Region:Middle East

Author(s):Rebecca

Product Code:KRAE3439

Pages:83

Published On:February 2026

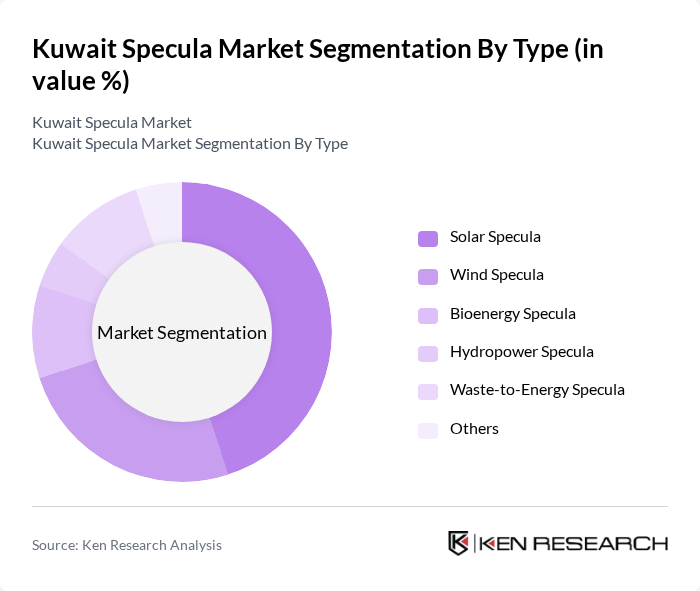

By Type:The market is segmented into various types, including Solar Specula, Wind Specula, Bioenergy Specula, Hydropower Specula, Waste-to-Energy Specula, and Others. Each type plays a crucial role in the overall market dynamics, with specific applications and consumer preferences influencing their growth. Solar Specula is currently leading the market due to its widespread adoption and technological advancements, while Wind Specula is gaining traction as investments in wind energy increase.

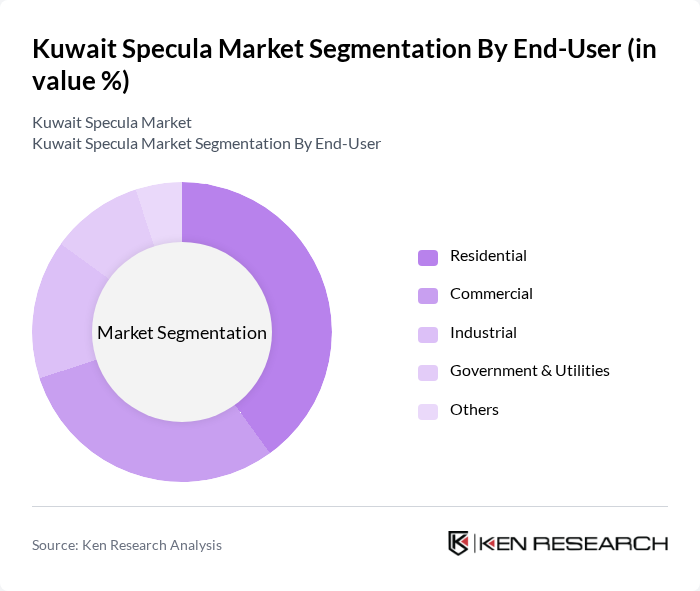

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. Each segment has distinct energy needs and consumption patterns, influencing the demand for various types of specula. The Residential segment is currently the largest, driven by increasing consumer awareness of renewable energy benefits and government incentives for home installations.

The Kuwait Specula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Renewable Energy Company, Gulf Energy Company, Alghanim Industries, KISR (Kuwait Institute for Scientific Research), Kuwait National Petroleum Company, Al-Manshar Group, Al-Dhow Engineering, Al-Babtain Group, Al-Futtaim Group, National Industries Group, Boubyan Bank, Kuwait Investment Authority, KIPCO (Kuwait Projects Company), Al-Sayer Group, United Gulf Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Kuwait specula market appears promising, driven by increasing government support and a growing emphasis on sustainable energy solutions. As Kuwait continues to diversify its energy sources, the integration of innovative technologies and financing models will likely enhance market accessibility. Furthermore, the rising awareness of environmental issues among consumers is expected to bolster demand for renewable energy solutions, paving the way for significant advancements in the specula sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Specula Wind Specula Bioenergy Specula Hydropower Specula Waste-to-Energy Specula Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Northern Kuwait Southern Kuwait Central Kuwait Others |

| By Technology | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification Others |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Specula Usage | 100 | Project Managers, Procurement Officers |

| Automotive Industry Applications | 80 | Manufacturing Engineers, Quality Control Managers |

| Consumer Goods Manufacturing | 70 | Product Development Managers, Supply Chain Analysts |

| Research & Development Insights | 60 | R&D Directors, Innovation Managers |

| Regulatory Compliance and Standards | 50 | Compliance Officers, Regulatory Affairs Managers |

The Kuwait Specula Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for renewable energy sources and government initiatives promoting sustainability.