Region:Asia

Author(s):Rebecca

Product Code:KRAA5844

Pages:91

Published On:September 2025

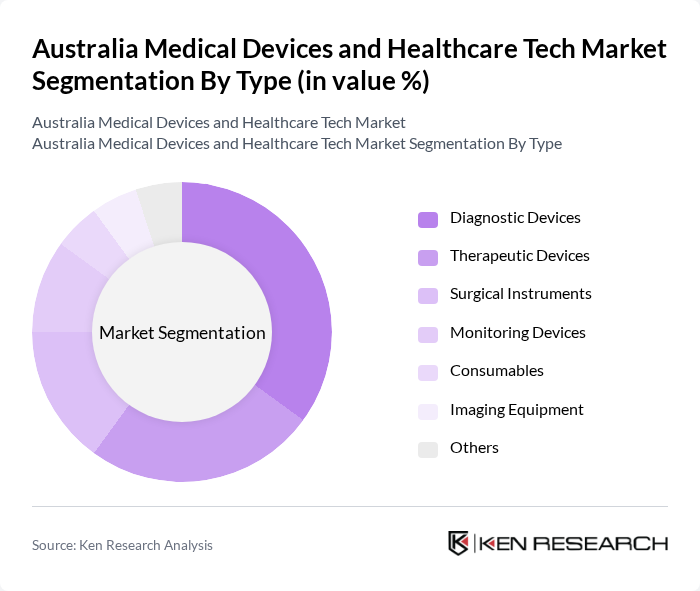

By Type:The market is segmented into various types of medical devices and healthcare technologies, including diagnostic devices, therapeutic devices, surgical instruments, monitoring devices, consumables, imaging equipment, and others. Among these, diagnostic devices are leading the market due to the increasing demand for early disease detection and management. The rise in chronic diseases and the need for regular health monitoring have significantly boosted the adoption of these devices, making them essential in both clinical and home settings.

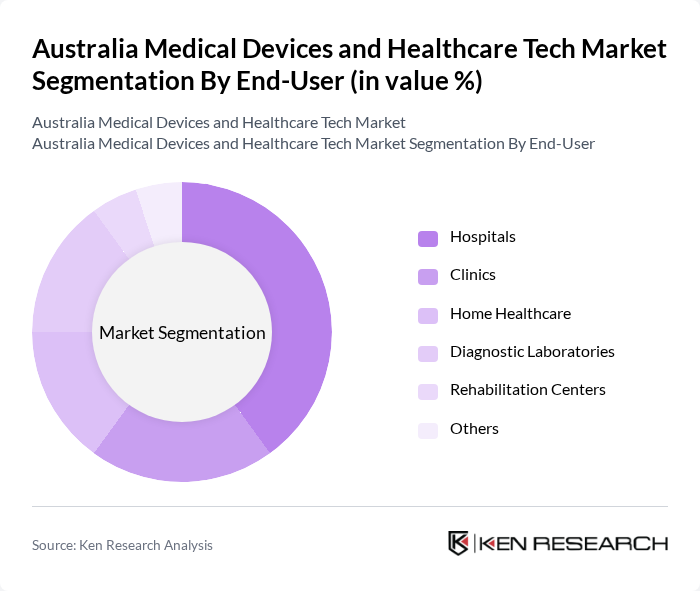

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, diagnostic laboratories, rehabilitation centers, and others. Hospitals are the dominant end-user segment, driven by the increasing number of patients requiring advanced medical care and the growing adoption of innovative technologies in hospital settings. The demand for efficient patient management and improved healthcare outcomes has led hospitals to invest heavily in medical devices and healthcare technologies.

The Australia Medical Devices and Healthcare Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as ResMed Inc., Cochlear Limited, CSL Limited, Ramsay Santé, Sonic Healthcare, Nanosonics Limited, Medical Developments International, Alcidion Group, iSignthis Ltd, Ellex Medical Lasers Limited, Paradigm Biopharmaceuticals, Volpara Health Technologies, 3M Australia, Becton Dickinson Australia, Abbott Laboratories Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia medical devices and healthcare tech market appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centric care. The integration of artificial intelligence and machine learning into healthcare solutions is expected to enhance diagnostic accuracy and treatment personalization. Additionally, the increasing adoption of telehealth services will likely reshape healthcare delivery, making it more efficient and accessible, particularly in rural areas. These trends indicate a dynamic market poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Surgical Instruments Monitoring Devices Consumables Imaging Equipment Others |

| By End-User | Hospitals Clinics Home Healthcare Diagnostic Laboratories Rehabilitation Centers Others |

| By Application | Cardiovascular Orthopedics Neurology Oncology Gynecology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology | Digital Health Technologies Robotics Wearable Technologies Telemedicine Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 100 | Product Managers, R&D Directors |

| Healthcare Technology Providers | 80 | IT Managers, Business Development Executives |

| Healthcare Professionals | 150 | Doctors, Nurses, Hospital Administrators |

| Patients Using Medical Devices | 120 | Patients, Caregivers, Health Advocates |

| Regulatory Bodies and Compliance Experts | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Australia Medical Devices and Healthcare Tech Market is valued at approximately USD 12 billion, driven by factors such as an aging population, increasing chronic diseases, and technological advancements that enhance patient care and treatment outcomes.