Region:Europe

Author(s):Shubham

Product Code:KRAB6567

Pages:87

Published On:October 2025

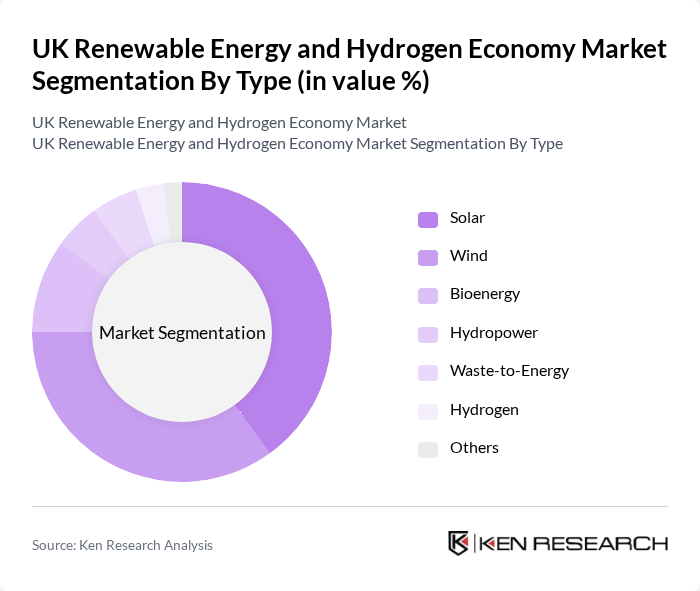

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Hydrogen, and Others. Among these, Solar and Wind are the most prominent due to their scalability and decreasing costs, which have made them attractive options for both residential and commercial applications. The increasing efficiency of solar panels and wind turbines has further propelled their adoption, making them the leading contributors to the renewable energy landscape.

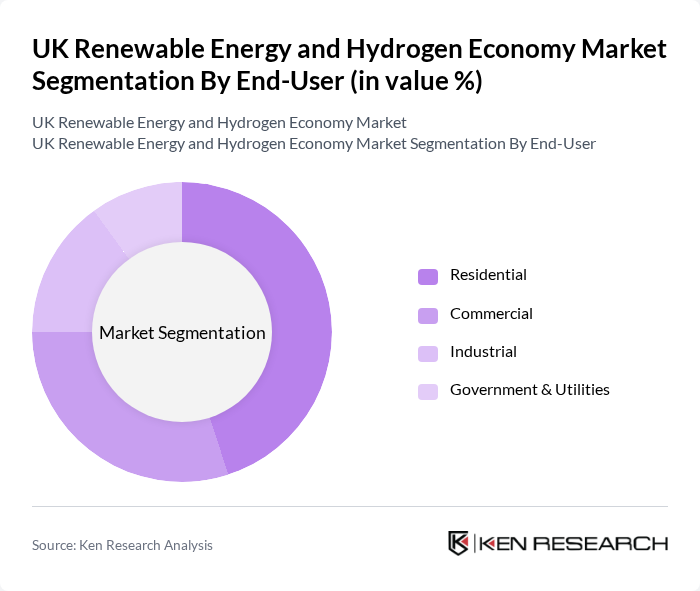

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently leading due to the growing trend of homeowners investing in solar panels and energy-efficient solutions. This shift is driven by rising energy costs and increased awareness of environmental issues, prompting consumers to seek sustainable energy alternatives.

The UK Renewable Energy and Hydrogen Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ørsted A/S, SSE plc, E.ON SE, Iberdrola S.A., Engie S.A., RWE AG, Vattenfall AB, Centrica plc, National Grid plc, Siemens Gamesa Renewable Energy, BP plc, Shell plc, TotalEnergies SE, Air Products and Chemicals, Inc., ITM Power plc contribute to innovation, geographic expansion, and service delivery in this space.

The UK renewable energy and hydrogen economy is poised for significant transformation, driven by technological advancements and increasing consumer demand for sustainable solutions. As the government continues to enhance its support through funding and regulatory frameworks, the market is expected to witness a surge in innovative projects. The integration of smart grid technologies and the expansion of offshore wind farms will play a crucial role in shaping the future landscape, ensuring a more resilient and sustainable energy system.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Hydrogen Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Project Developers | 100 | Project Managers, Business Development Executives |

| Hydrogen Technology Providers | 80 | Technical Directors, R&D Managers |

| Government Policy Makers | 60 | Energy Policy Analysts, Regulatory Affairs Specialists |

| Energy Consultants | 75 | Consultants, Market Analysts |

| End-users in Transportation Sector | 90 | Fleet Managers, Sustainability Officers |

The UK Renewable Energy and Hydrogen Economy Market is valued at approximately USD 55 billion, reflecting significant growth driven by investments in renewable technologies, government policies promoting sustainability, and increasing consumer demand for clean energy solutions.