quick and efficient delivery solutions. The rise of e-commerce has heightened consumer expectations for fast shipping, making last-mile logistics a critical focus for companies aiming to enhance customer satisfaction .

By Technology:The technology segmentation encompasses Automated Logistics Solutions and Digital Platforms and Software. Automated Logistics Solutions are gaining traction as companies seek to enhance operational efficiency and reduce costs. The integration of robotics and AI in warehousing and delivery processes is transforming the logistics landscape, making it a dominant force in the market .

The Latin America E-Commerce Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Libre, DHL Supply Chain, FedEx, UPS, B2W Digital (Americanas S.A.), Grupo Logístico Andreani, Loggi, Kangu, Olist, Rappi, DB Schenker, CEVA Logistics, GeFco Logistics, Kuehne + Nagel, Movile contribute to innovation, geographic expansion, and service delivery in this space.

The future of e-commerce logistics in Latin America appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Additionally, the growing emphasis on sustainability will likely shape logistics strategies, with businesses seeking eco-friendly solutions. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Warehousing and Storage Last-Mile Delivery Freight and Transportation Value-Added Services (Labeling, Packaging, Returns Management) |

| By Technology | Automated Logistics Solutions Digital Platforms and Software |

| By End-User | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) |

| By Destination | Domestic International/Cross-Border |

| By Product Category | Fashion and Apparel Consumer Electronics and Appliances Beauty and Personal Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 70 | Customer Experience Managers, Operations Directors |

| Warehouse Automation Technologies | 50 | Warehouse Managers, IT Specialists |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Third-Party Logistics Providers | 60 | Business Development Managers, Sales Executives |

The Latin America E-Commerce Logistics Solutions Market is valued at approximately USD 30 billion, driven by the rapid growth of online retail, increased internet penetration, and the demand for efficient delivery services.