Region:Global

Author(s):Rebecca

Product Code:KRAE2641

Pages:90

Published On:February 2026

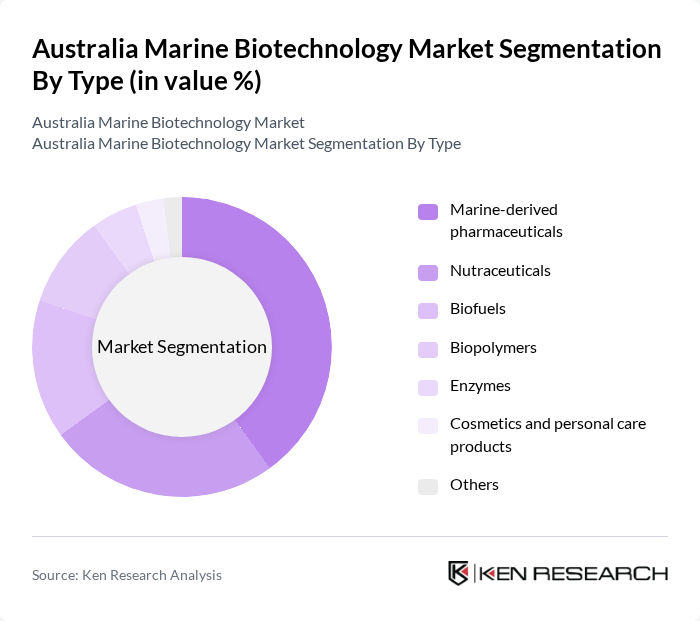

By Type:The marine biotechnology market can be segmented into various types, including marine-derived pharmaceuticals, nutraceuticals, biofuels, biopolymers, enzymes, cosmetics and personal care products, and others. Among these, marine-derived pharmaceuticals are gaining significant traction due to the increasing prevalence of chronic diseases and the need for innovative therapeutic solutions. Nutraceuticals are also witnessing robust growth as consumers become more health-conscious and seek natural health products. The demand for biofuels is driven by the global shift towards renewable energy sources, while biopolymers and enzymes are increasingly utilized in various industrial applications.

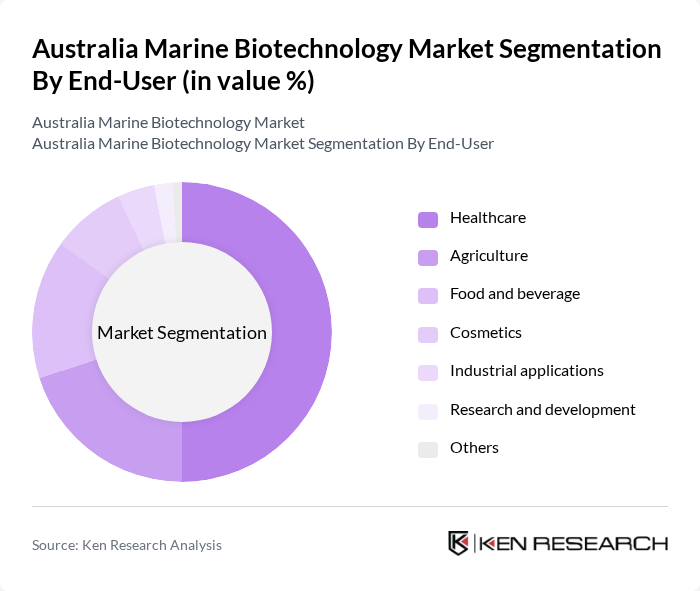

By End-User:The end-user segmentation of the marine biotechnology market includes healthcare, agriculture, food and beverage, cosmetics, industrial applications, research and development, and others. The healthcare sector is the largest end-user, driven by the increasing demand for innovative treatments and therapies derived from marine resources. The agriculture sector is also significant, as marine biotechnology offers sustainable solutions for crop enhancement and pest control. The food and beverage industry is leveraging marine ingredients for nutritional supplements and functional foods, while the cosmetics sector is increasingly incorporating marine-derived ingredients for their beneficial properties.

The Australia Marine Biotechnology Market is characterized by a dynamic mix of regional and international players. Leading participants such as CSL Limited, BioMarin Pharmaceutical Inc., Marinova Pty Ltd, Seaweed Solutions, Algaecytes, Australian Marine Conservation Society, Ocean Harvest Technology, BioPacific Partners, Sea Forest, Aqualife, PhycoHealth, Oceanic Laboratories, Marine Bioproducts Australia, Aquatic Biosciences, Blue BioTech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian marine biotechnology market appears promising, driven by increasing investments and technological advancements. As the demand for sustainable and innovative marine-derived products grows, companies are likely to focus on developing novel applications in pharmaceuticals and nutraceuticals. Additionally, collaborations between industry and academic institutions are expected to enhance research capabilities, leading to the discovery of new marine resources. This collaborative approach will be crucial in overcoming existing challenges and unlocking the full potential of the marine biotechnology sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Marine-derived pharmaceuticals Nutraceuticals Biofuels Biopolymers Enzymes Cosmetics and personal care products Others |

| By End-User | Healthcare Agriculture Food and beverage Cosmetics Industrial applications Research and development Others |

| By Application | Drug development Nutritional supplements Bioremediation Aquaculture Waste management Others |

| By Source | Marine algae Marine microorganisms Marine invertebrates Marine plants Others |

| By Distribution Channel | Direct sales Online retail Distributors Wholesalers Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Others |

| By Research Type | Fundamental research Applied research Developmental research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Research Scientists, Product Managers |

| Cosmetic Industry Innovations | 80 | Brand Managers, R&D Directors |

| Food and Nutraceuticals | 70 | Food Technologists, Quality Assurance Managers |

| Environmental Applications | 60 | Environmental Scientists, Policy Makers |

| Marine Biotechnology Startups | 90 | Founders, Business Development Managers |

The Australia Marine Biotechnology Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advancements in marine-derived pharmaceuticals, increasing demand for nutraceuticals, and interest in sustainable biofuels.