Region:Global

Author(s):Shubham

Product Code:KRAA0809

Pages:87

Published On:August 2025

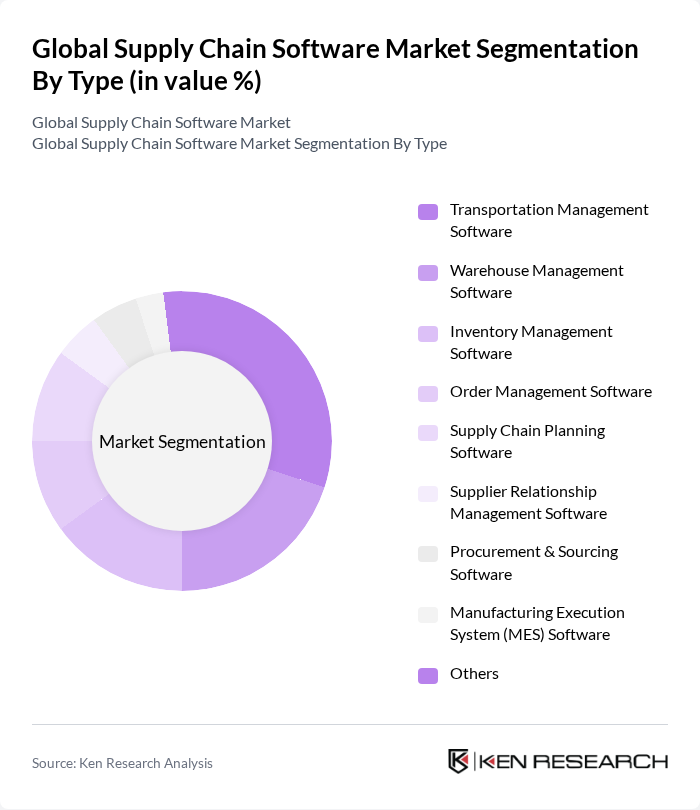

By Type:The market is segmented into various types of software solutions that address different aspects of supply chain management. The primary subsegments include Transportation Management Software, Warehouse Management Software, Inventory Management Software, Order Management Software, Supply Chain Planning Software, Supplier Relationship Management Software, Procurement & Sourcing Software, Manufacturing Execution System (MES) Software, and Others. Transportation Management Software leads the market, driven by the need for efficient logistics and transportation solutions as businesses focus on optimizing shipping processes. Warehouse Management and Inventory Management Software are also experiencing strong demand due to the rise of e-commerce and the need for real-time inventory visibility and fulfillment optimization .

By End-User:The end-user segmentation covers industries utilizing supply chain software solutions. The primary subsegments are Manufacturing, Retail, Healthcare, Automotive, Food and Beverage, E-commerce, Logistics & Transportation, and Others. Manufacturing is the leading end-user, driven by the need for efficient production and distribution processes and the adoption of automation and data analytics. Retail and E-commerce sectors are also significant users, leveraging supply chain software for inventory optimization and omnichannel fulfillment .

The Global Supply Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Kinaxis Inc., Infor, Inc., IBM Corporation, Coupa Software Incorporated, E2open, LLC, Descartes Systems Group Inc., Epicor Software Corporation, Logility, Inc., Körber AG, Magaya Corporation, Microsoft Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the supply chain software market is poised for significant transformation, driven by technological advancements and evolving consumer demands. As companies increasingly prioritize sustainability, the integration of eco-friendly practices into supply chain operations will become essential. Additionally, the rise of digital twins and advanced analytics will enhance predictive capabilities, allowing businesses to optimize their supply chains proactively. These trends indicate a shift towards more resilient and adaptive supply chain strategies, ensuring competitiveness in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Inventory Management Software Order Management Software Supply Chain Planning Software Supplier Relationship Management Software Procurement & Sourcing Software Manufacturing Execution System (MES) Software Others |

| By End-User | Manufacturing Retail Healthcare Automotive Food and Beverage E-commerce Logistics & Transportation Others |

| By Component | Software Services Consulting Support and Maintenance Managed Services Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors Online Sales Resellers |

| By Industry Vertical | Aerospace and Defense Pharmaceuticals Consumer Goods Electronics Energy & Utilities Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Software | 100 | Supply Chain Managers, IT Directors |

| Retail Inventory Management Solutions | 80 | Operations Managers, Inventory Analysts |

| Logistics and Transportation Management | 60 | Logistics Coordinators, Fleet Managers |

| Warehouse Management Systems | 50 | Warehouse Supervisors, IT Managers |

| E-commerce Supply Chain Solutions | 60 | E-commerce Managers, Fulfillment Directors |

The Global Supply Chain Software Market is valued at approximately USD 27.5 billion, reflecting a significant growth trend driven by the need for efficiency in logistics and supply chain operations, as well as advancements in technology such as AI and real-time data analytics.