Region:Africa

Author(s):Geetanshi

Product Code:KRAA1962

Pages:91

Published On:August 2025

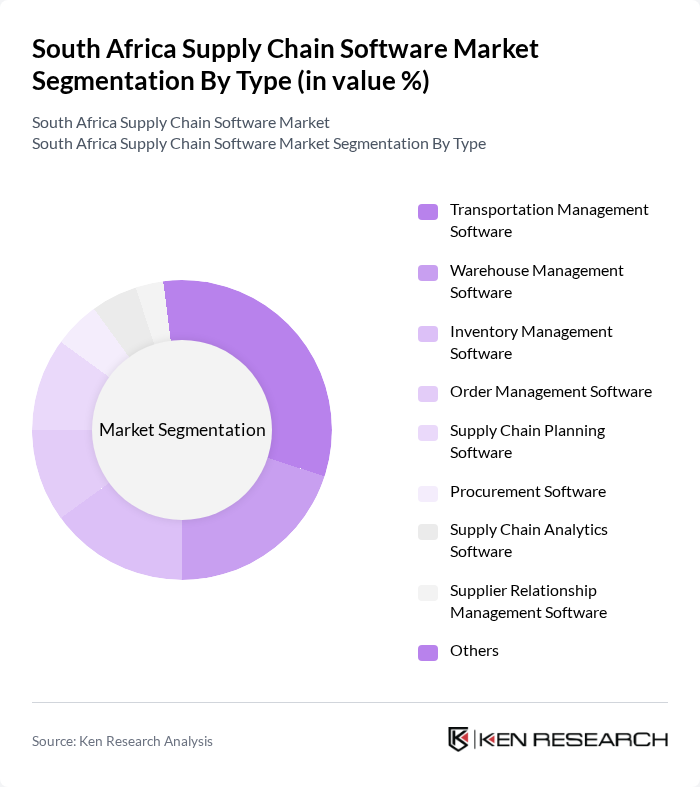

By Type:The South Africa Supply Chain Software Market can be segmented into various types, includingTransportation Management Software, Warehouse Management Software, Inventory Management Software, Order Management Software, Supply Chain Planning Software, Procurement Software, Supply Chain Analytics Software, Supplier Relationship Management Software, and Others. Among these,Transportation Management Softwareis currently leading the market due to the increasing demand for efficient logistics solutions and real-time tracking capabilities. The growing e-commerce sector and the need for optimized transportation routes are driving the adoption of this software.

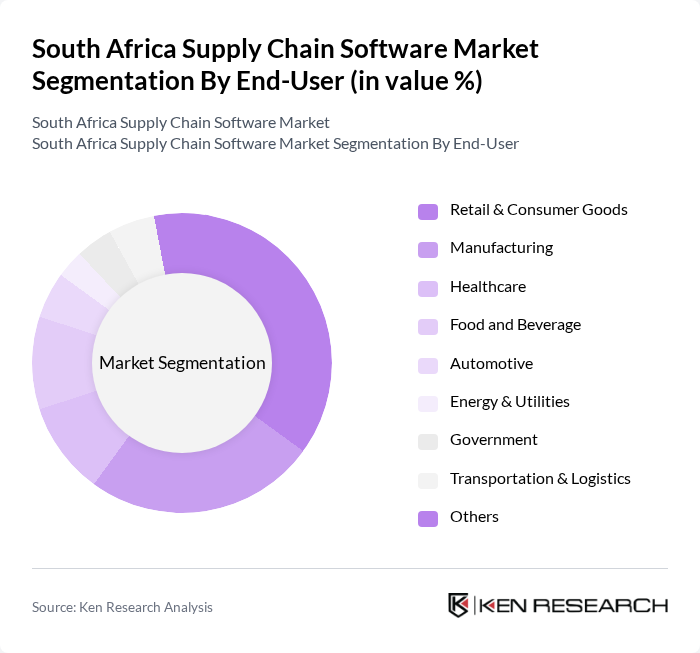

By End-User:The market can also be segmented by end-user industries, includingRetail & Consumer Goods, Manufacturing, Healthcare, Food and Beverage, Automotive, Energy & Utilities, Government, Transportation & Logistics, and Others. TheRetail & Consumer Goodssector is the leading end-user, driven by the rapid growth of e-commerce and the need for efficient supply chain management to meet consumer demands. The increasing focus on customer satisfaction and timely delivery is pushing retailers to adopt advanced supply chain software solutions.

The South Africa Supply Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Infor, Inc., Manhattan Associates, Inc., Kinaxis Inc., IBM Corporation, Microsoft Corporation, Epicor Software Corporation, Coupa Software Incorporated, Zycus Inc., IFS AB, E2open, LLC, Llamasoft, Inc. (now part of Coupa), Adapt IT Holdings Limited, Dovetail Business Solutions (South Africa), VSc Solutions (South Africa), Syspro (South Africa), Sage Group plc contribute to innovation, geographic expansion, and service delivery in this space.

The South African supply chain software market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize sustainability and efficiency, the integration of innovative technologies such as AI and IoT will become essential. Furthermore, government initiatives aimed at promoting digital transformation will likely bolster investment in supply chain solutions, enhancing overall operational capabilities and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Inventory Management Software Order Management Software Supply Chain Planning Software Procurement Software Supply Chain Analytics Software Supplier Relationship Management Software Others |

| By End-User | Retail & Consumer Goods Manufacturing Healthcare Food and Beverage Automotive Energy & Utilities Government Transportation & Logistics Others |

| By Application | Demand Planning Supply Planning Logistics Management Supplier Collaboration Risk Management Compliance & Traceability Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors Online Sales Resellers |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Mpumalanga Limpopo Free State North West Northern Cape Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Freemium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Software Adoption | 120 | Supply Chain Managers, IT Directors |

| Retail Supply Chain Software Usage | 90 | Logistics Coordinators, Operations Managers |

| Healthcare Supply Chain Solutions | 60 | Procurement Managers, IT Specialists |

| Food and Beverage Industry Software Trends | 50 | Quality Assurance Managers, Supply Chain Analysts |

| E-commerce Logistics Software Insights | 70 | eCommerce Operations Managers, Fulfillment Directors |

The South Africa Supply Chain Software Market is valued at approximately USD 65 million, reflecting a significant growth driven by the increasing demand for efficiency in logistics and inventory management, as well as the adoption of digital technologies across various sectors.