Region:Global

Author(s):Dev

Product Code:KRAB0456

Pages:93

Published On:August 2025

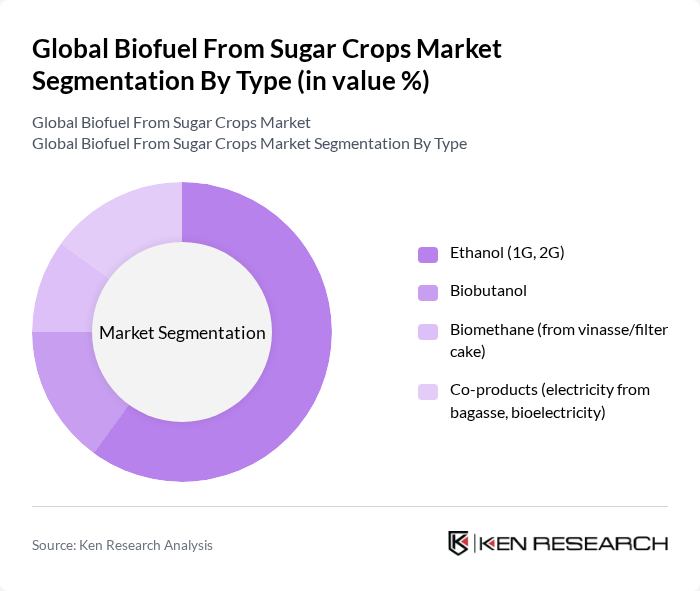

By Type:The market is segmented into various types of biofuels derived from sugar crops, including Ethanol (1G, 2G), Biobutanol, Biomethane (from vinasse/filter cake), and Co-products (electricity from bagasse, bioelectricity). Ethanol, particularly, has emerged as the leading sub-segment due to its widespread use in transportation fuels and its established production processes.

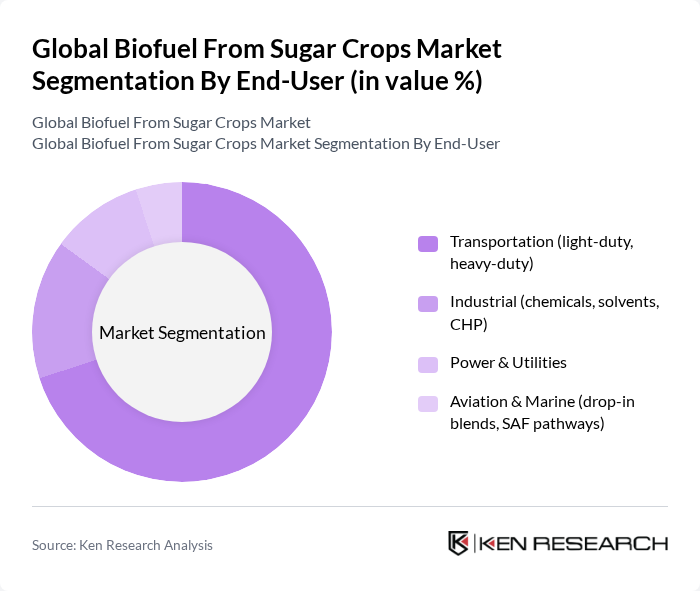

By End-User:The end-user segmentation includes Transportation (light-duty, heavy-duty), Industrial (chemicals, solvents, CHP), Power & Utilities, and Aviation & Marine (drop-in blends, SAF pathways). The transportation sector is the dominant end-user, driven by the increasing adoption of biofuels in vehicles and the push for cleaner fuel alternatives.

The Global Biofuel From Sugar Crops Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raízen S.A., Cosan S.A., Tereos S.A., Copersucar S.A., São Martinho S.A., Biosev S.A. (Louis Dreyfus Company Bioenergy), BP Bunge Bioenergia, Mitr Phol Group, Shree Renuka Sugars Ltd., Bajaj Hindusthan Sugar Ltd., Balrampur Chini Mills Ltd., Dalmia Bharat Sugar and Industries Ltd., Nordzucker AG, Südzucker AG (CropEnergies AG), Cristal Union (Cristanol) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biofuel market from sugar crops appears promising, driven by increasing global energy demands and a shift towards sustainable practices. As countries implement stricter emission reduction targets, the biofuel sector is expected to expand. Innovations in second-generation biofuels and digital technologies will enhance production efficiency. Furthermore, consumer preferences for eco-friendly products will likely drive market growth, creating a favorable environment for investment and development in the biofuel industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethanol (1G, 2G) Biobutanol Biomethane (from vinasse/filter cake) Co-products (electricity from bagasse, bioelectricity) |

| By End-User | Transportation (light-duty, heavy-duty) Industrial (chemicals, solvents, CHP) Power & Utilities Aviation & Marine (drop-in blends, SAF pathways) |

| By Feedstock | Sugarcane Sugar Beet Molasses Sweet Sorghum |

| By Distribution Channel | Fuel Blenders & Oil Marketing Companies Bulk Offtake (B2B, industrial) Retail Fuel Stations Direct Utility PPAs (bagasse power) |

| By Application | Transportation Fuels (E10–E100) Chemicals & Bioproducts (ETAC, MEG, solvents) Power Generation (bagasse cogeneration) On-site Energy & Steam |

| By Region | North America Europe Asia-Pacific Latin America |

| By Policy Support | Blending Mandates (e.g., E10/E20) Excise/Tariff Exemptions & Tax Credits Renewable Fuel Standard/Renewable Energy Certificates Sustainability Certification (ISCC, RenovaBio CBIOs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biofuel Production Facilities | 90 | Plant Managers, Production Supervisors |

| Sugar Crop Farmers | 120 | Farm Owners, Agricultural Consultants |

| Biofuel Technology Providers | 80 | R&D Managers, Technology Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Industry Analysts and Experts | 60 | Market Researchers, Economic Advisors |

The Global Biofuel From Sugar Crops Market is valued at approximately USD 21 billion, reflecting a robust growth driven by increasing demand for renewable energy, supportive government policies, and heightened consumer awareness regarding environmental sustainability.