Region:Middle East

Author(s):Geetanshi

Product Code:KRAA6872

Pages:81

Published On:January 2026

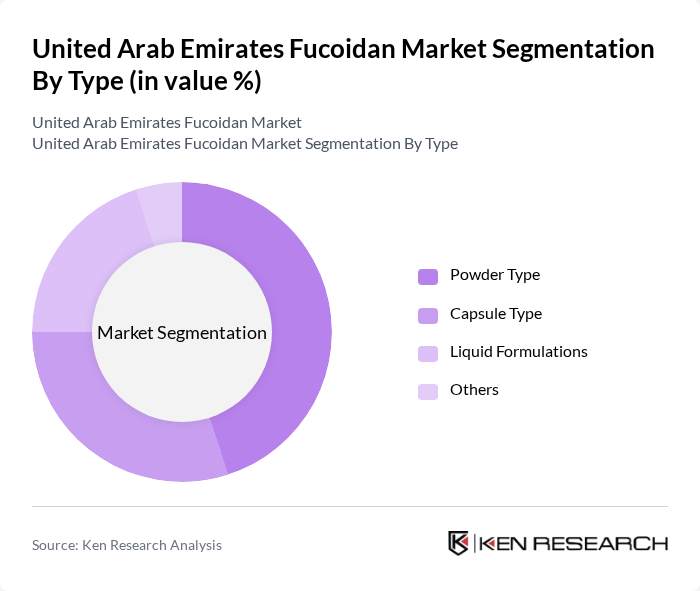

By Type:The market is segmented into various types, including Powder Type, Capsule Type, Liquid Formulations, and Others. Among these, the Powder Type is currently the most popular due to its versatility and ease of incorporation into various health products. Consumers prefer powdered forms for their convenience in mixing with beverages or food, which aligns with the growing trend of functional foods. The Capsule Type also holds a significant share, appealing to those seeking easy-to-consume dietary supplements. Liquid Formulations are gaining traction, particularly in the beauty and wellness sectors, as they are perceived to offer faster absorption rates.

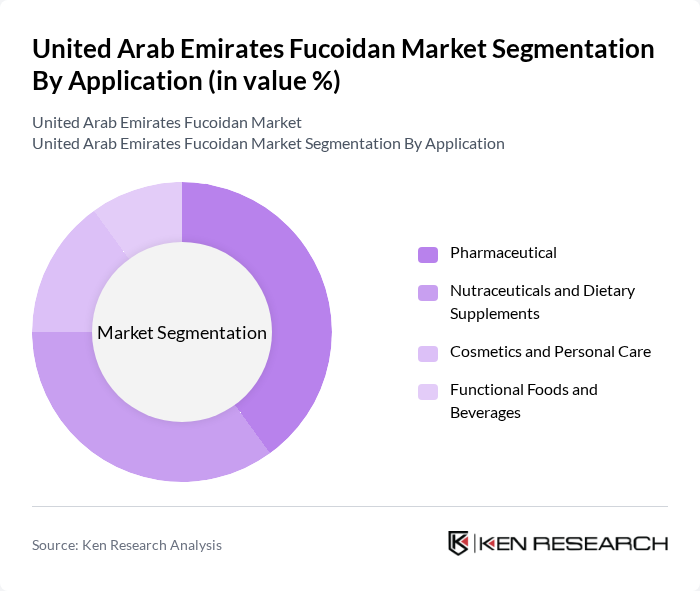

By Application:The applications of fucoidan are diverse, including Pharmaceutical, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care, and Functional Foods and Beverages. The Pharmaceutical segment is leading the market, driven by increasing research on fucoidan's therapeutic properties, particularly in cancer treatment and immune support. Nutraceuticals and Dietary Supplements are also significant, as consumers increasingly seek natural health solutions. The Cosmetics and Personal Care segment is witnessing growth due to the rising demand for natural ingredients in skincare products, while Functional Foods and Beverages are gaining popularity as consumers look for health-enhancing food options.

The United Arab Emirates Fucoidan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kanehide, Kamerycah, Marine Bioextracts, Algaia, BioCare Copenhagen, Nutraceuticals International, Ocean Harvest Technology, Aloha Medicinals, Marinalg, BioFucus, Seaweed & Co., Algalif, Fucus Extracts, GreenWave, Seaweed Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fucoidan market in the UAE appears promising, driven by increasing health awareness and a shift towards natural products. As consumers continue to prioritize wellness, the demand for fucoidan is expected to rise, particularly in the food and beverage sector. Innovations in product formulations and extraction technologies will likely enhance the appeal of fucoidan. Additionally, the growth of e-commerce platforms will facilitate wider distribution, making fucoidan products more accessible to health-conscious consumers across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Powder Type Capsule Type Liquid Formulations Others |

| By Application | Pharmaceutical Nutraceuticals and Dietary Supplements Cosmetics and Personal Care Functional Foods and Beverages |

| By Purity Grade | High-Purity Fucoidan (>95%) Standard Purity (85-95%) Lower Purity (<85%) Others |

| By Source | Brown Seaweed (Fucus vesiculosus, Laminaria japonica, Undaria pinnatifida) Red Seaweed Green Seaweed Others |

| By Distribution Channel | Online Retail Luxury Skincare and Resort Spas Specialty Pharmacies and Health Stores Premium Cosmetic Brands Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Retailers | 100 | Store Managers, Product Buyers |

| Cosmetic Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Nutritionists and Dieticians | 60 | Healthcare Professionals, Wellness Coaches |

| Marine Biotechnology Researchers | 50 | Academic Researchers, Industry Experts |

| Distributors of Natural Products | 70 | Supply Chain Managers, Sales Executives |

The United Arab Emirates Fucoidan Market is valued at approximately USD 1 million, reflecting a growing interest in health benefits associated with fucoidan, such as its anti-inflammatory and antioxidant properties.