Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1986

Pages:86

Published On:August 2025

By Type:The logistics solutions market is segmented into Fulfillment Services, Last-Mile Delivery, Warehousing Solutions, Freight Forwarding, Reverse Logistics, Cold Chain Logistics, Cross-Border Logistics, and Others. Among these, Last-Mile Delivery is the most dominant segment, driven by heightened consumer expectations for rapid and reliable delivery. The expansion of e-commerce platforms and the rise of on-demand retail have made efficient last-mile solutions essential, with logistics providers increasingly leveraging technology and micro-fulfillment centers to ensure timely deliveries .

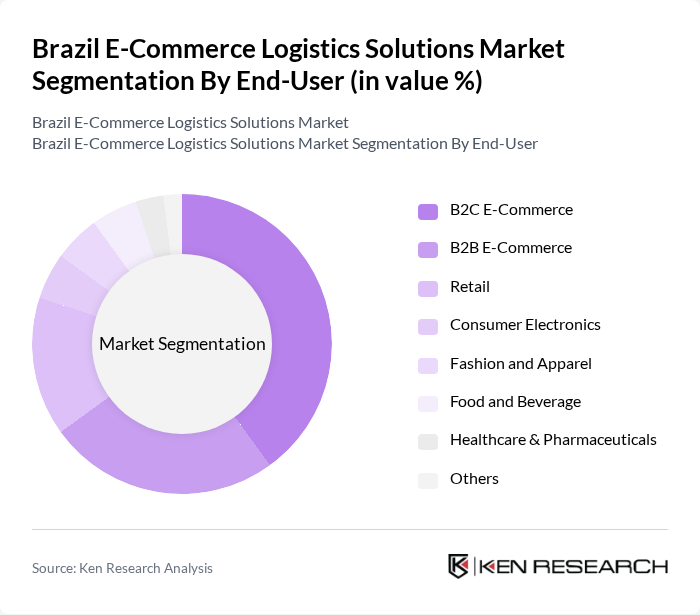

By End-User:The end-user segmentation includes B2C E-Commerce, B2B E-Commerce, Retail, Consumer Electronics, Fashion and Apparel, Food and Beverage, Healthcare & Pharmaceuticals, and Others. The B2C E-Commerce segment leads the market, propelled by a surge in online shopping, widespread smartphone adoption, and the increasing use of digital payment solutions. Enhanced consumer trust in online platforms and the growth of omnichannel retail strategies have further accelerated the expansion of B2C logistics services .

The Brazil E-Commerce Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Livre, Americanas S.A. (formerly B2W Digital), Magazine Luiza, Via S.A. (formerly Via Varejo), DHL Supply Chain, JSL S.A., Loggi Tecnologia, Correios (Empresa Brasileira de Correios e Telégrafos), Total Express, Sequoia Logística e Transportes, GOLLOG (GOL Linhas Aéreas’ logistics division), Rappi Brasil, Movile, Grupo SBF (Centauro), and Tenda Atacado contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's e-commerce logistics market appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and data analytics, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable logistics solutions will likely gain traction, aligning with global environmental standards. The growth of cross-border e-commerce will further expand market opportunities, necessitating innovative logistics strategies to meet diverse consumer demands and enhance service delivery across regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Fulfillment Services Last-Mile Delivery Warehousing Solutions Freight Forwarding Reverse Logistics Cold Chain Logistics Cross-Border Logistics Others |

| By End-User | B2C E-Commerce B2B E-Commerce Retail Consumer Electronics Fashion and Apparel Food and Beverage Healthcare & Pharmaceuticals Others |

| By Sales Channel | Online Marketplaces Direct-to-Consumer Social Commerce Mobile Apps Others |

| By Distribution Mode | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Locker & Pickup Points Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Dynamic Pricing Subscription-Based Pricing Others |

| By Customer Segment | Small and Medium Enterprises Large Enterprises Startups Individual Consumers Others |

| By Service Level | Standard Service Premium Service Customized Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 60 | Customer Experience Managers, Operations Directors |

| Warehouse Automation Technologies | 50 | Warehouse Operations Managers, IT Specialists |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Third-Party Logistics Providers | 60 | Business Development Managers, Supply Chain Analysts |

The Brazil E-Commerce Logistics Solutions Market is valued at approximately USD 11 billion, reflecting significant growth driven by the rapid expansion of online retail and increasing consumer demand for faster delivery options.