Region:Asia

Author(s):Shubham

Product Code:KRAA0728

Pages:95

Published On:August 2025

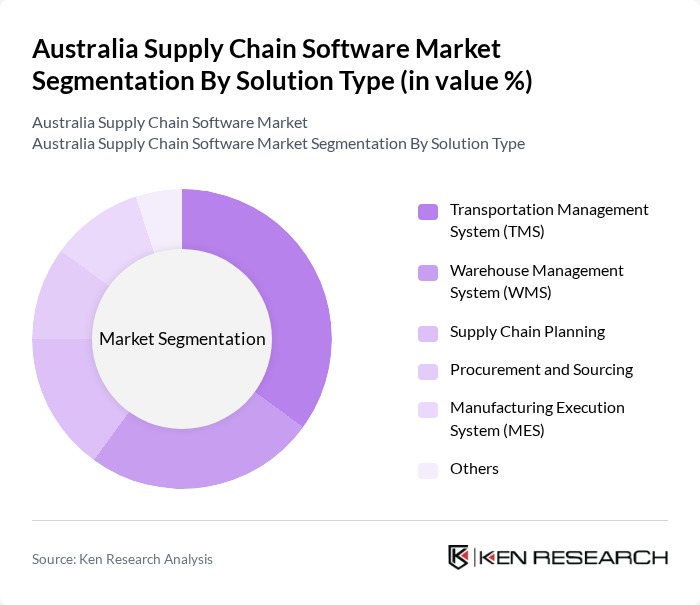

By Solution Type:

The solution type segmentation includes Transportation Management System (TMS), Warehouse Management System (WMS), Supply Chain Planning, Procurement and Sourcing, Manufacturing Execution System (MES), and Others. Among these, the Transportation Management System (TMS) is the leading sub-segment, driven by the increasing need for efficient logistics management, real-time tracking, and cost reduction in transportation. Businesses are increasingly adopting TMS solutions to optimize routes, manage freight costs, enhance end-to-end supply chain visibility, and respond quickly to disruptions .

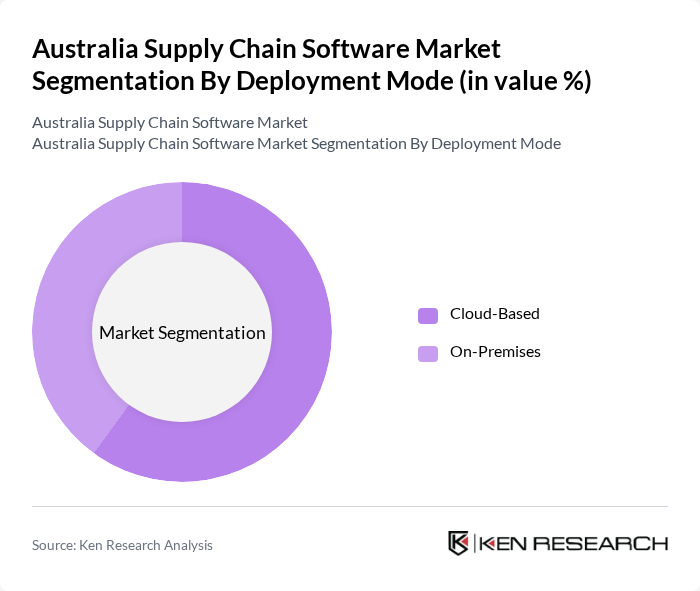

By Deployment Mode:

This segmentation includes Cloud-Based and On-Premises deployment modes. The Cloud-Based deployment mode is currently dominating the market due to its flexibility, scalability, and cost-effectiveness. Businesses are increasingly opting for cloud solutions to reduce IT overhead, enable rapid deployment, and enhance collaboration across supply chain partners, which is essential for real-time data sharing and decision-making in distributed and dynamic environments .

The Australia Supply Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Australia, Oracle Australia, Blue Yonder (formerly JDA Software), Manhattan Associates, Infor, Kinaxis, Coupa Software, Epicor Software, IBM Australia, Microsoft Dynamics 365, WiseTech Global, Pronto Software, E2open, Logility, and Zebra Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian supply chain software market appears promising, driven by technological advancements and evolving consumer demands. As businesses increasingly prioritize digital transformation, the integration of AI and machine learning is expected to enhance predictive analytics and operational efficiency. Furthermore, the growing emphasis on sustainability will compel companies to adopt eco-friendly practices, aligning their supply chains with environmental goals. This shift will likely create a more resilient and adaptive supply chain landscape in Australia, fostering innovation and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Transportation Management System (TMS) Warehouse Management System (WMS) Supply Chain Planning Procurement and Sourcing Manufacturing Execution System (MES) Others |

| By Deployment Mode | Cloud-Based On-Premises |

| By Organization Size | Small and Medium-Sized Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | Retail and Consumer Goods Healthcare and Pharmaceuticals Manufacturing Food and Beverages Transportation and Logistics Automotive Others |

| By Component | Solution (Software) Services (Professional Services, Managed Services) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Software Usage | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Process Optimization | 80 | Operations Managers, Production Supervisors |

| Logistics and Distribution Management | 60 | Logistics Coordinators, Warehouse Managers |

| Software Integration Challenges | 50 | IT Managers, Systems Analysts |

| Customer Relationship Management in Supply Chains | 60 | Customer Service Managers, Sales Directors |

The Australia Supply Chain Software Market is valued at approximately USD 350 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficiency in logistics and inventory management, alongside the adoption of advanced technologies.