Region:Asia

Author(s):Rebecca

Product Code:KRAE3442

Pages:85

Published On:February 2026

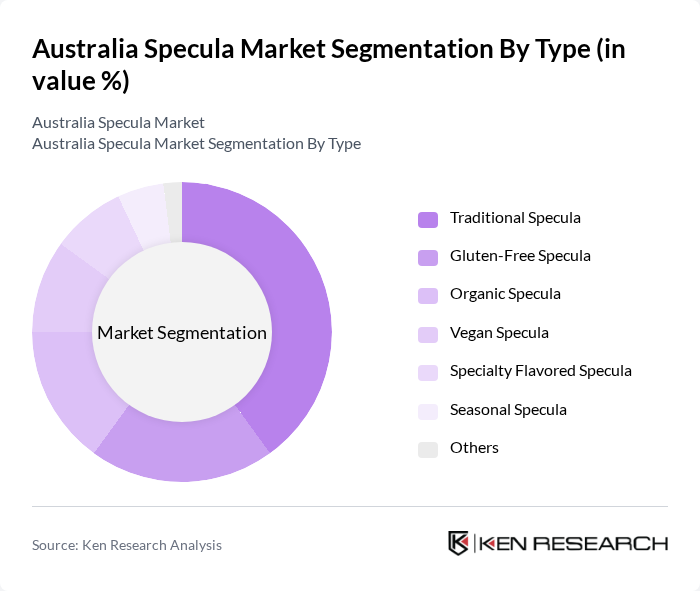

By Type:The market is segmented into various types, including Traditional Specula, Gluten-Free Specula, Organic Specula, Vegan Specula, Specialty Flavored Specula, Seasonal Specula, and Others. Among these, Traditional Specula is the most dominant segment, driven by its cultural significance and established consumer base. However, the Gluten-Free and Organic segments are gaining traction as health-conscious consumers seek alternatives that align with their dietary preferences.

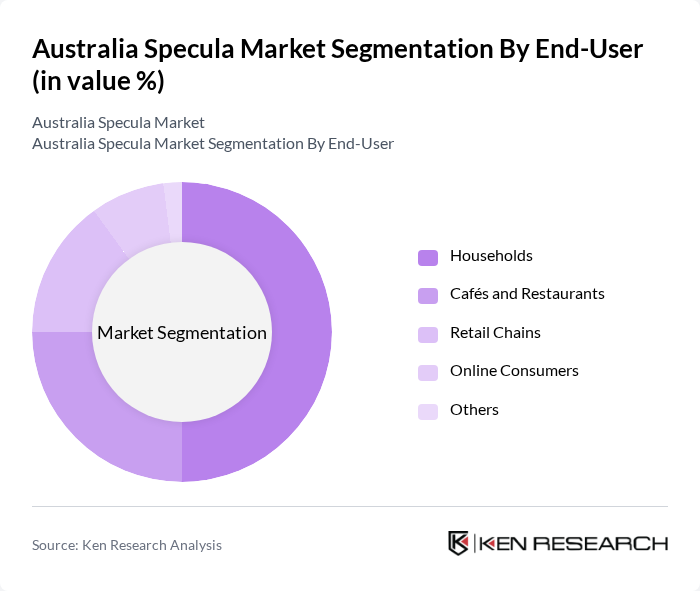

By End-User:The end-user segmentation includes Households, Cafés and Restaurants, Retail Chains, Online Consumers, and Others. Households represent the largest segment, as specula is a popular choice for home baking and festive occasions. Cafés and Restaurants are also significant contributors, as they often feature specula in their dessert offerings, appealing to customers looking for unique flavors.

The Australia Specula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Specula Co., Sweet Treats Australia, Gourmet Specula, Aussie Bites, Spice & Sweet, The Specula Factory, Crunchy Delights, Purely Specula, Artisan Bakes, Specula Delicacies, Nature's Treats, Sweet Harmony, Flavor Fusion, The Cookie Jar, Specula Bliss contribute to innovation, geographic expansion, and service delivery in this space.

The Australia specula market is poised for significant growth, driven by increasing consumer demand for health-oriented products and sustainable practices. As more consumers prioritize wellness, brands that innovate with organic ingredients and personalized offerings are likely to thrive. Additionally, the rise of e-commerce will facilitate broader market access, enabling brands to reach untapped demographics. The focus on sustainable packaging will also resonate with environmentally conscious consumers, further enhancing brand loyalty and market penetration in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Specula Gluten-Free Specula Organic Specula Vegan Specula Specialty Flavored Specula Seasonal Specula Others |

| By End-User | Households Cafés and Restaurants Retail Chains Online Consumers Others |

| By Distribution Channel | Supermarkets Specialty Stores E-commerce Platforms Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Flavor Profile | Classic Spices Sweet Variants Savory Options Others |

| By Price Range | Premium Mid-range Budget Others |

| By Consumer Demographics | Age Groups Income Levels Lifestyle Segments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Doctors, Nurses, Clinic Administrators |

| Laboratory Technicians | 100 | Lab Managers, Quality Control Officers |

| Medical Device Distributors | 80 | Sales Representatives, Distribution Managers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| End-Users in Clinical Settings | 120 | Healthcare Administrators, Procurement Officers |

The Australia Specula Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by increasing consumer demand for specialty baked goods, particularly during festive seasons, and a trend towards artisanal and gourmet products.