Region:North America

Author(s):Geetanshi

Product Code:KRAA0290

Pages:86

Published On:August 2025

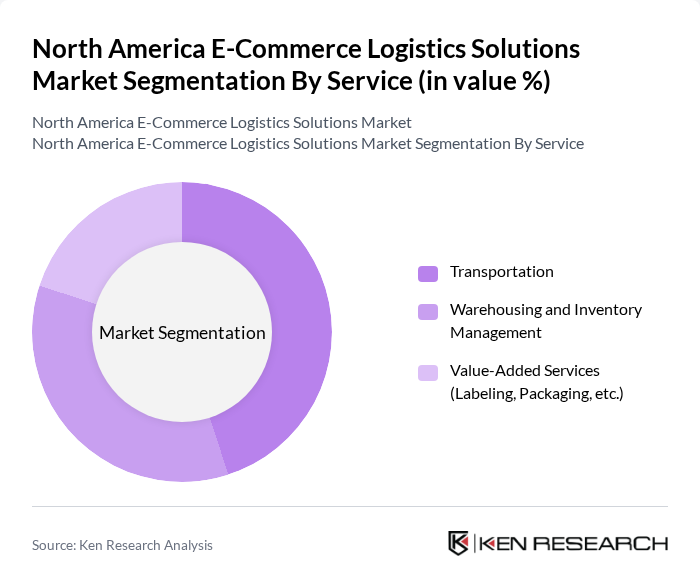

By Service:The service segment includes a range of offerings that facilitate the logistics process for e-commerce. The primary subsegments are Transportation, Warehousing and Inventory Management, and Value-Added Services (such as labeling, packaging, and reverse logistics). Transportation services focus on the movement of goods from suppliers to end consumers, including last-mile delivery. Warehousing and Inventory Management ensure efficient storage, order picking, and inventory tracking. Value-Added Services provide additional functionalities such as product customization, kitting, and returns management, enhancing the overall customer experience .

By Business Model:The business model segment is divided into B2C and B2B. B2C (Business to Consumer) logistics solutions focus on delivering products directly to individual consumers, a segment that has experienced significant growth due to the surge in online shopping and consumer expectations for fast, reliable delivery. B2B (Business to Business) logistics involves the movement of goods between businesses, supporting supply chain efficiency for manufacturers, wholesalers, and retailers .

The North America E-Commerce Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Logistics, FedEx Corporation, UPS Supply Chain Solutions, DHL eCommerce Solutions, XPO Logistics, ShipBob, Rakuten Super Logistics, Pitney Bowes, Ryder Supply Chain Solutions, Geodis, DSV, C.H. Robinson, Blue Yonder, Kuehne + Nagel, and Flexport contribute to innovation, geographic expansion, and service delivery in this space .

The North America e-commerce logistics solutions market is poised for significant evolution, driven by technological advancements and changing consumer expectations. As companies increasingly adopt automation and AI, operational efficiencies will improve, allowing for faster delivery times. Additionally, the rise of omnichannel fulfillment strategies will reshape logistics networks, enabling businesses to meet diverse customer needs. The focus on sustainability will also drive innovation, as companies seek eco-friendly logistics solutions to align with consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation Warehousing and Inventory Management Value-Added Services (Labeling, Packaging, etc.) |

| By Business Model | B2C B2B |

| By Destination | Domestic International/Cross-Border |

| By Product Category | Fashion and Apparel Consumer Electronics Home Appliances Furniture Beauty and Personal Care Products Other Products (Toys, Food Products, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 80 | Customer Experience Managers, Operations Directors |

| Warehouse Automation Technologies | 60 | IT Managers, Warehouse Operations Heads |

| Cross-Border E-commerce Logistics | 50 | International Trade Specialists, Compliance Officers |

| Cold Chain Logistics for E-commerce | 40 | Supply Chain Managers, Quality Assurance Leads |

The North America E-Commerce Logistics Solutions Market is valued at approximately USD 150 billion, reflecting significant growth driven by the expansion of online retail and consumer demand for faster delivery services.