Region:Asia

Author(s):Geetanshi

Product Code:KRAA5694

Pages:84

Published On:January 2026

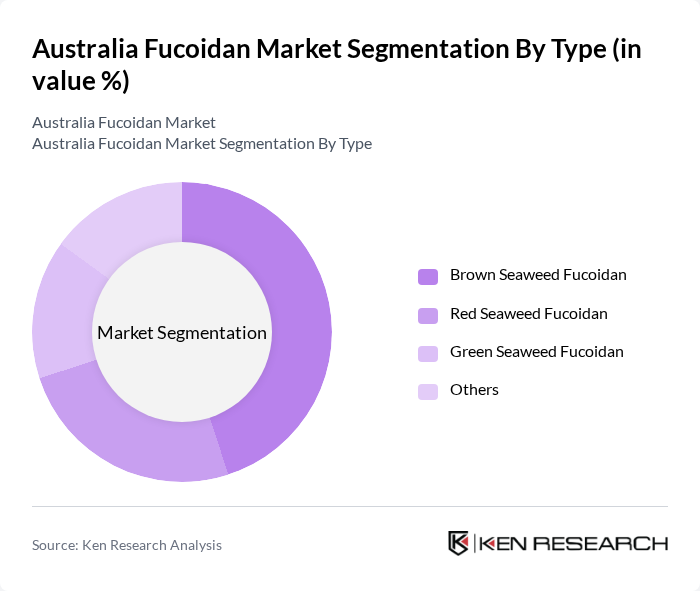

By Type:The market is segmented into various types of fucoidan, including Brown Seaweed Fucoidan, Red Seaweed Fucoidan, Green Seaweed Fucoidan, and Others. Among these, Brown Seaweed Fucoidan is the most dominant due to its high concentration of bioactive compounds and widespread use in dietary supplements and functional foods. The increasing consumer preference for natural health products has significantly boosted the demand for brown seaweed extracts, making it a key player in the market.

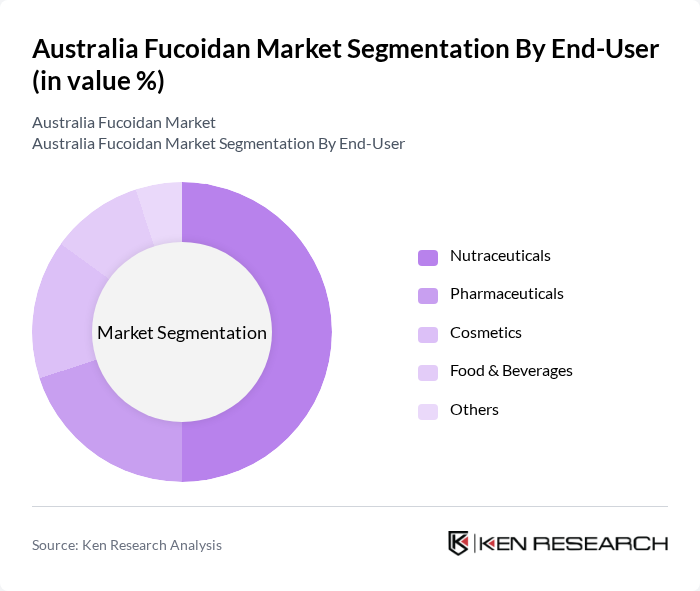

By End-User:The end-user segmentation includes Nutraceuticals, Pharmaceuticals, Cosmetics, Food & Beverages, and Others. The Nutraceuticals segment leads the market, driven by the growing trend of preventive healthcare and the increasing consumption of dietary supplements. Consumers are increasingly seeking natural ingredients for health benefits, which has led to a surge in the use of fucoidan in this sector.

The Australia Fucoidan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marinova Pty Ltd, Fucoidan International, Algaecal Inc., Seaweed Solutions, BioCare Copenhagen, Nutraceutical Corporation, Kappa Bioscience, Ocean Harvest Technology, GreenWave, Seaweed & Co., AstaReal, BioFucus, Algalif, Seaweed Solutions, Oceanic Nutraceuticals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia fucoidan market appears promising, driven by increasing health consciousness and a shift towards natural products. As consumers continue to seek out effective health solutions, the demand for fucoidan is expected to rise. Innovations in extraction technologies will likely enhance product quality and reduce costs, while collaborations with research institutions can lead to new applications and formulations, further expanding market reach and consumer acceptance.

| Segment | Sub-Segments |

|---|---|

| By Type | Brown Seaweed Fucoidan Red Seaweed Fucoidan Green Seaweed Fucoidan Others |

| By End-User | Nutraceuticals Pharmaceuticals Cosmetics Food & Beverages Others |

| By Source | Wild Harvested Cultivated Others |

| By Formulation | Powder Liquid Capsules Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| By Application | Dietary Supplements Functional Foods Personal Care Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Retailers | 75 | Store Managers, Product Buyers |

| Fucoidan Product Manufacturers | 65 | Production Managers, Quality Control Officers |

| Dietary Supplement Distributors | 60 | Sales Directors, Logistics Coordinators |

| Consumer Focus Groups | 45 | Health-Conscious Consumers, Dietary Supplement Users |

| Healthcare Professionals | 55 | Nutritionists, General Practitioners |

The Australia Fucoidan Market is valued at approximately USD 80 million, reflecting a significant growth driven by increasing health awareness and demand for natural products in nutraceuticals and cosmetics.