Region:Global

Author(s):Dev

Product Code:KRAA3572

Pages:93

Published On:September 2025

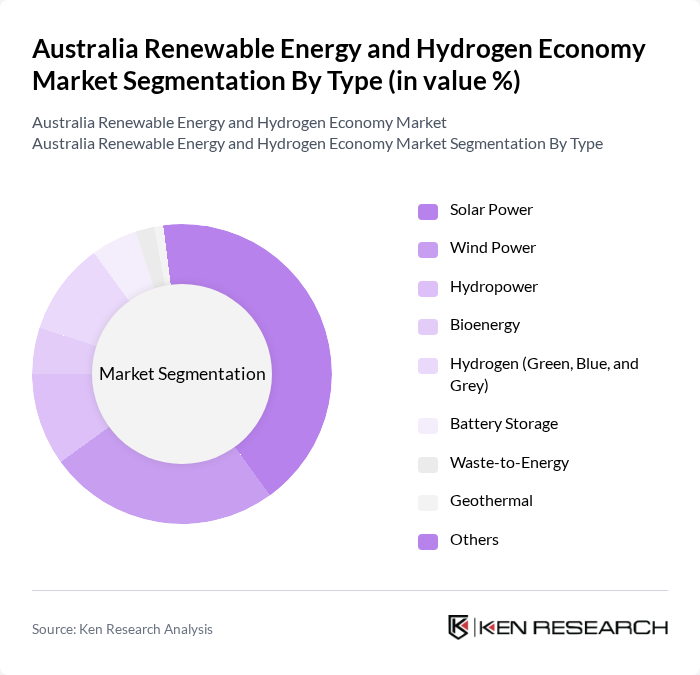

By Type:The market is segmented into various types, including Solar Power, Wind Power, Hydropower, Bioenergy, Hydrogen (Green, Blue, and Grey), Battery Storage, Waste-to-Energy, Geothermal, and Others. Each of these segments plays a crucial role in the overall energy mix, with specific applications and technologies driving their growth. Grid-scale solar generation and battery generation have reached all-time highs, while rooftop solar and wind have achieved new quarterly records.

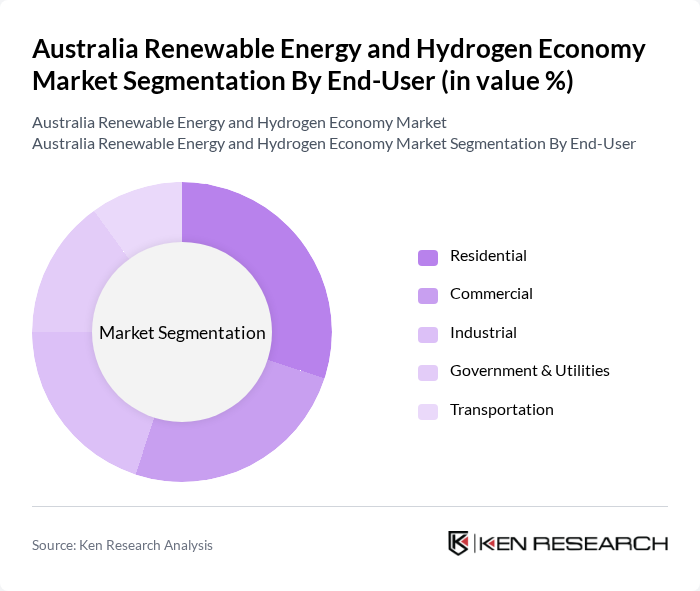

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Government & Utilities, and Transportation. Each segment has unique energy needs and consumption patterns, influencing the adoption of renewable energy solutions. Australia is experiencing a significant shift toward decentralized energy systems, with increased rooftop solar and battery storage adoption across residential and commercial sectors.

The Australia Renewable Energy and Hydrogen Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as AGL Energy Limited, Origin Energy Limited, Cleanaway Waste Management Limited, Infigen Energy, Neoen S.A., Australian Renewable Energy Agency (ARENA), Fortescue Future Industries, Woodside Energy Ltd., EnergyAustralia, CSIRO, Acciona, S.A., APA Group, Edify Energy Pty Ltd., Goldwind Science & Technology Co., Ltd., Iberdrola, S.A., RATCH Australia Corporation, Tilt Renewables, Vestas Wind Systems A/S, First Solar, Inc., Hydrogen Energy Supply Chain (HESC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Renewable Energy and Hydrogen Economy market appears promising, driven by increasing investments in innovative technologies and a strong commitment to sustainability. The integration of artificial intelligence and IoT in energy management systems is expected to enhance efficiency and reduce operational costs in future. Furthermore, the expansion of hydrogen production capabilities will play a pivotal role in decarbonizing various sectors, positioning Australia as a leader in the global renewable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Power Wind Power Hydropower Bioenergy Hydrogen (Green, Blue, and Grey) Battery Storage Waste-to-Energy Geothermal Others |

| By End-User | Residential Commercial Industrial Government & Utilities Transportation |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Hydrogen Fueling Stations |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Project Developers | 60 | Project Managers, Business Development Executives |

| Hydrogen Production Facilities | 50 | Operations Managers, Technical Directors |

| Energy Policy Makers | 40 | Government Officials, Regulatory Analysts |

| Investors in Renewable Energy | 45 | Investment Analysts, Portfolio Managers |

| End-users of Renewable Energy | 55 | Facility Managers, Sustainability Officers |

The Australia Renewable Energy and Hydrogen Economy Market is valued at approximately USD 165 billion, driven by government policies, technological advancements, and rising investments in hydrogen production. Renewables generated 43% of electricity in Australia's main power grid in early 2025.